The market for HEM is small, and limited mostly to PV and energy storage customers today – a niche of a niche. However, HEM could play a major role in the escalation of the residential storage market in Europe, if certain market conditions are realized. In this article, I will set out four signs to look out for, which will show that these conditions are being met.

An emerging market, but what is the reality?

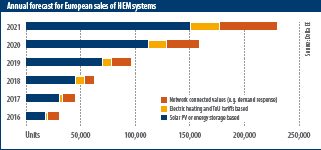

As shown in the graph above, the European HEM market is expected to grow from around 40,000 annual sales today to more than 200,000 a year by 2021.

Around two thirds of the annual HEM market is focused on solar PV system optimization, and we expect the share of these solutions to increase over the coming few years. This is mainly driven by decreasing incentives for PV export to the grid, increasing incentives for PV self-consumption, and other HEM value streams not being quite ripe for the picking.

However, this – and any subsequent growth – is dependent upon a variety of other favorable market conditions. Here, we outline four signs that we believe will be key to the growth of any future HEM market.

Connectivity of household devices

Our research shows that over 2.3 million European homes were equipped with connected home products in 2016, up from 1.5 million the previous year. Continued growth of this nature will be important, bringing greater customer awareness and acceptance of connected products, and enabling more cost sensitive – but larger – parts of the market for HEM to become unlocked.

A winning optimization platform

Today, a diverse range of players are working on different optimization platforms for the home. Eventually, one will ‘win’ and become the system of choice for the home. This will be a platform that is capable of managing multiple loads.

Residential energy storage market players and platform providers are pushing towards combining their products with other devices, like heat pumps, electric vehicle chargers, ‘smart’ electric storage heaters, hot water cylinders, and ‘smart’ plugs.

They are being joined by the likes of energy suppliers, manufacturers of electronics, heating equipment manufacturers, and other new entrants. And all are gradually moving towards the management of more electrical loads with their solutions.

However, closed protocols, multiple apps and platforms severely limit the amount of connectivity and communication between household loads. It also makes things complex and not easy to use for the customer. The development of a winning ecosystem and a HEM that is able to manage all the different loads will be critical for the HEM market to grow.

Additional value streams

A basic HEM does add value to an energy storage system proposition, with our calculations showing that a system payback of 14 years now, can be shortened to around 10 years in 2025 (for a best case scenario in Germany).

Adding a more advanced type of HEM adds considerable value to an energy storage system proposition. It does this by positioning energy storage to capture multiple values (not just from optimizing self-consumption and optimization at the electricity network level, but also expanding to include the likes of ancillary services value) that are likely to become accessible by 2025. As a result, we could see a payback of around six years possible in 2025.

Energy-as-a-Service

Innovative market players will start to utilize HEM to evolve into the ‘energy-company-of-the-future.’ Development of more sophisticated HEM solutions can pave the way for ‘storage-as-a-service’ or ‘energy-as-a-service’ business models to thrive in future energy markets. Here, multiple customer propositions become possible: “zero capex, peace of mind” offers with no up-front payment and flat rate costs can come enhanced with the benefit of providing green and locally generated electricity.

To providers, the benefit of creating deeper customer engagement, higher retention rates, and the ability to up-sell other products and services, is attracting existing energy suppliers as well as new entrants.

Key challenges

As part of the different propositions, energy storage platforms typically provide several functions.

Diagnostics: Remote monitoring & technician control/firmware upgrades to manage energy storage (ES) lifetime, allow manufacturers to meet warranty clauses (or detect operation outside of warranty limitations), deliver support contracts at lower cost, and allow a virtual power plant (VPP) operator to track and manage their assets.

Stakeholder engagement: Data for web and apps for demand/generation profiles and utilization statistics for end-users, third-party owners, and VPP operators.

Aggregated control: Aggregate operational data (e.g. state of charge), reconfigure ES en masse (e.g. take on/off frequency regulation service), support an aggregated dispatch to real-time signals.

However, to bridge the gap between energy storage and HEM, a number of challenges still need to be resolved.

First, there is a significant volume and frequency of data required to support the diagnostics and stakeholder engagement functions of the energy storage platform, which makes it very challenging to funnel this data through a standard protocol or third-party HEM.

Second, most energy storage aggregation platform developers (many of which are very distinct from ES manufacturers) are likely to be reluctant to expose too much of the communication between assets and their server, in order to protect their technological innovations and control concepts.

Third, platforms for other technology (such as smart storage heaters and smart heat pumps) also offer a similar feature set, and therefore have similar constraints/concerns to ES manufacturers.

And finally, as the home energy storage market is still new, and long-term performance of residential energy storage is still uncertain, a key challenge for the HEM provider is how to effectively share local control of an energy storage asset in a manner that doesn’t introduce major degradation or reliability issues.

These challenges will drive a mixture of energy storage manufacturers’ platforms and third-party energy storage aggregation platforms towards the development of wider HEM features, rather than opening up their energy storage platforms or aggregation logic to HEMS players.

Big names and new entrants

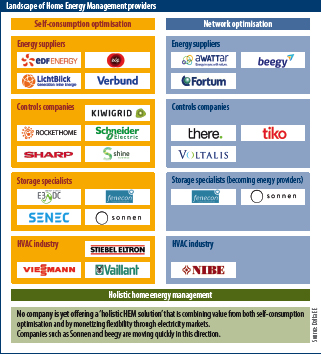

As shown in the graph on p. 72, the market is currently most focused on solar PV self-consumption optimization, mostly driven by PV players, battery manufacturers and storage providers, as well as certain control companies. In the chart to the left, you can see a selection of the different types of players involved in the HEM market landscape as a whole.

A greater number of new entrants, and some established names, are looking at entering the HEM market through capitalizing on value from network optimization – that is, optimizing when there is the existence of time-of-use (ToU) tariffs. There are also some companies looking at capitalizing on value from offering balancing services for the grid, although today this is mainly being driven by smaller technology specialists.

Where we see the biggest future opportunity is with the ‘holistic’ or ‘advanced’ HEM solution: one that combines value from both self-consumption optimization and from monetizing flexibility through electricity markets. Those that move the quickest and most effectively in this direction have the best chance of taking a leading position in this emerging market. And ultimately in this case, HEM can have a major role in the escalation of the residential storage market in Europe, helping to create a tipping point for the emergence of energy-as-a-service as a mass market proposition.

Author: Scott Dwyer

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.