With the dawn of electromobility and the resulting increase in EV production, the market for EV batteries has seen consistently high growth rates over the past few years. In 2017, for instance, global EV battery manufacturers produced an estimated 30 gigawatt-hours of storage capacity, almost 60% more than in the previous year – a trend that is poised to continue.

This market represents a substantial, but so far untapped, potential opportunity for European battery makers and carmakers, as well as for the European economy in general. Currently, the market is dominated by players from only three countries, all of them in Asia: China, Japan, and Korea. In 2017, less than 3% of the total global demand for EV batteries was supplied by companies outside these three countries, and only approximately 1% was supplied by European companies.

In this article, we assess the potential market for EV battery production in Europe and look at the major benefits of having such an industry located there. Moreover, we analyze the key decision criteria for battery cell manufacturers when deciding the location of new production capacity.

Current situation: Electric-vehicle-battery-production paradox in Europe

Thus far, the EV battery situation in Europe has been something of a paradox: while European carmakers have struggled to secure sufficient battery supply, investments in battery manufacturing have been concentrated in Asia. Of the 70 announced gigafactories globally, 46 are based in China. Unlike China, Europe does not have a coherent industrial strategy to attract large-scale battery manufacturing. The resulting challenges for this incumbent industry and problems with planned investment have even led some of Europe’s homegrown battery manufacturers to set up shop elsewhere – namely, China. Netherlands-based Lithium Werks, which already has two plants in China, announced plans in September for another. The company says it prefers to build plants in China, because the infrastructure is better, and it is easier to get the permits needed to build a factory.

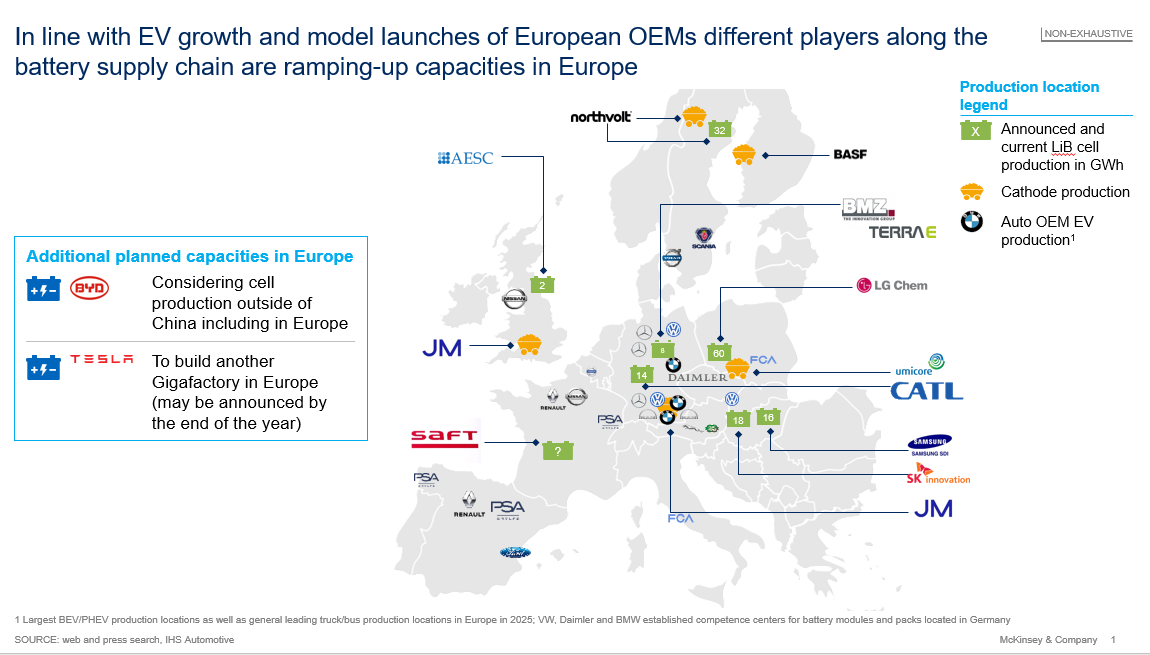

With limited local options for supplying batteries, European car manufacturers have largely secured supply so far by signing long-term deals with Asian producers. Daimler, for example, ruled out further investments in cell production in 2016, after an early venture in Saxony failed to secure sufficient demand. Nissan currently has a plant in Sunderland, United Kingdom, but is seeking to divest. Volkswagen does plan to produce batteries in Europe with SK Innovation, but it also has major supply deals with LG Chem, Samsung, and Chinese battery maker Contemporary Amperex Technology.

