A new wave of accessibility

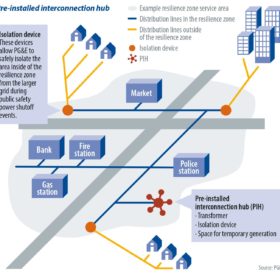

The recent massive blackouts in California have cast a spotlight on the ability of microgrids to provide resilient and reliable power in the face of grid outages. But microgrids are not a new concept. The deployment of decentralized power generation assets on a small distribution network can actually be traced back to the 19th century […]

How long?

Solar stocks underperformed the broader market in October. The Guggenheim Solar ETF (TAN) rose 0.2% versus the S&P 500 and the Dow Jones industrial average, which increased 1.9% and 0.7%, respectively.

The missing piece…

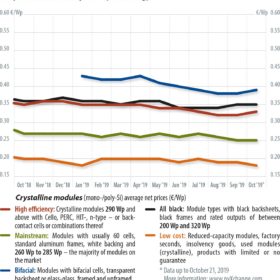

After some short-term price drops at the end of the third quarter to quickly draw down inventories and make room for new goods, the market is now largely back on track. The prices across all panel types have stabilized – only the prices for high-efficiency and bifacial products have seen a slight uptick, but this […]

A record year for trackers

It was a record year for global shipments of single-axis solar photovoltaic (PV) trackers in 2018, as they increased by more than 40%, surpassing 20 GW globally for the first time, writes IHS Markit senior analyst Camron Barati. While the United States continued to be the largest individual market for single-axis trackers last year, shipments also increased in Mexico, Australia, Egypt, Spain, and other large utility-scale markets.

Module prices continue to slide

After China’s National Day holiday, demand started picking up at a slow pace, but the anticipated installation rush did not occur as expected, due to land and financing issues, as well as the return of winter. These factors will also delay the timing of more than 6 GW of capacity to the first half of next year. PV InfoLink has thus downwardly revised its estimates for installed capacity in the fourth quarter to 11.3 GW in China and 30 GW globally, bringing this year’s global demand forecast to below 120 GW.

Offgrid goes global

Offgrid solar power has emerged as a vital part of the PV business across the African continent, and is now spreading to other parts of the globe, mainly with solar home systems and microgrids. pv magazine examines the core issues of financing, business models and the quest for user data.

A second chance to electrify Africa?

The April 2019 insolvency of shooting-star solar provider Mobisol hit the offgrid solar sector like a bombshell, throwing into question the private-sector model of supplying renewable energy to some of the world’s poorest people. Industry insiders concluded that socially minded entrepreneurs, among them Mobisol, took the revolutionary pay-as-you-go system as far as they could, before becoming bogged down in the unforgiving terrain of Africa’s markets. Then, in early September, French energy giant Engie acquired Mobisol, shocking the sector with its against-the-grain plan to take the company’s quest for universal access to energy to another level.

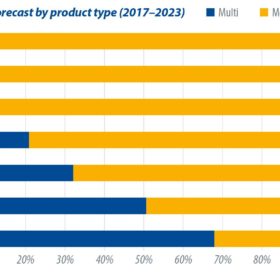

Downstream up: Taiwan’s multi-GW ambitions

Once the world’s second-largest PV cell manufacturer, Taiwan’s upstream industry was crippled under its inability to compete with mainland China’s bullish global takeover in PV manufacturing. The island’s government has put forth efforts to keep Taiwan’s PV supply chain intact – and ambitious goals and initiatives are driving demand from the downstream up.

In position to undermine utilities

Plenty of ideas surrounding the future design of the U.S. grid model are floating around the solar industry these days, but few seem as compelling as the solar+storage-based microgrid. These local electrical communities are proliferating, particularly on the East Coast and West Coast, including the hallowed turf where once mighty utilities — like now-bankrupt Pacific Gas & Electric (PG&E) — defended their monopolies.

An end to shutdowns

Last month, millions of Californians were left in the dark because their utility, Pacific Gas & Electric (PG&E), preemptively shut down power lines to avoid igniting wildfires. The Public Safety Power Shutoff (PSPS) resulted in substantial economic losses for California residents and businesses – including include lost wages, lost revenues, spoiled food and delayed production – with one economist estimating the losses at $2.5 billion. Not so easy to quantify were the disruptions to daily life and the more serious, sometimes fatal, consequences.