UNSW finds solutions to LID in PERC cells

Researchers from the University of New South Wales have pinpointed the causes of Light Induced Degradation in PERC cells and have developed process to eliminate them. Presenting on the second day of SNEC trade show in Shanghai, UNSW’s Stuart Wenham noted that there are two type of cell defects that lead to LID, one of which manifests as pronounced LID between five and ten years after installation.

The enthusiastic uptake of PERC technology has been the major technology trend within PV cell manufacturing in recent years. Delivering a substantial efficiency boost and with the ability to be deployed as an upgrade to existing cell lines, PERC production continues to increase in volume and as a share of overall output. LID, which is often also influenced by temperature, is a particularly “nasty” effect, said Wenham, wiping out the efficiency boost delivered through the PERC processes and potentially manifesting itself many years after module installation.

UNSW says that it can test for both Type 1 and Type 2 defects in PERC cells that will eventually lead to LID. Wenham set out how his team could also model future degradation as a result of both defects.

The Australian PV researchers, who have worked closely with the Chinese PV industry for many years with Wenham himself a former Suntech CTO, have also been involved in developing manufacturing processes and equipment through which both types of LID-causing defects can be addressed. The process involves cell hydrogenation and then controlling the charge state of hydrogen atoms throughout the process steps.

“Stuart [Wenham] said the LID problem has been solved at UNSW, but it’s a bit more complicated than it first appeared,” said Martin Green, who heads up the UNSW’s Center for Advanced Photovoltaics. “The second type of [LID-causing] defect depends on the details on the hydrogenation process itself.”

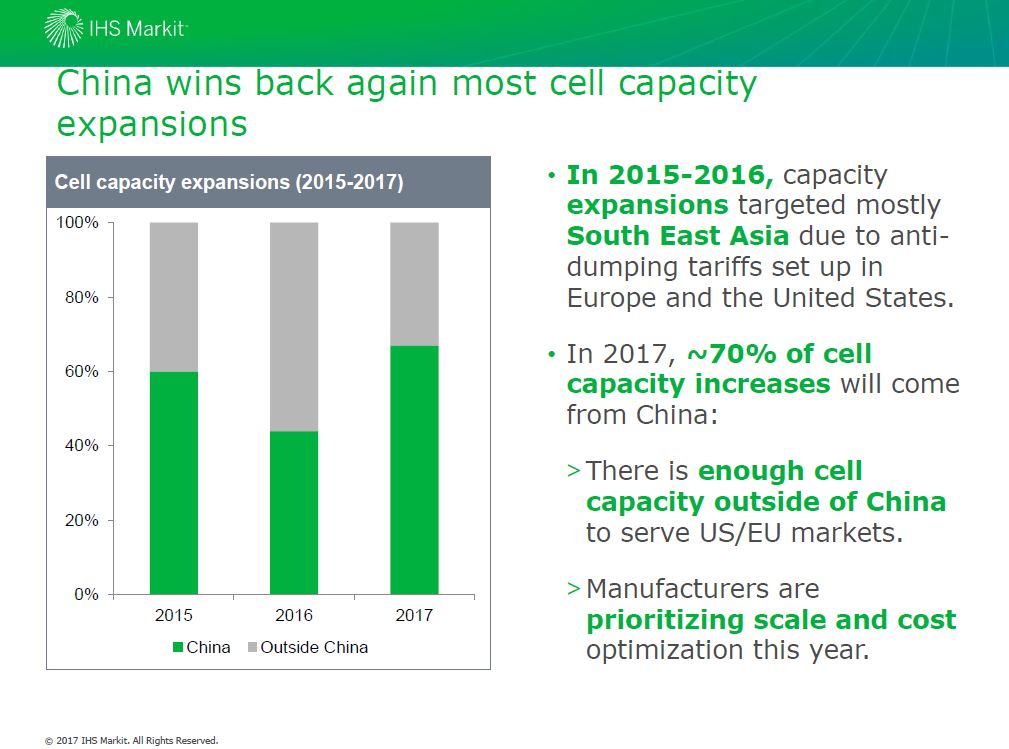

China to drive cell capacity growth in 2017, says IHS Markit

China is poised to account for 70% of all new PV cell capacity expansion in 2017, according to IHS Markit’s Edurne Zoco.

Leading Chinese solar cell manufacturers now have enough overseas capacity to serve the U.S. and European markets, thereby freeing up investment funds and R&D efforts to build further capacity within China in order to support expected growth this year, says Zoco.

The chief priority now among Chinese solar cell producers is to build scale and address cost optimization in 2017, with a big focus among many to maintain high and stable utilization rates across all nodes.

Globally, 2017 will also usher in further market share growth for monocrystalline cells, gaining on 2016’s 29% market share as costs continue to fall. By 2020, IHS Markit says, mono cells will account for 37% of the market. China’s Top Runner program is just one of a series of high-efficiency-supporting policies aiding the uptake of mono.

The general trend of module overcapacity has not impacted the high-efficiency cell sector, where there remains strong demand for such products throughout most leading and emerging markets. Standard-type BSF cells are losing market share, with PERC set to claim 24% of the market by the end of 2017, growing to 30% by 2020.

