Floating PV (FPV) represents a growing opportunity for developers to install solar in countries that face land constraints. In specific locations that have favorable conditions – such as water bodies with proximity to existing grid connections, including hydropower dams or water treatment plants – it is also advantageous, as floating PV can use existing infrastructure to make it more cost-competitive. Offshore installations at the pilot stage are proving successful and are being closely monitored as they increase in size.

However, in some cases FPV will continue to be a relatively niche technology, as countries and developers consider it a relatively expensive method of installing solar compared to ground-mount and rooftop solar, especially with regard to stringent requirements for anchoring, insurance, permits, and water surface rights.

Bigger projects

New records continue to be broken as both suppliers and developers increase their knowledge relating to the capabilities of FPV technology. Currently, China holds the record for the largest floating PV installation of 150 MW in Anhui province, but this is set to be surpassed by a 180 MW installation in Taiwan – due to be completed in 2020-21 – using both Sungrow and Ciel et Terre floats. BayWa r.e. currently has the largest FPV project in Europe, completed in the Netherlands, at 27.4 MW in size.

Technological enhancements are also improving FPV’s attractiveness in terms of economics and site location. For example, the largest tracking floating PV (a system with rotating floating PV islands that follow the sun during the day) installation is now under construction in the Netherlands, at just under 23 MW in size. Also, offshore floating PV pilots have been installed in the Dutch North Sea and are being installed in the United Arab Emirates.

China dominates

China maintained its ranking as the largest market for floating PV for the third year in a row in 2019. Its rate of installations fell in 2019, compared to record installations in 2018, owing to the general decline of the Chinese PV market following policy support uncertainty in 2019 and the removal of the Top Runner program, which helped incentivize the use of high-end technology. Overall, China’s installed floating PV base is estimated to be double the next 11 countries, with cumulative installations of more than 5 MW. The nation continues to install large amounts of solar on and over water, but many of these installations are located on piles and not floating mounts.

Emerging opportunities

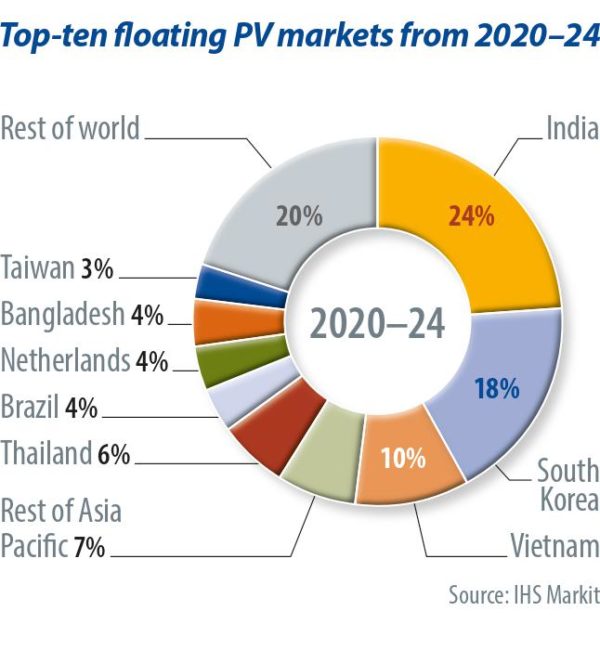

IHS Markit expects Asia to account for more than 70% of total floating PV installations in the next five years. The top three markets are expected to be India, South Korea, and Vietnam, which will account for more than half of total installations if development and completion continues as planned. IHS Markit is tracking over 300 floating PV projects globally in its solar deal tracker, from early-stage development to under construction, that will be completed within the next five years. The bulk of them are heavily concentrated in Asia. Tenders and auctions are expected to be the main drivers to help the adoption of floating PV in many Asian markets, but fallout from Covid-19 may dampen the rate of installation of floating PV.

Outside of Asia, the key markets will be the Netherlands, which has set itself an aggressive target for floating PV with its abundance of shallow inland water and its support via the SDE+ subsidy scheme. Brazil is expected to be the biggest market for floating PV in the Americas due to its siting of floating PV on hydropower plant sites.

Both Ciel et Terre and Sungrow continue to dominate the global market for floating PV mounting suppliers, jointly accounting for 70% of all completed or under-construction installations. Sungrow continues to have the largest installed base due to its large market share in China and in other Asian markets, but Ciel et Terre has the widest global footprint of all floating PV mount suppliers. Many of the other floating PV mount suppliers are headquartered in early-growth floating PV markets such as China, Japan, and South Korea.

Positive outlook

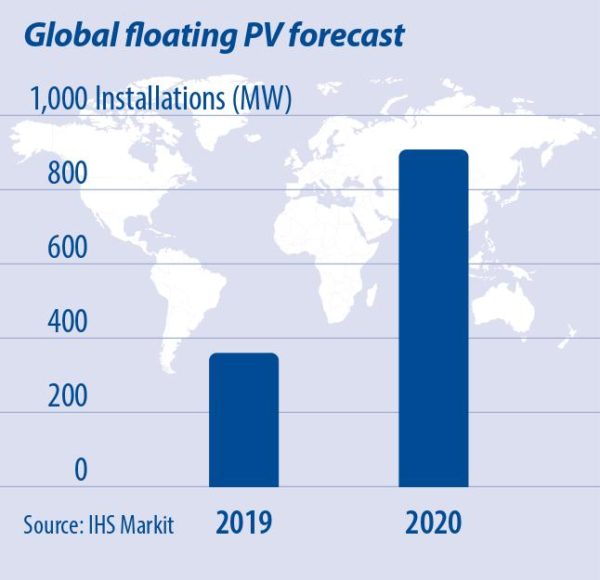

Floating PV installations are expected to grow strongly in the coming years due to an increasing pipeline of global projects. Many of the largest planned installations are facing delays with tenders, site challenges, and financing, but expectations are high for record-breaking floating PV systems to begin construction shortly. Floating PV may not be the cheapest method of installing solar, but its benefits can outweigh the challenges. In many countries, particularly in densely populated areas, there is an appetite to utilize this technology. This is especially true at sites that are close to grid connection points, making projects economically viable and weather patterns more manageable. Disused mining sites, hydropower plants, shallow inland waterways, and manmade reservoirs are among the many locations that are considered attractive, while offshore floating solar is being tested and evaluated further.

Chris Beadle & Cormac Gilligan

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hi, It was an interesting reading about floating solar. I will appreciate another write-up about the brands chosen by developers in respect of pv modules n inverters, in recent past (2019-2020), highlighting the performances. Regards, Harun.