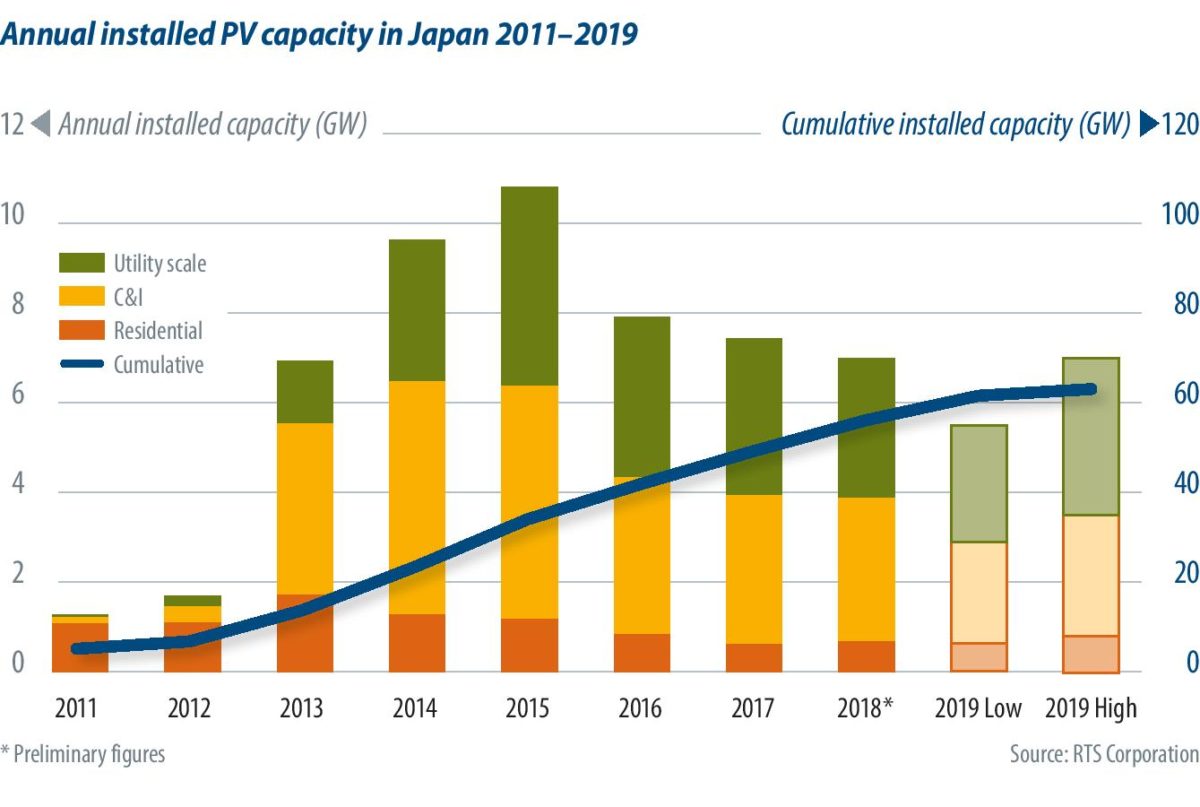

In the Japanese zodiac, 2019 is the year of the boar. In the Chinese zodiac, it is the year of the pig. The boar is sometimes depicted dashing towards a target. In the Japanese stock market, the year of the boar is recognized as the year of stabilization. The Japanese PV market’s peak was 2015, with 10.8 GW, from which point it has declined each year. We may see further slowing of installed capacity in 2019, but it seems the year also provides opportunities for the solar sector, and it is expected to be a year for the PV industry to prepare for new development, and expanding business in the 2020s – particularly in the residential market segment.

FIT reforms

The Japanese Ministry of Economy Trade and Industry’s (METI’s) solar committee agreed on a FIT of JPY 14/kWh ($0.13) for PV systems between 10 and 500 kW. The FIT will be officially approved by the Minister of METI by the end of March.

In the committee meeting, there was no discussion on the FIT for residential

(<10 kW), which is already set at JPY 24 or JPY 26/kWh ($0.22 or $0.24), depending on the region. While the FIT level is reduced by 22% from the previous year for the non-residential sector, RTS does not expect this change to crush the market segment.

After the first major revision of the FIT in April 2017, the connection deadline was set for previously approved projects. METI introduced a three year deadline for non-residential PV projects over 10 kW in size that had signed contracts with a utility after August 1, 2016. Projects approved by the end of Fiscal 2016, (March 2017) need to start operation by March 2019. In addition, METI has set new rules for projects that signed a contract before the end of July 2016.

In December 2018, METI announced new measures to address the FIT-approved pipeline which had not yet commenced operation. The purpose was to reduce the financial burden of Japan’s solar program. PV projects will receive a reduced FIT depending on their commissioning date, as well as a deadline for full operation. Projects 2 MW or more need to start operation by September 2020. Those under 2 MW must start by March 2020.

According to METI, around 32 GW of non-residential FIT projects had not commenced operation. While a grace period was set for projects at 2 MW and greater, it seems most would start operation between 2019 and 2020. These measures may cause a construction rush. Thus, as shown in the graph over the page, RTS Corporation expects 5.5 to 7 GW to be installed in 2019.

METI tenders

As part of efforts to reduce high solar power prices in Japan, a tender program was introduced from FY 2017. Three tenders were implemented by the end of 2018. These aimed at selecting projects of 2 MW or more. The bid capacity exceeded the target for the first time in the third tender results announced in December 2018.

No projects were selected for the second tender because there was no application with a ceiling price below JPY 15.55/kWh ($0.14) disclosed after the bidding. Seven projects totaling 196.96 MW won the bid. The lowest winning price was JPY 14.25/kWh ($0.13) and the highest was 15.45/kWh ($0.14). The cost reductions achieved through the introduction of the tender scheme were confirmed.

METI’s FY 2019 plan for PV tenders is expanded to come in at 500 kW or more, and the total target capacity is 750 MW (fourth tender: 300 MW, fifth tender: 450 MW). The ceiling price will not be announced for the fourth tender. For the fifth tender, announcement of the ceiling price will be decided after reviewing the results of the fourth tender. Assuming the size of the target total capacity and successful results of the third tender, METI expects successful results for this year’s tenders. Recent price reductions of modules and inverters in Japan are certainly helpful for the tender participants.

Residential storage opportunity

Players in residential PV expect big opportunities for retrofitting storage. In 2019 the FIT purchase period for residential PV systems will expire. As of November 2019, 10 years after the start of the program, the number of rooftop systems for which the FIT will expire is expected to reach 530,000, totaling 2 GW. This will grow to 1.65 million systems, with a capacity of 6.7 GW by 2023.

Those residential PV owners have several options, such as self-consumption in combination with electric vehicles (EVs) or batteries, as well as the sale of surplus electricity via one-on-one contracts with utilities or power producers and suppliers (PPSs), a newly formed power distribution business under Japan’s electricity market reform.

Residential PV players are now offering batteries for retrofit as well as new houses. Heavy rains in western Japan and the 2018 Hokkaido earthquake have increased consumer interest. Players are also considering post-FIT business models utilizing PV plus batteries, preparing for the post-FIT era and the movement toward Zero Energy Houses.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.