At a crossroads

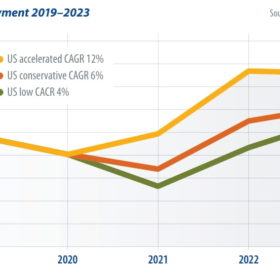

The rapid growth currently underway in the U.S. solar market is impressive to behold. More than 40% year-on-year growth is nothing short of stellar. Looking at the market segments, the residential rooftop business appears to be becoming more streamlined and shedding some of the overheads that had maintained relatively high prices. Innovations are being adopted in the commercial and industrial rooftop solar sector (pp. 78-80). And at the utility scale, a mix of state-level policies like Renewable Portfolio Standards, an ongoing appetite for PPAs, and the continued support of the Investment Tax Credit (pp. 20-23) look to have provided fertile turf for solar developers.

Supply chain shake-up

Solar stocks have underperformed in the broader market in August, writes Jesse Pichel of ROTH Capital Partners. Project delays could be on the horizon as more module imports are held up at customs, and the supply chain will start to see impacts as suppliers look for options to source polysilicon outside of China.

Delayed reaction

As of Oct. 22, the overall market posted strong performance, with the Invesco Solar ETF leading the pack.

Reduced risk for resi PV

The Invesco Solar ETF, an exchange-traded fund that tracks the MAC Global Solar Energy Index, witnessed a slight downturn in September, while performing marginally better relative to the S&P 500 and Dow Jones Industrial Average, writes Jesse Pichel of ROTH Capital Partners.

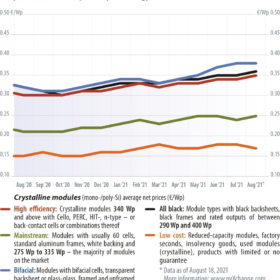

PV prices: High today, higher tomorrow

Some time ago, when I lived in the center of Berlin, I was a regular at the farmers’ market to buy fresh fruit and vegetables. One greengrocer advertised his wares with the words “cheap today, expensive tomorrow.” It would almost be desirable if we PV wholesalers could offer our modules with a similar slogan. Unfortunately, no one in the industry can currently claim that solar modules are cheap – quite the opposite. Following a brief respite, prices have climbed again in recent weeks. Since the previous low in September 2020, prices for new, grade-A goods have already risen by an average of 20% to a level not seen since April 2019.

Global tracker shipments reached 45 GW in 2020

The global single-axis tracker market increased shipment volume by 40% year on year to reach 45 GW in 2020. This was despite significant pandemic-related supply chain turbulence that resulted in longer lead times for the delivery of components, the idling of steelmaking capacity in some key markets, container shipping dislocation, and widespread restrictions, particularly at ports. Most notably, this caused the cost of some commodities, such as steel, to more than double between 2020 and 2021. Jason Sheridan, a senior research analyst for IHS Markit, runs through some of the key developments in the tracker market.

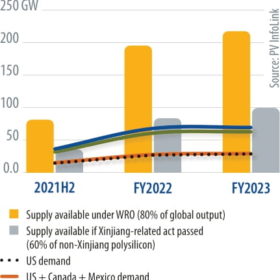

Polysilicon amid international trade disputes

Polysilicon capacity is unable to catch up with rapid capacity expansion in the mid and downstream segments, writes Corrine Lin, chief analyst for PV InfoLink. New polysilicon capacity requires big capex investment and a lead time of more than two years to complete construction and reach full operation. With unbalanced capacity between the upstream and downstream segments, polysilicon prices have been rising since the second half of 2020, with prices for mono-grade polysilicon surpassing CNY 200/kg ($27.40) in June 2021, up more than 250% year on year.

Trolley car conundrum

The U.S. solar industry faces a moral dilemma, writes Paula Mints of SPV Market Research. Either continue to deploy projects and set aside concerns about forced labor in China’s Xinjiang region, or source PV cells and modules from elsewhere, while bearing higher costs, in the pursuit of urgent action against climate change.

Policy driving expansion

The U.S. renewable energy market is on a tear. According to the International Renewable Energy Agency, the United States added 29 GW of renewable energy capacity in 2020 – almost 80% more than the year before. But high growth rates are needed to meet the Biden administration’s goal of a carbon-free electricity grid by 2035. Policymakers are now discussing a slew of measures in Washington to accelerate the clean energy transition, reports pv magazine publisher Eckhart K. Gouras.

Will Lebanon’s solar rise?

A year after a sudden explosion in Beirut killed more than 200 people, destroying solar installations in the port and sending the country into a complete downfall, a question emerges: Can Lebanon use this experience to set its economy on a new sustainable pathway, supported by a viable energy sector? Solar energy offers some lessons.