From pv magazine 06/2021

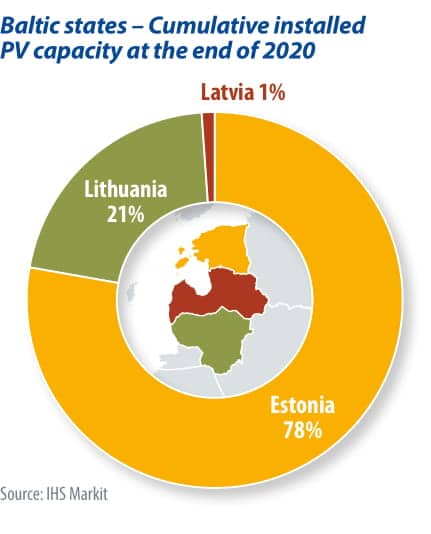

At the end of 2020, the three Baltic states had a cumulative installed PV capacity of 800 MW. More than three-quarters of this has been installed in Estonia. Lithuania accounts for around one-fifth, while installations in Latvia are negligible.

The need to replace conventional power plants that were recently closed or are to be phased out partly explains the higher motivation for Estonia and Lithuania to expand the use of solar energy. As one of the EU member states with the highest per capita CO2 emissions, Estonia is being urged by the European Union to reduce its use of shale oil – the largest power generation source in the country. The planned closure of old shale oil facilities is incentivizing increased use of renewables.

Lithuania has been highly dependent on electricity imports since the closing of its last reactor at the Ignalina nuclear power plant in 2009. The plant was a bone of contention for Lithuania’s independence movement, Sąjūdis, in the late 1980s. Plans for a new nuclear power plant were shattered after Lithuanians voted against the resumption of the technology in a 2012 referendum. With a high share of hydropower, Latvia’s need for the build-out of further renewable capacities is less urgent.

Estonian market

Estonia’s PV market was driven by a feed-in premium scheme until the end of 2020. This scheme was discontinued for new installations outside of tenders from 51 kW to 1 MW at the end of 2018, and for systems smaller than 50 kW at the end of 2020. The phasing-out of the incentive created a rush of installations in 2020. As clusters of systems below 50 kW were permitted, a large part of Estonia’s installed capacity was made up of larger systems. The high volume of grid-connection requests for PV systems of close to 500 MW overwhelmed the grid companies, meaning nearly all plants built in 2020 will be connected to the grid in 2021 or in 2022. New installations instead have fallen drastically in 2021.

Net-metering in Lithuania

Since its introduction in 2015, Lithuania’s net-metering scheme has been amended several times. The most important changes came in October 2019. The upper size limit for commercial PV installations to run under net-metering was increased from 100 kW to 500 kW, and the upper limit for a simplified permitting process of microgeneration systems was raised from 10 kW to 30 kW. Another change to the net-metering scheme is the option to consume the electricity at a different location to the place of generation.

The latter has opened a whole new business model that enables customers who do not have their own roof space to buy or rent part of a solar park, and to run their part of the installation under the national net-metering scheme. It also helps developers to attract small investors. To bring together developers and investors, state-controlled utility Ignitis founded the first remote solar park platform in October 2019. Other companies offering participation in remote solar parks include Sun Investment group, Latvian utility Latvenergo, Egrupė and Saulės Grąža, and Solet Technics. The first remote solar parks to operate under this scheme were realized in 2020.

In addition to the net-metering scheme, Lithuania subsidizes on- and off-grid systems of up to 10 kW per installation, financed by the EU structural fund. Another subsidy for commercial systems in 2020 is also expected to be reissued in 2021. Latvia’s net-billing scheme was first introduced in 2014 and is much less attractive than the Lithuanian net-metering program. In Latvia, the electricity fed into the grid from the PV producer is not fully compensated. Improvements for microgeneration systems, effective from April 1, 2020, have only slightly increased the scheme’s attractiveness. Systems below 11.1 kW no longer need a permit from the Ministry of Economics, and net-metering systems are now exempt from the variable part of the mandatory procurement component (MPC) fee for electricity fed into the grid and taken back.

While the Latvian government is reportedly contemplating the opening of the net-billing scheme to larger systems and commercial installations, there are no known plans to improve the level of remuneration for the injected electricity.

Technology neutral tenders

To reach their renewable energy targets, Estonia and Lithuania have launched technology-neutral auctions, exposing PV projects to strong competition from wind power plants.

Lithuania’s auctions have not yet resulted in any awarded PV capacity. A pilot awarded all available capacity to a wind project, while the first regular round launched in May 2020 was cancelled due to low participation. A round planned for April 2021 has also been cancelled. According to the government, if all permitted renewable energy projects (mainly wind) are taken into account, the planned 5 TWh annually from renewables by 2025 should be reached without the need for further incentives. However, new auction rounds are not out of the question.

Estonia’s auctions have been more successful for solar. A total of 7.2 MW of PV projects below 1 MW was awarded in the first two pilot rounds in 2020. Each for an annual production of 5 GWh, for a feed-in premium on top of the wholesale price, to be paid for 12 years. After a third pilot round in July 2021, two large rounds are planned for late 2021 and for 2024 or 2025, with annual generation of 450 GWh and 650 GWh, respectively. However, there are concerns the entire first large tender could go to one wind power project.

Little progress

Utility-scale projects have emerged that could potentially be built outside of state auctions. In 2018, Estonian company Estiko Energia won a tender for a land plot near Tartu to be used for the construction of a 140-hectare solar park. But delays in clearing the site of thousands of tires were extensive. The project, with a planned capacity of up to 75 MW, has now missed the opportunity to benefit from the FIP scheme outside of government auctions, and the current status or plan is unclear.

A floating PV project of between 200 MW and 250 MW was planned for the reservoir of the Lithuanian Kruonis hydroelectric plant. However, during the installation of a 60 kW pilot system, the available technical solutions turned out to be unsuitable, and in 2020 the decision was made to postpone the project

indefinitely.

About the author

Susanne von Aichberger is a senior analyst on the clean energy technology team at IHS Markit. She performs market analysis of trends and strategies in the downstream part of the PV market. Her focus areas include solar PV markets in Europe and in parts of the Asia-Pacific region.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.