PV Expo Tokyo 2024: Lightweight solar modules, agri-PV and big storage aims

PV Expo Tokyo 2024, Japan’s main solar industry event, has concluded with record numbers, innovative products, and new trends. Storage auctions and new rules for power purchase agreements (PPAs) are driving the market to new spaces, as project developers scramble for land to build on, while lightweight plastic modules continue to gain prominence.

Agricultural PV emerges as Japan’s next opportunity

Self-consumption, the ability to isolate from the grid and provide power in the event of outages, and agricultural solar are key components in the 2020 revisions to Japan’s feed-in tariff program, reports RTS Corp.’s Izumi Kaizuka.

Nothing boring about Japan’s year of the boar

With tenders coming in for large-scale projects, and decade-old generous FIT programs being phased out, new opportunities and challenges are facing Japan’s PV players. Izumi Kaizuka from Tokyo-based analyst RTS Corporation sets out the major market trends for 2019.

Construction commences on 213 MW of solar in Japan

Pacifico Energy is set to commence construction on two utility-scale PV projects totaling 112 MW and 72 MW, respectively, while Trina Solar is working on a 29 MW plant.

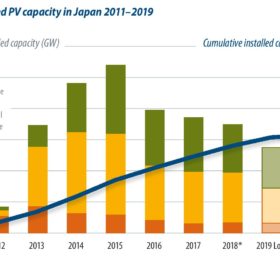

Japan: Disappointing first auction; plans for 200 GW solar by 2050

Japan’s first solar PV auction has reaped disappointing results, with just 41 MW set to be developed. Under the revised FIT, meanwhile, 27.7 GW were cancelled. Despite this, JPEA is aiming for 200 GW of solar PV installs by 2050. Overall, cumulative installed capacity has reached over 40 GW. There are still many plans afoot for large-scale projects, although it is the rooftop sector, which holds the most promise.