From the June edition of pv magazine

In 2018, the market share of high-efficiency passivated emitter rear contact (PERC) solar cells combined with half-cell and bifacial module technologies increased faster than anticipated. Surprisingly, the strong growth of these higher-efficiency cell and module technologies was primarily the by-product of a sharp decline in module prices.

Module prices declined by nearly 30% in the second half of 2018 and the margins for module suppliers shrank significantly. In the third quarter, the market stagnation accelerated the migration of most leading players toward producing higher efficiency products, an area where these manufacturers could still differentiate and achieve some positive margins.

As a result, the growth in higher-efficiency technologies was driven not only by increasing market demand, but also by a strong supply-side push.

PERC up

As a consequence of this end-of-the-year push, PERC has become the mainstream cell technology, outnumbering back surface field (BSF). Furthermore, an increasing number of leading suppliers are stepping into research and development initiatives for higher efficiency n-type cells.

However, because of the high required capex, stretched balance sheets, technological barriers, and small scale, the cost of n-type products is still too high to support an attractively priced module for most project investors. A new technology, tunnel oxide passivated contacts (TOPCon), which is now only applied to n-type cells, might turn into a breakthrough if manufacturers are successful in applying it to the mass production of PERC cells.

LCOE reduction

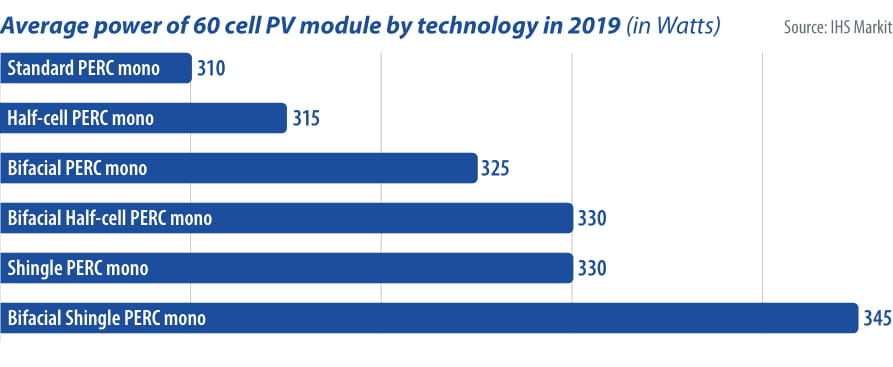

For module suppliers, the key market strategy continues to be reducing the levelized cost of electricity (LCOE). Suppliers are achieving this via different approaches that are used in combination to maximize the LCOE reduction. In recent years, these approaches have included changing the module’s specifications – such as moving from 60 cells to 72 cells, or from 1,000 V to 1,500 V. Suppliers also have moved to larger wafer modules or have changed the cells’ layout, i.e., adopting half-cell, bifacial, and shingle configurations.

IHS Markit foresees a major push from the supply chain toward larger cells and modules in order to increase module efficiency. By reducing the gap between cells without increasing the module size, some manufacturers can achieve cell sizes up to 157.4 mm by 157.4 mm, compared to the industry’s current standard wafer size of 156 mm by 156 mm. At the moment, 157.4 mm is the maximum wafer size for a conventional-sized module, but manufacturers are also engaging in research efforts to reach cell sizes of 158.75, 161.7, or even 166.7 mm, although there are still some technical and material challenges to solve before reaching mass production.

Therefore, the major manufacturers are promoting larger wafer/cell modules, but they are doing it gradually while waiting for the cost of some module materials to become more competitive.

Bifacial modules gain prominence

Bifacial module technology is rapidly gaining ground within the PV industry, since it allows a significant boost of total module power output and is compatible with almost all types of cell technology. As with half-cell technology, manufacturing bifacial modules does not represent a major departure from existing production processes. The major change is that bifacial modules require the replacement of the traditional backsheet with glass or a transparent backsheet. With thinner glass prices declining, more bifacial manufacturers are favoring glass-glass now, which allows them to extend 30 years of power output warranty, which is higher than the industry average of 25 years.

For all of the above reasons, manufacturers are increasingly switching to bifacial production lines and actively promoting this technology to EPCs and developers. Different cell types and technologies have different bifaciality rates, which define the ratio of the front-side efficiency over the rear-side efficiency. Overall, n-type HJT has the highest bifaciality, at more than 90%, while n-type PERT can reach up to 90%. PERC technology is roughly in the 70% to 80% range.

Despite its lower bifaciality rate, PERC is expected to drive the boom in bifacial technology adoption during the next few years because of its lower production costs. In addition to increased module power output, this technology provides all the advantages of traditional glass-glass modules, including lower potential-induced degradation (PID) and light-induced degradation (LID). In the case of n-type cells, PERC offers higher resistance and higher tolerance for harsh environments, especially with solar modules with frames.

Bifacial barriers

The biggest barrier for bifacial module growth is the lack of standards for testing and labeling the rear-side performance of the module. This performance boost can vary from 5% to 30%, which impacts the bankability of projects using bifacial modules. It is challenging to model the performance of a bifacial module for developers or financial institutions since it is strongly influenced by the installation method and location. There are significant efforts underway to develop some industry standards and certifications by the International Electrotechnical Commission (IEC), but no final approval yet.

Despite the lack of an industry standard, bifacial technology was the biggest winner in the third round of the Top Runner program in China in 2018, with more than 40% of projects winning the tenders including bifacial modules. IHS Markit expects bifacial to increase steadily over the next three years, especially once standards are finally set up and demonstration projects in China provide field data that convince financial institutions and support the widespread adoption of the technology outside of China.

Strong long-term outlook for bifacial technology

Bifacial technology is facing some short-term obstacles, mainly higher production costs and difficulties in product manufacturing standardization. However, as consolidation continues among module suppliers, IHS Markit has seen manufacturers accelerating the promotion and acceptance of new bifacial products in the market.

The combination of bifacial and half-cell technology will be the dominant trend among advanced module technologies in 2019 and beyond because of its low technological barriers, small capex requirements, and significant gains in module power output.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Some of the early reports of PERC panel failures points to the “practice” of how the “back layer” is held in place. Some of the same complaints have been leveled at “shingled” construction as at least some manufacturers use some kind of adhesive to shingle the solar cells together. I’m thinking like more industry review and testing should be done by entities like IEEE for extended periods of time under extra harsh conditions to see how these assemblies fail in real time and at what rate.