Zoco’s presentation at the first Plenary Session at the SNEC Conference addressed key trends for the global PV market in 2017 and beyond. IHS Markit is expecting the solar market to add 79 GW of new capacity this year, with an upside potential of 85 GW depending on whether China beats the more conservative installation projections.

The main trends continue to be China leadership, Indian growth, a U.S. slowdown and European and Japanese stagnation, Zoco said. Between then, the U.S. and Chinese solar markets are poised to add 8 GW less than in 2016, but China will see fewer quarterly demand peaks and a more even distribution of installations throughout the year

Latin America and the MENA region will be the main growth areas for solar over the next five years, Zoco said, with emerging markets adding more than 64 GW of new PV capacity between 2017 and 2021.

Looking farther ahead, the global installation base for solar will likely reach 770 GW by 2021, with more than 60 1 GW+ markets around the world by that date.

Bürkle claims dramatically reduced lamination times

German lamination supplier Bürkle announced at the show that it has achieved a dramatic reduction in lamination times. For standard backsheet modules, Bürkle said that it can reduce process times by 26.7%. The result was achieved on the company’s easy-lam and Ypsator platforms.

In the fast-growing glass-glass market, Bürkle says that it can achieve a reduction in lamination time of 30.1%.

Lamination times for glass-backsheet was reduced from 7.5 minutes to 5.5 minutes, with 6.5 to 4.5 glass-glass. Dual-glass is a two-step process with the entire lamination running 13.5 – including cooling.

Looking towards costs, on a 72-cell module, the reduction in lamination time can deliver savings of 10.2% on glass-backsheet modules, and 9.9% on glass-glass. Bürkle engineers stipulate the results are dependent on materials.

“These results can deliver flexibility to module manufactures,” said Bürkle’s Sraisth, when presenting the development today during the SNEC conference. Sraisth said he had worked for nine months to develop the process innovations required to bring down the lamination times. “This is just the beginning,” he said.

Miss Mongolia attends SNEC to support PV in her homeland

Former Miss Mongolia Britta Battogtokh attended the SNEC yesterday, in an attempt to encourage solar deployment in her home country. The glamorous and articulate solar advocate said that solar had made a profound impact in rural areas in Mongolia and has the potential to alleviate high levels of pollution in Mongolian cities.

“The main goal is to connect solar companies to Mongolian officials,” said Battogtokh. She said that her work in advocating for solar had allowed her to travel widely and that it links to her personal life experience.

“In Mongolia there is a lot of pollution in the winter, for three or four months,” said Battogtokh. “That is why the government is pushing towards solar power plants. I grew up in the countryside and we didn’t have electricity. We lived in a Yurt and had one PV panel and a small battery, and so my work with solar is connected to my background.”

Battogtokh only attended SNEC on the first day yesterday, but had a clear message for both government officials in Mongolia and the global industry: “It’s clear, solar is the future.”

Turning point for distributed generation

Although distributed-generation (DG) solar has been a key development priority for the Chinese government for several years, build-out has thus far fallen short of expectations. Annual installations hit 34.5 GW in 2016, with DG projects accounting for just 4.23 GW of the total, according to statistics from the National Energy Administration (NEA). However, many industry participants believe that 2017 could mark a turning point.

“In 2017, ‘distribution’ will be the keyword,” said Lengen Shu, GCL Finance (Group) Holdings.

Numerous issues have discouraged banks from financing for DG projects, including concerns over the stability of the incentives that provincial and municipal authorities offer on top of the central government’s subsidies. While developers have successfully installed arrays on factory rooftops in recent years, growth in the residential segment remains stalled by a dearth of suitable rooftops, concerns about the structural integrity of buildings, a lack of clarity over long-term building ownership and the weakness of contracts.

But Shu believes that the biggest barrier to financing for DG solar is public awareness. “How can we build an ecosystem to support DG?” he asked, arguing that the weakening of the Chinese currency is a risk that continues to complicate the outlook for financing in 2017. “We need to promote DG as something that’s good for the public.”

Hong Li, chief financial officer of United PV, believes that sliding power prices have further discouraged investment in DG and utility-scale projects. While he said that the cost of capital is a concern, he also bemoaned the tendency for provincial authorities to push developers to use local suppliers to win projects. “Different kinds of subsidies can change returns on investment,” he said.

Curtailment of PV from the grid — particularly in northwestern China — also discourages lenders from investing in projects, although Li noted that the expected completion of an ultra-high voltage DC transmission line from Gansu province this year could provide some relief. However, grid operators will likely continue to favour coal-fired capacity over solar in heavily-curtailed locations such as the Xinjiang region, he said.

Curtailment of PV from the grid — particularly in northwestern China — also discourages lenders from investing in projects, although Li noted that the expected completion of an ultra-high voltage DC transmission line from Gansu province this year could provide some relief. However, grid operators will likely continue to favour coal-fired capacity over solar in heavily-curtailed locations such as the Xinjiang region, he said.

“We need to limit our investment in such areas,” he added. “We’re looking to strengthen investment in central China.”

Alex Sun, general manager of Apollo Solar, said that third-party energy-management service providers can play an important role in reducing finance-related risks. The company — affiliated with wind-turbine supplier Envision Energy — currently manages more than 60 GW of solar, wind and storage capacity worldwide. In 2016, it worked with financial institutions such as China Development Bank and China CITIC Bank.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.