Of all the technologies available to produce electricity, PV is by far the simplest and most stable. Combined with its scalability, this is the key reason why PV can be successfully deployed in remote areas where there is no sophisticated maintenance infrastructure available. But the essential component of a PV plant, the modules, are error-prone, and even small defects can reduce the overall power production over time considerably. Therefore, it’s not just breakdowns of complete modules that are relevant. Astonishingly, most residential PV installations lack any kind of monitoring system, and even for commercial and utility-scale PV power plants it is considered sufficient to monitor the power output to assure proper functioning of the solar system. This level of operational control provides you at best a granularity at the string level regarding the performance of your modules. If a higher level of surveillance detail is desired, the main option available thus far has involved equipping the solar installation with module-level power electronics (MLPE) instead of standard string inverters or central inverters (depending on the size of the power plant).

Yet this level of sophistication comes at a price of more than $0.10 per watt to the initial investment cost. These higher costs for MLPE solutions can only be justified if you have a difficult plant layout, such as different orientations of modules, varying string lengths, or shading. Under these circumstances, MLPE solutions can provide a meaningful improvement and, thus, the extra cost can be amortized over time. On the other hand, if your modules are all well matched in their power rating and face the same orientation – as is typically the case for larger installations – the added benefit of module level inverters or power optimizers is limited, which means you pay for a functionality that under these circumstances is not really required and thus proves too expensive.

A third way

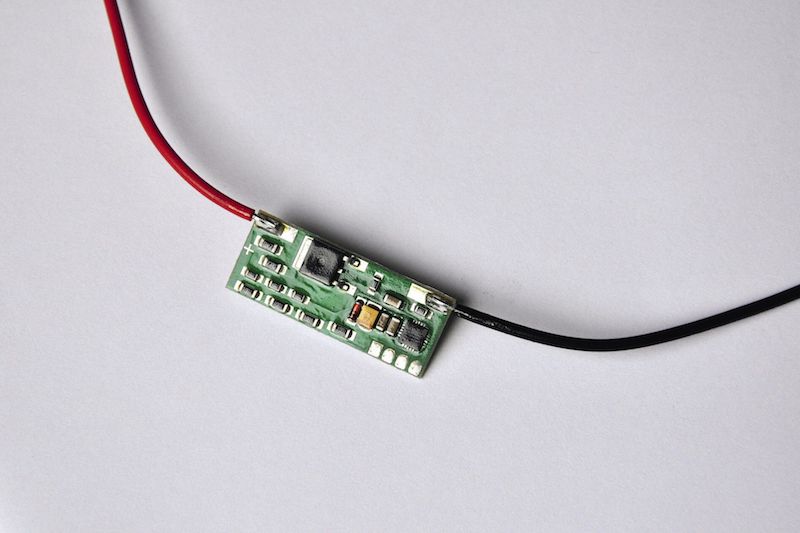

This is where the SunSniffer-approach can come into play. The SunSniffer is a high accuracy sensor that is attached to each module (ideally in the junction box) and monitors its voltage and temperature at 30 second intervals. A string reader collects these data from all of the modules in the string, and also logs the current and voltage of the string and sends this information via RS 485 to a gateway.

PV MAGAZINE WEBINAR

New monitoring options promise greater control at lower costs

Are conventional monitoring methods for solar plants actually substandard? Or do solutions providers simply make such claims as a marketing tactic?

In pv magazine’s upcoming webinar, you will have the chance to form your own opinion. Analyst Götz Fischbeck, the author of this article, has investigated the pros and cons of the main options that are currently available, particularly SunSniffer’s module-level monitoring system. Ingmar Kruse, CEO of SunSniffer and a sponsor of this webinar, maintains that for an additional investment of just $0.02/Wp, investors can reduce their O&M costs by 20%. This could radically change current O&M practices, as site engineers would no longer have to waste their time looking for degraded modules, connectors, or other defects. Instead, they could use a mobile app to precisely identify modules that are contributing to yield losses that exceed certain thresholds of acceptability.

Experts: Götz Fischbeck, analyst – Ingmar Kruse, CEO of SunSniffer

Moderator: Ian Clover, Senior Editor of pv magazine

Join the free webinar discussion on Wednesday, November 1 at 4:00 p.m. Register for free.

The internet gateway relays the data to a data center where intelligent algorithms with artificial intelligence and data mining evaluate the data and are able to identify even the smallest deviations. All of this additional information on the performance of the PV system can be gleaned for less than $0.02/W of additional capital expenditure, which means it costs less than 20% of what an MLPE-solution would.