With most car manufacturers opting not to produce batteries themselves and failing to secure supplies near their European plants, European car manufacturers run the risk of operating at a distinct disadvantage to competing car manufacturers that are closer and better able to secure battery supply as the demand for EVs grows. Consequently, there may be lucrative opportunities for battery manufacturers that establish facilities in the right places at the right times.

Opportunity in transition: Additional battery manufacturing capacity needed

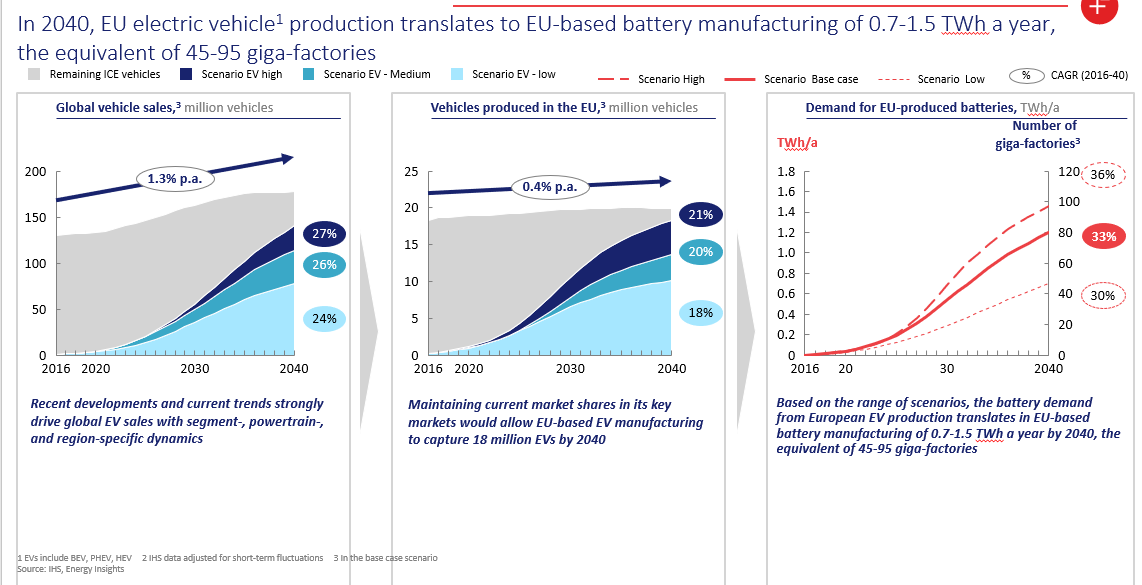

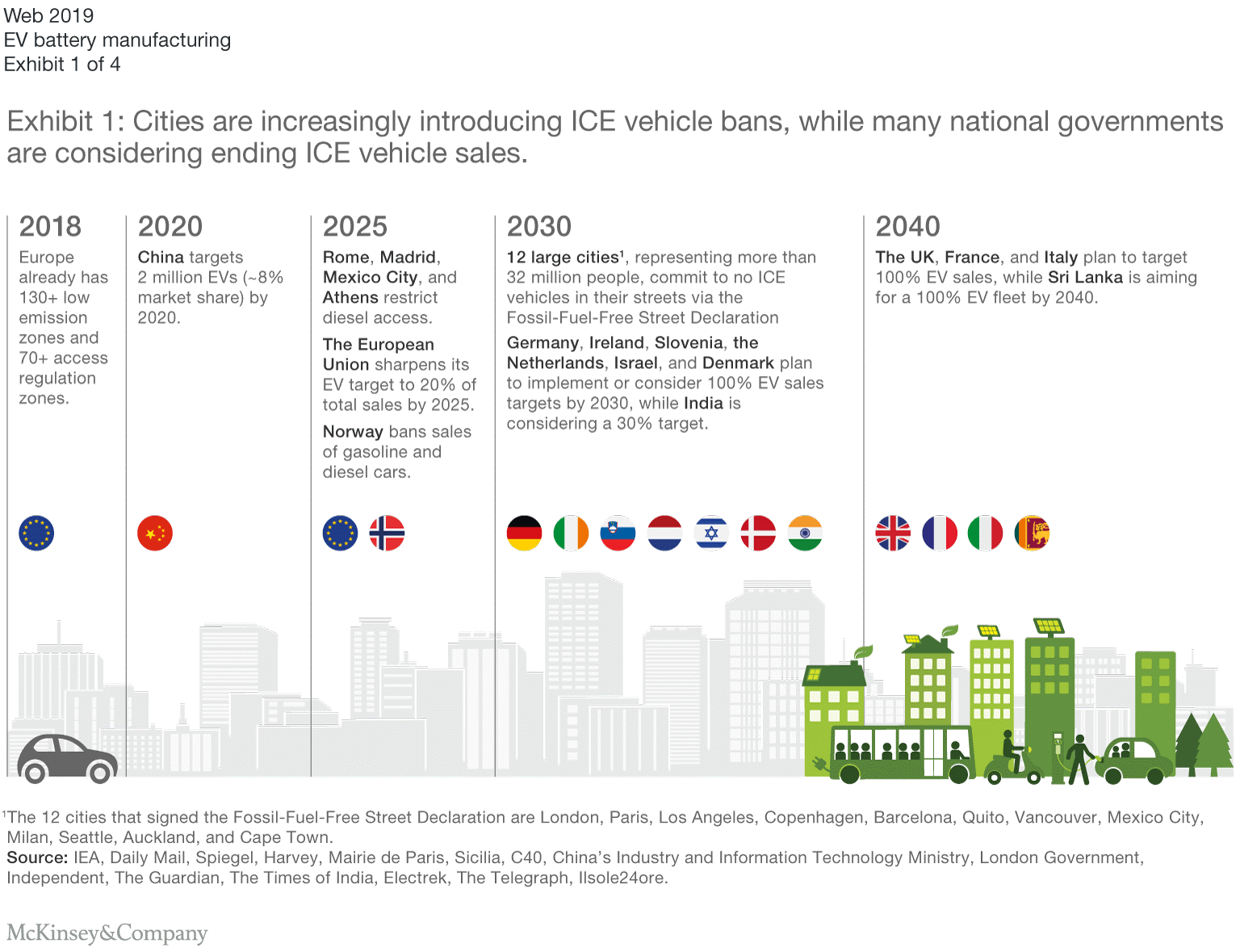

With the rapidly improving economics of EVs and a regulatory push across different European countries, we anticipate that by 2040 about 70% of all vehicles sold in Europe across different segments – i.e. passenger cars, vans, trucks and buses – will be electric. Falling battery costs make it likely that the total cost of ownership for a passenger EV will reach parity with internal-combustion-engine (ICE) cars by the mid-2020s. In the meantime, tightening efficiency targets will push car manufacturers to electrify a larger share of their produced fleets, while the sharing economy, autonomous driving, and transport as a service provide further incentives for electrification by fleet operators. In addition, many European governments have announced to ban the sales of ICE vehicles by 2030 or 2040 (Exhibit 1).

This dramatic increase in EV numbers means that the potential battery market is huge. We project that by 2040, battery demand from EVs produced in Europe will reach a total of 1,200 GWh per year, which is enough for 80 gigafactories with a capacity of 15 GWh per year (Exhibit 2).

The projected battery demand from EVs produced in Europe is more than five times the volume of currently confirmed projects in Europe, which include, for instance, Northvolt in Sweden, LG Chem in Wroclaw, Samsung SDI in Göd, and Daimler and Contemporary Amperex Technology in Erfurt (Exhibit 3)—leaving a shortfall in demand of about 1,000 GWh per year by 2040. This gap will have to be met by either battery imports or additional battery-manufacturing capacity in Europe.

Strategic considerations: Regional battery production

European car manufacturers, policy makers, and potential battery suppliers have strong economic and strategic incentives to ensure local battery production. The battery is the single most costly part of an EV, currently making up between 35-45% of total cost. It is also expected to be the tightest in supply as EV production and supply chains ramp up in the coming years. Not having this strategic part of the production process close by carries significant supply-chain risks for OEMs and represents a lost opportunity for policy makers to locate a significant share of value creation in Europe.

