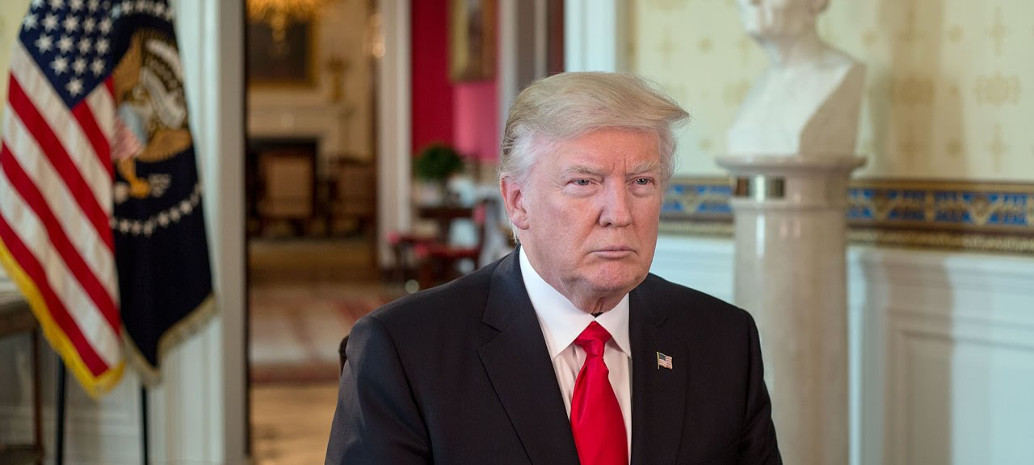

January 13. That is the last day that the administration of U.S. President Donald Trump can make a decision on whether or not to impose trade sanctions on U.S. imports of crystalline silicon solar cells and modules, originating from pretty much anywhere in the world outside U.S. borders.

This case has already dragged on for seven months, but now we are in the final stretch before the Trump Administration’s decision. Some time before the end of the day, the U.S. International Trade Commission (ITC) will send its report to the president, beginning a 60-day countdown for him to act.

pv magazine staff has found no sources that can tell us more about this confidential report, and ITC staff has stated that a public version will be released at an unspecified later date. However, analysts who we spoke with have suggested that the report will likely not contain recommendations that are substantively different than what the four commissioners offered on October 31.

And while those more muted recommendations of trade measures were welcomed by the bulk of the U.S. solar industry which opposes restrictive trade action, Trump is not bound to follow ITC’s recommendations.

In fact, according to an ITC document the president is free to impose “an increase in or imposition of a tariff, a tariff-rate quota, or a modification or imposition of a quantitative restriction; negotiating agreements, auctioning import licenses, initiating international negotiations, submitting legislative proposals to Congress; taking other appropriate and feasible action otherwise authorized; or any combination of the above actions.”

In other words, President Trump can do just about anything. There are precious few limitations, but these include that initial trade action can last four years (and be extended to up to eight years), and that tariffs are limited to 50% of the price of products “above the rate existing before the proclamation of action”.

This last detail may be more complex than it first appears. While all the commissioners who recommended import duties would have the tariff values calculated on the cost when solar products enter the nation, SolarWorld and Suniva have asked for duties equal to 50% of the prices during timeframes covering previous years when solar cells and modules were much more expensive.

Neither SolarWorld nor Suniva has done much to mitigate these proposals, which we at pv magazine feel are dangerous and unreasonable.

Another important detail will be the scope of the case. The commissioners have recommended that a number of nations with which the United States has free trade agreements be excluded from trade action. And while most of these nations have little if any cell and/or module factories, the list includes Singapore, which hosts an 800 MW annual supply of potentially tariff-free cells and modules through REC Solar’s facility.

However these are also only recommendations, and the Trump Administration is free to expand the scope to cover any of these nations.

In the interim, the U.S. solar industry is living in limbo, with major projects being put on hold due to uncertainty around future module prices and supply.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Trump you have stalled the PV market and thus threaten my ability to support our local Texas business. It would be great to see the President and the governer of Texas Support Texas Law and stop unlicensed U.S Sunpower, TXU and Google from destroying licensed Electrical contractors working the local markets. We not only obey the law, but also invest our profits in higher wages, equipment and Real estate. National / investor own companies partipating in local services are locus that result in national debt ( bankruptcies )and loss jobs.