Solar could hold advantage in post-pandemic global energy sector

The International Energy Agency has acknowledged dramatic falls in energy investment caused by the Covid-19 crisis but said renewables, including PV, offered an attractive proposition to investors as the dust settled, given their enticing economics and short turnaround times.

The weekend read: Sustainable finance – reassessing risk, purpose

The global Covid-19 crisis has had a tumultuous impact on the global economy. It has brought investment risk and purpose into sharp focus, while also bolstering sustainable finance. But what does it mean for solar? Felicia Jackson reports from London on the evolving investment landscape, with climate and social impacts becoming more prominent in financial decision making.

N-type uptake under Covid-19

As p-type mono cell efficiencies edge closer to their limits, n-type cells are increasingly being recognized as next-generation technologies, writes PV InfoLink analyst Amy Fang. Manufacturers have focused their research and development efforts in recent years on the creation of commercially viable pathways for heterojunction (HJT) and tunnel-oxidized passivated contact (TOPCon) cells.

It may be safe to put PV panels in landfills, but that doesn’t mean we should

According to a new report from the International Energy Agency (IEA), health risks from lead in crystalline silicon PV panels are one order of magnitude — or about one-tenth — below the risk levels set by the U.S. Environmental Protection Agency.

Covid-19 weekly round-up: Residential systems in Italy will get a 110% tax rebate and UK consumers are being paid to turn appliances on as coronavirus turns the energy world upside down

Plus, Australia’s Greens want renewables front and center of the post Covid-19 economy and Mexican plant owners are overturning a politically-motivated ban on clean energy, however, Indian developer Acme solar says pandemic delays warrant it reneging on the terms of the record-low solar price agreement it signed.

Solar panel recycling: Turning ticking time bombs into opportunities

Australia has certainly demonstrated its appetite for solar power. Now, with the average lifespan of a solar panel being approximately 20 years, many installations from the early 2000’s are set to reach end-of-life. Will they end up in landfill or be recycled? The cost of recycling is higher than landfill, and the value of recovered materials is smaller than the original, so there’s limited interest in recycling. But given the presence of heavy metals, such as lead and tin, if waste is managed poorly, we’re on track for another recycling crisis. A potential time bomb could present itself as an opportunity, however, if the global EV industry showed an interest in the recovered solar products.

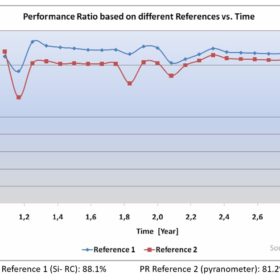

Comparisons of PR factors for large-scale solar PV power plants limited

For an investor of large-scale solar PV power plants, efficiency and reliability are two of the most interesting issues. For rating purposes, the Performance Ratio (PR) factor, has been created. However, this metric is only suitable for comparisons to a limited extent, argues Edwin Cunow, owner of LSPV Consulting.

Covid-19 weekly round-up: US job losses raise concern but France and China continued to add new solar

Cell supply shortages could kick-start manufacturing activity in India, EV car sales are braced for a fall while still gaining market share and a new date has been set for the world’s biggest solar trade show.

Sunny regions could see one-cent solar within a decade

The solar learning curve usually applied to panel costs has been extrapolated to the larger, non-module element of the price of solar electricity generated by big projects, leading one commentator to predict new solar projects could be cheaper than legacy fossil fuel plants within 10-15 years in certain markets.

Electric vehicles show more resilience than conventional cars during Covid-19 shock

EV sales are set to be 1.7 million off because of the economic fallout of the Covid-19 crisis, however analyst BloombergNEF predicts that will be less of a hit than the anticipated fall in sales of conventional cars, increasing the penetration of electric models into the overall market.