For European nations, the risk is that falling production of ICE vehicles and EV production without secure local battery capacity might result in the European automotive industry becoming uncompetitive, which could cause OEMs to move to countries with better-served supply chains. OEMs typically prefer to manufacture their products close to the markets. Yet, they could prioritize being close to the critical part of their supply chains and move their EV production closer to battery manufacturing, should battery manufacturers decide not to locate their gigafactories near anticipated EV production.

European car manufacturers, however, do not seem particularly eager to get involved in battery cell manufacturing themselves. First, it is difficult to find the right chemistry, set up the production process, and get other components in place to produce battery cells. This kind of knowledge does not reflect the core competencies of a car OEM. Instead, car OEMs typically see value in the packaging of cells into modules and battery packs, as well as in designing the cells. Second, producing batteries in house or switching to a wider base of suppliers – perhaps even European suppliers – often presents risks; namely, that individual suppliers cannot secure enough raw materials at low-enough prices to support the required production.

Growing battery demand has already put pressure on a scarce materials supply, raising supply risks. The price of lithium has tripled since 2015, and global cobalt production in 2025 would need to be double that of 2016 production to satisfy global EV demand. To minimize this risk, EV manufacturers may be well advised to integrate more closely with cell manufacturers that have strong control over their own supply chains. Currently, a handful of (Chinese, Japanese, and Korean) cell manufacturers dominate the market and much of the value chain, with control extending, in some cases, as far as the mines that extract lithium and other key metals.

Moreover, sourcing from nearby battery manufacturers allows OEMs to eliminate supply-chain risks, including transport concerns for dangerous goods and working-capital issues, while enabling co-development and troubleshooting of battery cells, packs, and EVs. We find that this can more than offset the potentially lower costs of a more distant plant, such as ones in countries that pay high up-front capital-expenditure subsidies, while allowing for greater flexibility and mitigating the risks associated with sourcing all batteries from one region.

Coordination: The concerted effort of all stakeholders is required for successful ramp-up of battery production

To meet battery demand in the mid-2020s, automotive industry players, their suppliers, and policy makers must start making the required arrangements now or find ways to accelerate the timeline. Recent experience shows it takes five to seven years from the start of planning a battery-manufacturing plant and setting up a pilot production line to reach full operational capacity of several gigawatt-hours per year.

The timing of establishing new battery production capacity, however, is critical. If EV production ramps up before cell manufacturers have established local production, EV manufacturers might have already secured battery supply for their first cycle of new product platforms. On the other hand, if cell manufacturing ramps up before significant EV demand is in place, battery manufacturers face the choice between building smaller plants, which are less efficient because they don’t benefit from the optimal size (typically around 8 to 15 GWh per year for optimal scale effects), or running large plants at (initial) low utilization due to lack of demand.

Regarding the scale of new plants, larger facilities with more than 8 GWh per year in capacity have been shown to be twice as productive per euro invested than smaller projects. Recent projects with more than 8 GWh per year have invested on average about US$120 million per GWh per year in capacity. Extrapolating this to cover the 1,200 GWh per year required by 2040 reveals a total investment of approximately $150 billion across Europe to manufacture the cells. Further investment in R&D and the value chain, such as in electrolytes and electrodes, would add to that requirement.

Homegrown advantages: Other reasons why Europe needs battery manufacturing

Should EV-battery-production capacity be installed in Europe, it would bring considerable advantages for Europe’s economic, industrial, and sustainability efforts. With 1,200 GWh per year of demand in 2040, the value of the cell market alone would be around €90 billion per year,[1] with the potential to create about a quarter of a million jobs in battery-cell manufacturing and R&D[2].

Bringing gigafactories to Europe also has the potential to create jobs upstream in the supply chain and downstream in areas like reverse logistics, recycling, and reuse. Furthermore, many components of European vehicles are manufactured elsewhere today; securing battery manufacturing in Europe could help reverse this trend and locate much of the automotive industry’s value-creation efforts in Europe.

Locating cell manufacturers close to OEMs in Europe allows to create a research and innovation ecosystem, fostering co-development among players in EV production, cell-manufacturing, and upstream materials development and production, including cathodes, anodes, and electrolytes, along with recycling, research, and innovation networks.

Battery-cell technology is also developing rapidly. Next-generation technologies, such as all-solid-state batteries, are already appearing on the horizon, and constant R&D is required to keep up. Asian manufacturers are currently more advanced, and European OEMs and cell manufacturers will have to decide whether to partner with them, try to catch up with them, or attempt to leapfrog to the next technological cycle.

