What would have been

It was only a year ago, but it feels like a world away. June in the European solar industry without Intersolar, of course now The smarter E, feels very strange indeed.

Ahead of the curve

Buoyed by expectations of strong performance in the U.S. residential market, solar stocks outperformed the broader market in May, writes Jesse Pichel of ROTH Capital Partners.

Is size all that matters?

A few months back, Martin Schachinger of pvXchange asked a question: Are bifacial modules taking over the market? Earlier, he had already noted the ongoing shift from full-cell to half-cut modules. And now, both trends seem to have foretold developments that are currently unfolding. While this cannot exactly be characterized as progress, because current developments are being driven by big Asian manufacturers, it certainly warrants a critical eye. Just a few months ago, the consensus was that the 500 W limit could only be cracked, if at all, by adding together both sides of a bifacial panel’s output. Now companies are close to introducing products to the market that have monofacial output of more than 500 W. How was this achieved so quickly?

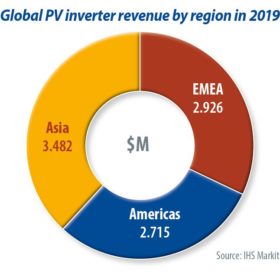

Record shipments push global solar PV inverter market past $9 billion in 2019

The PV inverter market achieved record shipments in 2019, writes IHS Markit’s Miguel de Jesus, driven by booming shipments in key markets such as the United States, Spain, Latin America, Ukraine and Vietnam. Revenue rose rapidly, surpassing the $9 billion mark in 2019 for the first time.

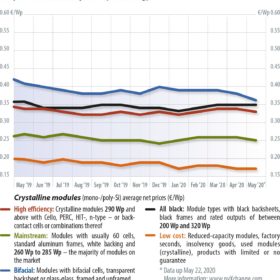

Module prices plunge as Covid-19 hammers demand

Some European countries and emerging markets are now showing signs of slow recovery, as the Covid-19 pandemic brought overseas markets to a shuddering halt in late March. However, demand is expected to remain weak through the beginning of the third quarter, writes PV InfoLink’s Amy Fang, as it will take time for overseas markets to snap back. Meanwhile, the Chinese market is again busy with the June 30 installation rush, as the government has left tariff timelines unchanged up to the middle of May.

U.S. solar – beyond the pandemic horizon

Despite a coronavirus-related bump in the road for the U.S. solar market, the future is still quite strong for all applications, from the residential segment to the utility scale, reports Paula Mints, chief analyst for SPV Market Research.

Beware of zombies: PV thriving after chaos

In times of crisis, a population usually divides itself into two opinion groups. On the one hand, there are those who believe the storm will pass and things will return to business as usual. And on the other, there are those who took the time to embrace the new reality, accepted it, and now swear that the old world has disappeared and won’t ever come back. In general, writes Becquerel Institute’s Gaëtan Masson, reality splits between the two and makes everyone wrong. And this is what might be about to happen in the solar PV sector.

A green road to recovery

In 2019, the European Commission presented the European Green Deal, under which it aims to become climate-neutral by 2050. In May of this year, the commission also unveiled a new instrument to fund the bloc’s recovery from the Covid-19 crisis, in line with the Green Deal principles. This reinforced the drive for renewables investment. pv magazine examines what the latest developments mean for solar.

Climate-neutral EU before 2050

The European Commission has positioned the Green Deal at the center of its policy priorities. The goals have been set: climate-neutrality, zero greenhouse gas emissions, and the complete decarbonization of the energy sector by 2050. The stakes are high, writes SolarPower Europe CEO Walburga Hemetsberger, but thus far Commission President Ursula von der Leyen has made good on her promises.

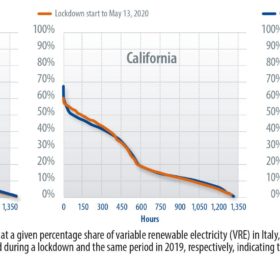

Covid-19 bolsters an EU Green Deal

The health and economic crisis caused by Covid-19 has had significant short-term impacts on European electricity demand. But the policy response to the crisis will shape the energy transition in Europe over the long term. With the €1.85 trillion recovery plan proposed by the European Commission, European leaders are aiming to jump-start the economy while maintaining focus on the energy transition.