Chinese PV Industry Brief: Xinte wants to add another 200,000 tons of polysilicon capacity

Xinte’s new manufacturing facility is planned to be located in Changji county, in the Xinjiang Uygur autonomous region. Moreover, Longi is planning to build another factory in Erdos City, Inner Mongolia.

Chinese PV Industry Brief: 50 GW plan for rooftop, BIPV

Elsewhere, Wafer manufacturer Shangji Automation has secured a long-term wafer supply agreement from cell maker Aiko Solar and wafer maker Zhonghuan Semiconductor reported record revenue for 2021. Furthermore, GCL-Poly appears to have backtracked on its plan to rename the business GCL Technology

Chinese PV Industry Brief: Wafer prices rise as Aiko Solar halts shares offering

Manufacturers Longi and Zhonghuan Semiconductor have both raised the price of their 182mm wafers while holding the cost of their other products as rival Shuangliang Eco-energy signed deals for more wafer production equipment.

IHS Markit: Battery prices won’t fall until 2024

The London-based analyst has published a series of clean tech predictions for the year which also highlighted the rising proportion of sub-5MW solar projects in the global market, and cheaper clean energy financing costs even as panel prices continue to rise.

Chinese PV Industry Brief: More glass capacity and a 5GW module factory under construction

Glass maker Flat Glass wants to add 7,200 MT of new glass capacity spread across six new production lines and panel manufacturer Eging PV started construction of a new PV panel factory with an annual capacity of 5 GW.

Chinese PV Industry Brief: Daqo could make 125,000 tons of poly this year

Also, heterojunction module manufacturer Huasun has begun assembling production lines at its new 2GW factory and Trina Solar has agreed to buy 290 million wafers from Beijing Jingyuntong Technology.

Impressive numbers for Chinese solar panel glassmaker

Xinyi Solar has proposed a dividend for the second year running as it announced shareholders would bank net profits of $630 million despite rising materials and shipping costs last year.

‘The major solar players will shift from PERC to TOPCon’

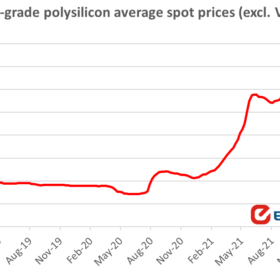

US analyst Clean Energy Associates made some notable predictions in its Q4 survey of the world solar manufacturing market, including echoing predictions made elsewhere that the new polysilicon production capacity coming online now will help arrest the spike in solar panel prices.

Chinese PV Industry Brief: Shangji Automation expands polysilicon capacity by 100,000 MT

In other news, Longi announced it further raised wafer prices and the China Photovoltaic Industry Association (CPIA) said the Chinese PV market may reach a size of up to 90 GW in 2022.

Polysilicon price fluctuations expected to continue until late 2023

Two industry experts have provided analyses of the current polysilicon price scenario in a chat with pv magazine and both agreed that polysilicon demand is still growing faster than supply. The price may decrease starting from the second quarter and reach more reasonable levels by the end of the year.