But is the increased level of information about the status of the module worth this extra investment? “Of course,” says Ingmar Kruse, CEO of SunSniffer. “Just consider the time frame we are talking about: Today’s solar power plants are built to last at least 20 years and more; often even 30 years are advertised as a realistic lifetime over which the modules are promised to deliver at least 80% of their nominal power rating.

“How can you make a guarantee claim unless you have exact performance data of each individual module, including its temperature?” Kruse asks. “Unless your module has a massive problem, the level of accuracy provided by the other monitoring systems will not grant you the information required to demonstrate that your module’s performance lies outside the tolerance band provided by the guarantee. Module temperatures can vary by more than 10°C in a PV installation. This could lead to power output differences of 4% between two identical modules. Add to this the measurement uncertainty of the irradiation and you will have a hard time claiming a module warranty in the first five years of operation, unless the underperformance exceeds 10%.”

A recent study by the Bavarian Center of Applied Energy Research (ZAE Bayern) on 120 PV plants of all sizes revealed that on average, 8% of the modules in all of the installations had defects that the plant operators had not yet detected.

Popular content

Even in large-scale installations bigger than 1 MW, all of which had monitoring systems in place, on average 5% of the modules exhibited defects that would warrant an exchange. Yet these errors had gone unnoticed so far.

“The question is if you are willing to take a chance,” Kruse said when asked if equipping modules with the SunSniffer was worth it. “There is a high likelihood that over the lifetime of your PV power plant some 5% of your modules will be affected by defects not identifiable by the coarser monitoring methods in place today. That corresponds to one defective module per string. You will be better off financially in the long run if you are willing to accept the slightly higher initial capex. It also tremendously simplifies the management of PV power plants.”

Kruse says it is no coincidence that there is strong interest from India and China. “In these countries most of the PV installations are commissioned by utilities, which follow a build-and-hold strategy. They are interested to draw the maximum power from the systems over the complete lifespan. In Western countries we see a lot of secondary trading of PV power plants. After two or three years of operation the plant will often be sold, based on their power generation documented over this limited time span. If the buyer is sophisticated enough they will perform a thermal imaging of the power plant before considering a purchase. You would be surprised by what quality issues pop up once a thorough analysis of the power plant is undertaken.”

Moreover, Kruse argues, the significance of thermographic analysis of PV power plants strongly depends on the experience of the person who takes the thermal images and analyzes the data. Misinterpretations are a frequent occurrence and further on-site examinations of identified modules have to be performed before a warranty claim can be issued.

Playing the long game

Given the fact that the one-off costs of performing a thermal image scan of a PV power plant are quite significant, such an analysis will typically be initiated only in one of the following two instances: The deviation between expected and actual performance of the power plant has become so significant that it can no longer be ignored; or a change in ownership is planned. In either case, it means that any defects identified by the thermographic analysis will have persisted for quite some time before they are revealed through the elaborate analysis procedure.

“The SunSniffer performs a complete scan of the power plant every 30 seconds. Like no other monitoring solution, we have the data available at an accuracy level that allows us to identify errors much earlier than any other approaches,” said Kruse. “This gives the operator the information required to time any maintenance work on the power plant in such a way that it yields maximum cost efficiency of the truck rolls without compromising the energy harvest.”

O&M is much easier once it is possible to see the exact power generation of each module. You only have to define a threshold from what underperformance level you want to swap the modules.

“Besides identifying malfunctioning modules early on, the optimization of O&M costs of a PV plant are the second-most striking argument for deploying a SunSniffer solution,” Kruse adds. “Feedback has shown that savings in excess of 24% in O&M can be achieved when our SunSniffer solution is deployed – or sometimes significantly more. In particular for small residential PV plants, error search often becomes prohibitively expensive.”

As PV power plants are seen less and less as financial assets and become more an integral part of the power generation mix, a more holistic approach to building, maintaining, and operating PV power plants will become common practice – leading to an increase in standards at each stage. “We have a solution to meet these elevated standards, which is why we are optimistic that more and more module manufacturers will embrace our technology. As one of the first manufacturers, AEG Industrial Solar has decided to offer all of its high performance modules with a junction box integrated with the SunSniffer solution as an option.”

Author : Götz Fischbeck

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Seems like over kill to me.

How often do those sensors go bad vs the actual modual?

How much time and labor to get them all connected and check them out?