From pv magazine 11/2021

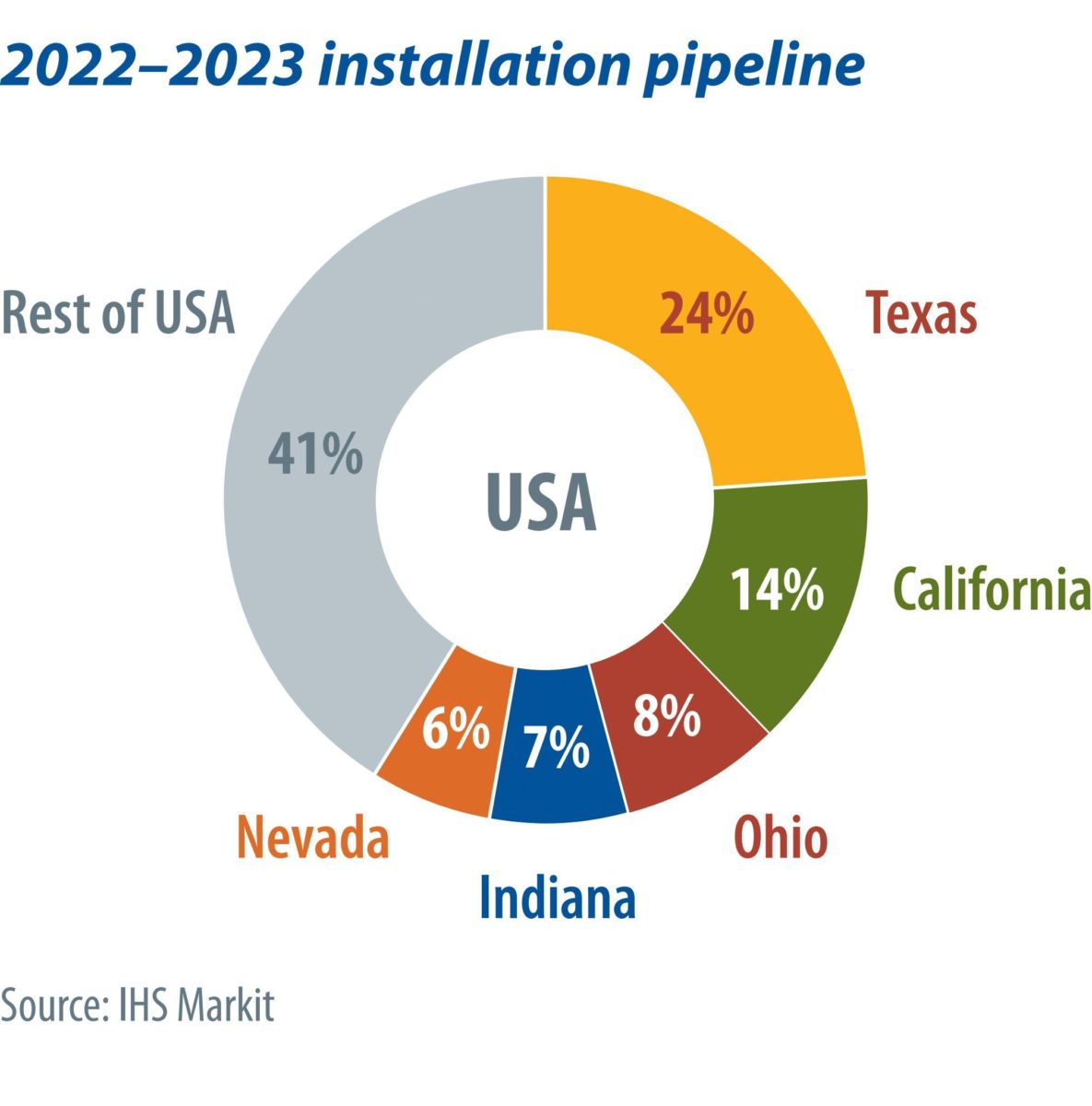

The pipeline shown in the bottom-right chart includes projects that have been approved, are currently under construction, or are completed or operational. These are baseline projects incorporated in IHS Markit’s installation forecast. The 2022 pipeline for utility-scale solar projects planned for completion in the United States is nearly 50% greater than in 2021 and 2023. This buildup is the combined effect of pandemic-related supply chain impacts, the solar Investment Tax Credit (ITC) schedule and multiple Internal Revenue Service (IRS) notices regarding continuity safe harbor deadlines, as well as other factors such as state renewable portfolio standard (RPS) requirements and corporate power purchase agreements (CPPAs).

