Perseverance pays off

With the global pandemic showing few signs of relenting, disruption is commonplace in many parts of the world. Indeed, the dawn of 2022 is taking place against the backdrop of far more unknowns than knowns. Yet despite this, the PV industry is set to achieve another year of rapid expansion. Global installations are widely tipped to exceed 200GW for the year (pp. 12-13), and it will be one in which the milestone of 1 terawatt of installed PV capacity will be surpassed.

Policy headwinds

Solar stocks underperformed broader markets in December, writes Jesse Pichel of ROTH Capital Partners. The Invesco Solar ETF decreased 8.5%, while the S&P 500 increased by 2.4%, and the Dow Jones Industrial Average increased by 3.9%.

Out with the old, in with the new

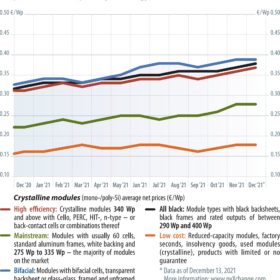

When module and balance of system prices are high, new installations become less profitable and the focus shifts back to renovating and optimizing existing arrays. Although there are signs that the upward price trend is slowing, Martin Schachinger and Falko Krause say there is still no evidence that prices are stabilizing or falling.

A perfect storm for PV

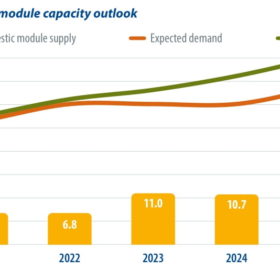

The supply chain disruptions that started in the second half of 2020, with the economic opening after Covid-19’s initial waves, reached new highs in 2021. Edurne Zoco, IHS Markit’s executive director for clean technology and renewables, sees five main drivers for the disruptions of the industry throughout 2021. However, forecasts remain bullish, with more than 200GW of new PV installations expected this year.

Building back better

The United States set new plans for the energy transition and climate change after President Joe Biden took office, setting the nation on a path to achieving its ambitious goals with legislation related to renewable energy deployment. Albert Hsieh, a researcher at PV InfoLink, explores the various factors affecting solar development in the United States and the possible impacts on the PV industry if the Build Back Better Act is passed.

Reality check

Ecstasy to agony summarizes the past year of solar. As technology evolves and materials are optimized every year, we’re witnessing rapid advancements accelerating the transition to a low-carbon economy with the implementation of artificial intelligence applications, writes Denisa Fainis, general secretary of the Middle East Solar Industry Association. Real-time data, advanced analytics, and automation are essential to the digitalization of increasingly decentralized power systems.

Connecting MENA

The spark of renewables in the MENA region has increased the need for new interconnectors. Big projects with high capacities are being planned across borders to raise electricity exchanges across the region, reviving the dream of a MENA integrated electricity grid.

Slow progress toward a big rooftop goal

A vibrant industry across the Middle East – including manufacturers, wholesalers, and a large number of EPCs and installers – supply decarbonized electricity to meet growing air-conditioning demand, tapping the region’s abundant sunshine. However, progress toward this vision of a distributed-generation solar market segment and industry in the Gulf region has been slow, according to the president of the Middle East Solar Industry Association (MESIA), Ahmed Nada.

EU works to expand on-grid renewables in Bangladesh

Off-grid solar has been a major success story in Bangladesh. The next step in the country’s decarbonization journey is the grid integration of larger-scale renewables – a project in which the EU is playing a major role. Syful Islam reports from Dhaka on the programs and progress.

New tools for fossil fuels

Long thought of as adversaries to renewable energy, fossil fuel assets and infrastructure also present opportunities for solar, its green-hydrogen output, and smart energy storage. Natalie Filatoff reports from Sydney on the opportunities and approaches the miners are taking.