Indian solar PV manufacturers are still facing a series of challenges that are limiting their ability to capture a larger piece of the growing domestic market, finds new analysis by Mercom Capital Group.

With installations expected to soar past 9 GW in 2017 – more than doubling on last year’s capacity growth – the opportunities appear rife for homegrown firms to play a leading part in this market expansion.

However, high levels of low-cost Chinese imports are unlikely to subside any time soon, and political wrangling regarding the controversial Domestic Content Requirements (DCR) has done little to aid domestic manufacturers’ cause. Additional problems run through the sector, including a lack of scale and investment, and mixed policy support from government that is serving to undermine confidence in India’s ability to deliver a supportive and stable climate in which to invest in solar power.

Mercom Capital Group’s analysis of the current state of the Indian domestic solar manufacturing market finds a sector that was active long before any policy or significant market demand existed. Prior to the establishment of the transformative National Solar Mission (NSM), Indian solar firms focused on original equipment manufacturing and exports to Europe, amassing billions of dollars in export revenues between 2008 and 2012.

When Chinese manufacturing boomed, module prices began to fall sharply, dropping from $1.80/W to $0.65/W between 2011 and 2012, and state-backed Chinese firms were able to corner vast shares of the global market at the cost of Indian suppliers.

Current capacity

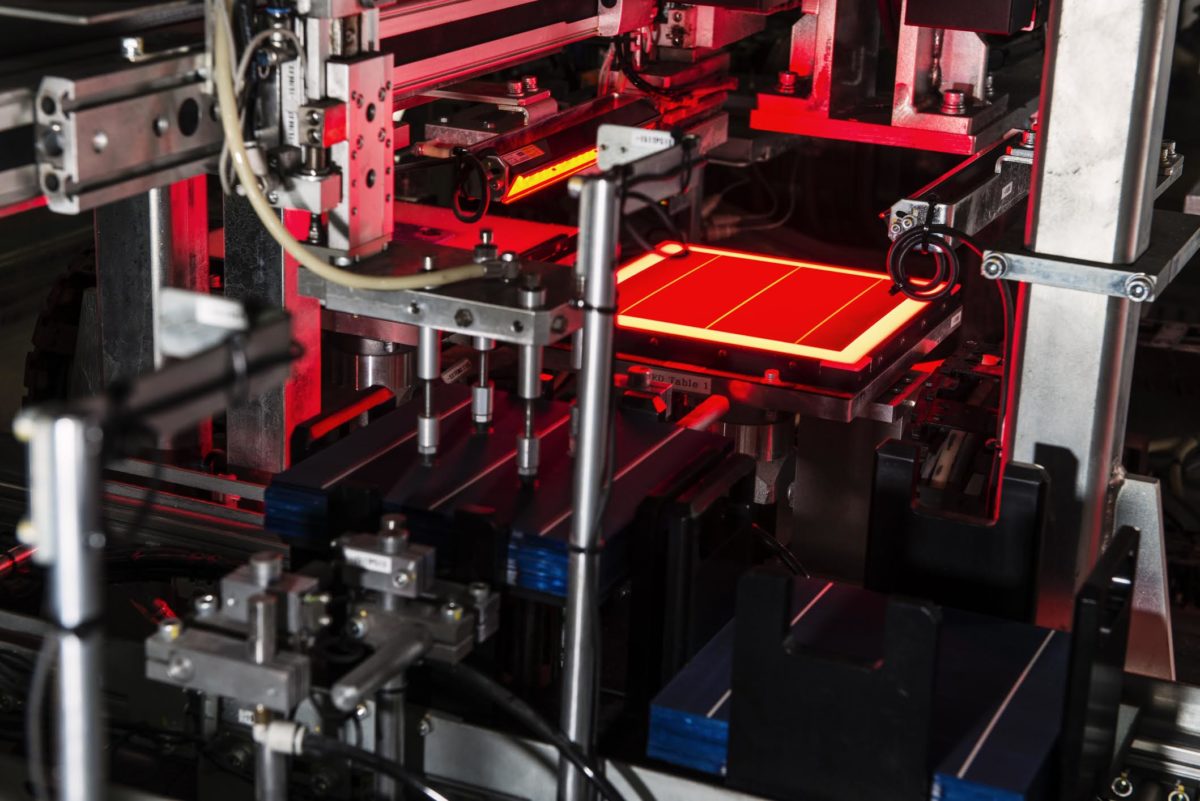

Mercom data shows that the current manufacturing capacity in India stands at 8,008 MW and 2,815 MW for modules and cells respectively. However, much of this is idle or outdated capacity, and the truer operationals figures are closer to 5,246 MW and 1,448 MW respectively, as of December 2016. Working capacity is much lower, at around 3 GW for modules, Mercom’s analysis shows.

India’s cumulative installed solar PV capacity is 9.6 GW. Between April and October last year, solar export and import activity reached $1.22 billion. More than $1 billion of this figure was solar imports; an imbalance exacerbated by the price mismatch between domestically produced modules and the cheaper Chinese modules.

However, there exist further challenges facing Indian solar firms. “The major problems plaguing the sector are a lack of scale, insufficient government support and an underdeveloped supply chain,” an official at Waaree Energies told Mercom Capital Group. A Shukra Solar representative also said that manufacturers often struggle to gain access to funding to build manufacturing units. Private banks were singled-out for criticism for their unwillingness to lend, or lend at attractive rates.

Popular content

The World Trade Organization’s ruling that India’s DCR contravened its trade agreement has also harmed domestic manufacturers, others told Mercom, and this has prompted growing calls for government to deliver alternative supportive policies and finance, particularly in R&D.

An offer by the Ministry of New and Renewable Energy (MNRE) for local firms to build 500 MW of polysilicon manufacturing facilities in return for IPP rights to develop attractive 1,500 MW solar parks appears to have run cold, Vikram Solar told Mercom: “While the offer was made, we have not heard back from MNRE on this topic”.

Further, the current budget made no mention of any forthcoming subsidy or government incentive, much to the dismay of Indian manufacturers.

Actions being taken

Modules produced in India generally cost around 10% more than Chinese imports, and the recent flurry of record-low auction bids – such as that seen last week in Madhya Pradesh – can only come to realization with the use of cheaper Chinese solar panels. To combat this wide and growing imbalance, the government’s “Make in India” program aims to offer 20-25% capital subsidies and other incentives to domestic manufacturers. The Viability Gap Funding (VGF) mechanism is also a form of subsidy that has enjoyed some successful uptake.

Another method of support comes via the Goods and Services Tax (GST), which waives 12% countervailing duty and 5% VAT on solar components produced domestically, the Ministry of Commerce told Mercom.

“Other than announcing DCR auctions for government installations, there is no concrete policy proposal yet,” said Mercom Capital Group CEO Raj Prabhu. “Access to financing at competitive rates is something many manufacturers are looking for. Unless there is scale it seems like an impossible task to compete with Chinese manufacturers on price.

“Cheaper infrastructure and R&D investment are other areas that the government can focus on. American and European manufacturers have tried and failed to upend the domination of Chinese manufacturers, and it remains to be seen how far the Indian government is willing to go to support local manufacturers.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.