The Chinese solar manufacturer expects to “record a considerable decrease in the consolidated profit attributable to the owners of the company, for about 75% as compared to that for the period ended June 30, 2016,” it said in a statement to the Hong Kong stock exchange, without providing additional figures.

It posted a profit of CNY 325.5 million ($48.9 million) in the first half of 2016, partly because disposal gains on solar farms were significant, at roughly CNY 144 million. However, the company also attributed its narrower anticipated profit for the first half of this year to several other factors, including interest expenses it incurred on $260 million issued in February. In addition, it pointed to higher costs required to hedge against currency risks in the January-June period, as well as a decline in fair value gains on convertible bonds.

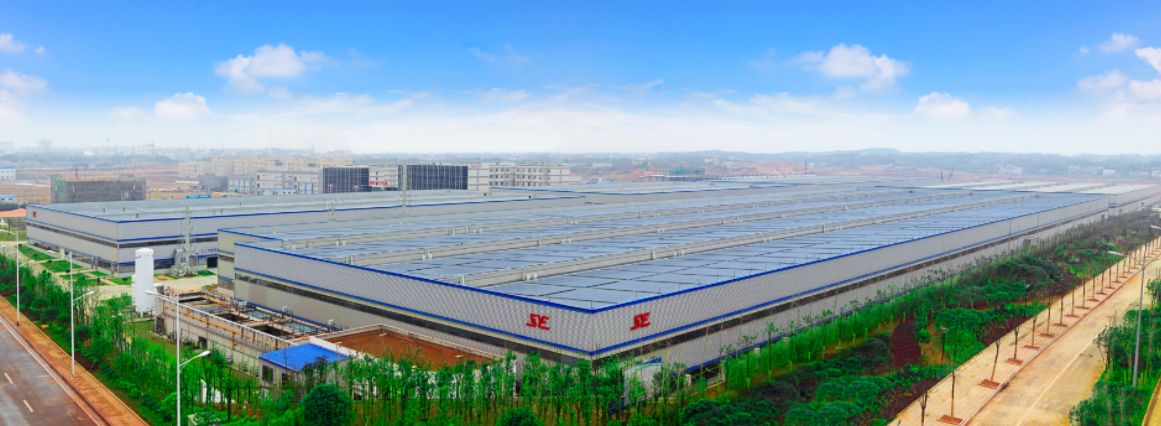

However, Singyes Solar said that its solar EPC, curtainwall and green building businesses continue to meet performance expectations, based on preliminary, unaudited results for the six months to the end of June. As a result, it expects stable revenue growth in the first half of 2017, with no significant changes in its gross profit margin.

Popular content

In late July, Singyes Solar completed the spin-off of its Singyes New Materials unit, which is now a non-wholly owned subsidiary, with shares listed on the Shenzhen stock exchange’s growth enterprise market. The group posted a net profit of CNY 512.5 million in 2016, up 43% year on year. Its cumulative grid-connected PV capacity in China reached 270.7 MW at the end of December.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.