From pv magazine 07/2021

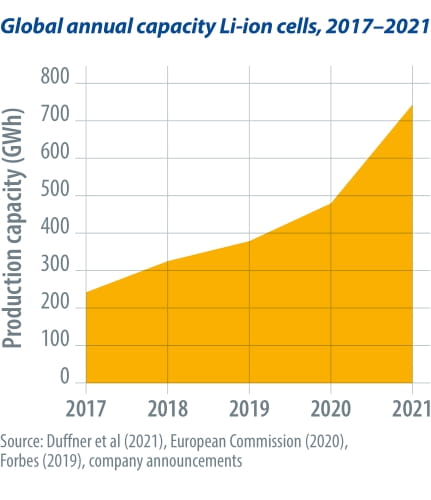

China currently leads the race in Li-ion cell manufacturing, accounting for around 70% of total production worldwide. At the same time, Europe accounts for a mere 8% of annual global production capacity, at 62 GWh.

Europe has outlined a clear strategy to become less dependent on importing cells from Asia with the creation of the European Battery Alliance, positioning itself as an emerging competitive market globally for the coming years. Its core objectives are ensuring that industries are financially aided throughout the value chain; research, innovation and training; and the creation of a “battery passport” to prioritize domestic manufacturing as a key point to start a circular economy around EU-made Li-ion cells. To this end, it created the Important Project of Common European Interest (IPCEI) Fund, supporting seven member states with €3.2 billion in activities, from mining for raw materials to recycling used battery units.

Big plans

European Li-ion cell production capacity should increase tenfold by 2025, with 25 gigafactories planned for that year, and a further five already announced for 2030. This translates into a total annual production capacity of around 591 GWh already in 2025.

We have identified six gigafactories currently operational in the EU, equivalent to a total production capacity of Li-ion cells of 62 GWh. By 2025, this is expected to increase to 25 plants and a production capacity of around 591 GWh, and reaching 664 GWh by 2030.

This capacity is likely to increase further, as some projects have announced their installed capacities, but not yet their commissioning dates. These are estimated to add a further 120 GWh of manufacturing capacity by 2030, placing the total at 784 GWh.

Germany has both the highest number of planned gigafactory plants by 2030 (nine projects) and a planned capacity almost three times larger than Hungary, the next largest. Tesla, Northvolt and LG Chem are expected to grasp 32% of the total share of European Li-ion cell capacity by 2030, with further potential for Northvolt involvement in future projects for Skoda.

Stationary storage

Li-ion cell production from European gigafactories is estimated to be heavily weighted to the EV market, although this varies by state.

The milestone of 30 million EVs on the road by 2030 is a huge leap from the present 1.8 million electric and plug-in hybrid vehicles. Considering that an average EV battery pack is currently around 60.7 kWh, the total capacity necessary for these new vehicles would be at least 1,700 GWh.

Therefore, there is a clear drive to ramp-up local production capacity of Li-ion cells in order to meet that future demand. The cumulative output for the EV industry will be just under 4,500 GWh by 2030. By contrast, stationary storage applications will represent a much lower market share, despite substantial growth during this decade.

From 2023, the focus of Li-ion cell production for the automotive sector starts to decrease, stabilizing at around 90% of total capacity. The FREYR and Northvolt gigafactories in the Nordics are expected to provide the bulk of the capacity for stationary storage. Gigafactories planned in other countries will predominantly supply Li-ion cells to automotive manufacturers.

Continental market

Even though Europe will see a tenfold increase in its Li-ion cell production capacity in just four years, project funding will be largely dependent on securing long-term supply deals for cells.

Car manufacturers are securing supply through long-term contracts with cell manufacturers. These agreements translate into the bulk of the required funding for gigafactories. There are three strategies used by the majority of EV automakers to ensure their long-term production targets can be met.

- Establish their own projects, giving themselves exclusive access to the full production capacity.

- Directly finance gigafactory projects together with another stakeholder who will be developing the site and manufacturing the cells, which will then be exclusively used to supply their EV fleet.

- Strike long-term contracts with a gigafactory developer and Li-ion cell manufacturer, where there is an agreed capacity in gigawatt-hours that will serve their supply needs.

The latter two options enable developers to secure the bulk of the funding necessary to construct and commission a gigafactory. Additional capacity can then be allocated to the production of cells for stationary storage applications, leaving an even smaller margin free for shorter-term contracts.

Cost reductions

While 90% of cell production capacity from EU gigafactories will supply the automotive industry by 2030, the market for stationary storage is also growing. Increasing levels of renewables, improved local resilience and grid independence, and enhanced savings from dynamic retail tariffs are the main factors driving the near sixfold increase of production capacity for stationary storage by that year.

With the scale of this increase in supply, it is expected that cell and battery costs will keep falling to 2030, with the automotive industry being the main driver. Cell costs are expected to record a further 27% drop by 2030, from the 2023 estimates. Contributing to this decrease are reductions in shipping expenses and material costs from enhancing the cell’s efficiency levels and adopting lower cost compositions.

Our European Market Monitor on Energy Storage forecasts that stationary battery storage will reach nearly 30 GWh of cumulative installed capacity by 2025. On the other hand, the total annual European production capacity not yet committed for EVs will exceed 60 GWh by the same year.

Although the industry will be competing against further growth in EV take-up for this capacity, the potential supply of Li-ion cells for stationary applications is projected to be 10 times the market demand in 2025.

About the author

João Coelho joined Delta-EE’s Edinburgh office in November 2020, working on the Flexibility and Energy Storage team. Before joining Delta-EE, João spent a year at tiko Energy Solutions AG, working on solution designing, consultancy and research projects. He is currently in the process of delivering and presenting his double-degree master’s thesis with Uppsala Universitet, in Sweden, and IST, in Portugal.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.