Furthermore, battery-player reputation will play a role, as European top-tier OEMs are unlikely to source from suppliers without proven track records. As the technology develops further, production of the next generation of batteries may even be best served by players not yet active in the current battery supply chain but with a proven record in high-tech manufacturing. There are European engineering and technology companies that may be well placed to step in as “second movers” and take a share of the next-generation-battery market.

In terms of sustainability, sourcing cells in European countries would allow manufacturers to benefit from Europe’s rapidly decarbonizing power systems and reduce the overall carbon footprint of EVs in line with European targets for vehicle-life-cycle decarbonization.

Attractive location: Why make batteries in Europe?

Battery producers have a wide range of locations to choose from, so understanding their needs can prove beneficial to countries that are making it a priority to attract this industry. At a high level, battery cell manufacturers are typically looking for the best business case and lowest risk in supportive political environments, capitalizing where they can on financial incentives, smooth permitting and licensing processes, clean energy, access to skilled labour, and proximity to customers and suppliers with good access to raw materials.

Many countries in Europe can offer these elements. The political systems in most European countries are predictable, and there is a strong commitment at most levels of government to transition to a lower carbon system, of which EVs and their batteries are key components. Some have well-connected ports with good access to international raw-materials markets. Supporting infrastructure is widespread, as are supporting services.

Europe has some of the best technical-research facilities and universities in the world, which is especially important as battery technology develops. In Central Europe in particular, proximity to research institutions, as well as to suppliers of raw materials and manufacturers, allows battery manufacturers, sometimes together with manufacturers, to capture innovation spill-over and codevelop state-of-the-art components, batteries, and EV platforms.

While state-aid rules limit European states from offering direct financial incentives, the European Union offers financing through a range of institutions and programs. In Eastern Europe, some manufacturers are offered tax breaks in special economic zones, and costs for energy, labor, and land use are still relatively low.

Additionally, some of Europe’s competitive edges will grow in importance over time. These include its robust educational and knowledge bases, which will become more significant as low-cost labor is gradually automated and technical expertise becomes increasingly critical.

Europe’s strong background in recycling will become more important for manufacturers as the norms for extended producer responsibility rise, and as upward pressure is put on the price of raw materials, such as cobalt and lithium. Having supply chains for reverse logistics and recycling in place also enhances security of supply of rare materials, which are often produced in volatile regions. Establishing a closed recycling loop could be a major competitive advantage for European countries in implementing a sustainable battery life cycle.

Conclusion

It is important that Europe realizes the significance of the potential for local battery manufacturing and its importance for the transition to EV production. If this industry cannot be established in Europe, future EV manufacturing might happen elsewhere, with value creation and jobs following – potentially including current EV and legacy ICE-vehicle production, over time. Establishing battery manufacturing in Europe, however, could not only secure EV production and other manufacturing jobs, but also create new jobs in areas like cell manufacturing, battery supply chain, and beyond. If this enormous opportunity is to be captured, stakeholders must act now, before EV manufacturers close decades-long supplier agreements—and leave latecomers to the EV-battery industry in the dust.

About the authors

James Eddy is a partner in McKinsey’s London office, Alexander Pfeiffer is a specialist, and Jasper van de Staaij is a senior solution leader and associate partner of Energy Insights, both from the Amsterdam office.

The authors wish to thank Nicolò Campagnol, Enrico Furnari, Johan Lammers, and Michiel Nivard for their contributions to this article.

[1] Assuming average battery price of $76 per kilowatt-hour in 2040.

[2] Assuming the same job requirements for gigawatt-hours-per-year capacity as the Tesla Gigafactory applied on 1,200 gigawatt-hours-per-year capacity in Europe in 2040.

Content from McKinsey & Company, www.mckinsey.com. Copyright (c) 2019 McKinsey & Company. All rights reserved. Reprinted by permission.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Really good explanation and general look to growing battery industries. One thing missing here is the substantial improvement in R&D on dry thick solvent free cathode production that increase energy density (>300 Wh/kg), can cut both costs production of cells and capital expenditure on production facility by up to 50% by dropping use of solvents and other time and resources consuming process in chatode production. Tesla/Maxwell will use this tech and Fraunhofer develop similar dry film cathode, and 24M/Kyocera too are testing this process in pilot production.

@mauro could you provide the source for your statement? Would be very interesting, thanks.