US solar installations grew in 2018 despite tariffs

Clean energy analyst BloombergNEF says the U.S. installed 11.7 GWdc last year – 15% more capacity than earlier estimated – as well as 292 MW of batteries. Despite new solar and wind growth, and coal closures, however, emissions still rose from 2017 levels on the back on increased gas use.

US leads as the volume of corporate clean energy bought smashes record

Companies in the United States accounted for more than 60% of the clean energy deals signed by corporations worldwide last year, according to BloombergNEF. A proposed renewable portfolio standard for Chinese business, though, could turn the picture upside down in a year’s time.

Green power certificates and curtailment will be key to China’s grid parity solar ambition

Analysts have welcomed the measures ushered in by Beijing to encourage the development of PV projects without central subsidies, but with the obstacles the policy aims to address having dogged Chinese solar for years, more detail is required.

Solar investment slid on the back of cheaper modules and China setback

The world again saw more than $300 billion of clean energy investment in 2018, according to BloombergNEF, and although wind narrowed the gap on solar, plunging module prices skewed the figures as PV capacity additions rose 10 GW.

New products contribute to another record year for sustainable finance

BloombergNEF figures show financial vehicles linked to environmental and/or social benefits amounted to $247bn worldwide in 2018. The US led the way, almost entirely because state-backed mortgage provider Fannie Mae issued $19.8bn worth of green home loans.

Developing countries biggest installers of renewables – BloombergNEF

In a new report, BloombergNEF notes a significant uptake in renewable energy in developing countries, which are clearly outperforming OECD countries. The trend is due to reductions in equipment costs and new business models that enable access to capital. Still, many emerging markets are also the biggest installers of new coal capacity. India and China alone, are said to account for 81% of newly added coal-fired power stations.

Solar, wind cheapest source of new generation in major economies – report

Solar and/or wind are said to be the cheapest source of new energy generation in all major economies, apart from Japan, finds BloombergNEF. It adds that China’s utility-scale PV market has contracted by over a third this year; and that battery costs are set to drop a further 66% by 2030, driven by EV adoption.

What’s in store for storage? $620bn

The rise of batteries will attract that headline figure in investment up to 2040, say analysts, as exponential growth in EV ownership, falling stationery system costs and the needs of the world’s grid-poor regions combine to boost lithium-ion technology.

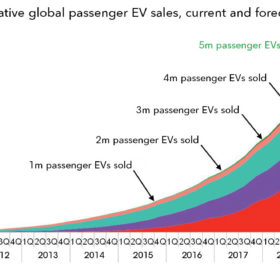

Global EV sales hit 4 million, soaring market sees next million in May 2019

While it took 60 months to reach the first million electric vehicle (EV) sales, in late 2015, it took the fourth million just six months. China is driving this development. Meanwhile, as first generation EVs batteries are reaching their end-of-life, interest in second-life use cases is growing. The volume of retired EV battery packs is set to be 108 GWh by 2029 – representing a third of the expected storage capacity market at that time.

Batteries material market set to grow 9% until 2022

A report by Technavio suggests the global market for battery materials could grow 9% annually in the next four years. Analysts point to the increasing installation of storage systems with PV as a key driver. pv magazine has covered previous reports predicting significant growth in PV and storage systems.