Previously, companies operated under the assumption that the ITC continuity safe harbor placed a 2023 in-service deadline for projects that started construction in 2019, 2020, and 2021. Developers originally planned for completion in 2022 to meet the in-service deadline in 2023. In the past, the anticipation leading up to the ITC step-down in 2016, prior to its extension in late 2015, resulted in a large, accumulated pipeline. Similarly, the 2022 pipeline reflects anticipated ITC step-downs, with a significant buildup of ITC 30 and ITC 26 projects in a few key states.

Five states

Texas, California, Ohio, Indiana, and Nevada constitute 39 GW or 59% of U.S. installations in the 2022-23 pipeline.

Texas, California, and Nevada remain key drivers of the U.S. utility-scale market. In Texas, more than one-quarter of the pipeline over the next two years is from corporate PPAs where the purchaser is a non-utility entity. Primoris and Mortenson have EPC contracts for 20% of the Texas pipeline. In California, Recurrent Energy, CIM Group, 8minutenergy, Clearway Energy Group, and EDP Renewables will be the primary owners for over half of the 2022-23 pipeline. In Nevada, NV Energy will be the PPA electricity purchaser for half of the state’s installations, while half of the 2022-23 pipeline will be owned by EDF Group and Primergy.

With comparatively moderate solar resources, the burgeoning Ohio and Indiana markets will see significant installations driven by unique circumstances in each state. In Ohio, despite reductions to the state’s Alternative Energy Portfolio Standard (AEPS), and other recent policies, corporate solar PPAs and the closure of economically challenged coal plants continue to give the opportunity to solar. In July, Vistra said it will accelerate the retirement of its coal-fired Zimmer Power Plant to mid-2022 due to the plant’s inability to meet the price point in the PJM capacity auction for the 2022-23 period.

Also in Ohio, Amazon Web Services has signed 2 GW of solar PPAs to power its facilities. The 2022 installation pipeline in Indiana is also being driven by retirements of uneconomic, aging coal-fired resources. Northern Indiana Public Service Company (NIPSCO) is retiring two coal-fired units at its Schahfer Generating Station by the end of 2021, and the remaining two units by May 2023. This is part of NIPSCO’s plan to retire all of its coal-fired generating units by 2028.

Procurement challenges

Solar PV installations were expected to peak in 2022 because developers had to satisfy the 2023 in-service deadline to capture the ITC. However, the IRS extended the ITC safe harbor period from four to six years for solar PV projects that began construction between 2016 and 2020, therefore removing the urgency to install in 2022.

Contingent on how companies adapt to inflated freight costs and module supply and policy challenges, many of these solar projects may continue to move forward until they are completed in 2022 and become operational in 2023. However, this huge pipeline of projects in 2022 driven by the ITC timing is also being compounded by supply chain impacts of the pandemic. Component supply challenges due to a global containerized shipping shortage, port congestions, and high component prices due to raw material price increases in early 2021 are likely to cause delays in 2022, especially without the urgency to install in 2022 to meet the in-service deadline.

To add to the uncertainty, the U.S. Customs and Border Protection Withhold Release Order (WRO) on silica-based products made by Hoshine Silicon Industry Co. has resulted in multiple companies having solar PV modules detained at ports, with no exact data on the volume being detained or the potential pipeline impact. Market drivers such as rising prices for renewable energy certificates, PPAs, and emissions credits are improving the outlook for solar development, but challenges remain in offsetting inflated freight costs and disruptions to the module supply chain.

IHS Markit’s forecast does not include approved projects without PPAs, as projects without a legal obligation to serve customers may seek to defer development to align with the ITC extension to 2025. This does not mean projects lacking PPAs won’t achieve installation by 2022, as projects at the planning stage have already incurred costs and permitting and contractual requirements for certain projects may set the pace regardless of any PPA or the ITC extension.

Despite downside risk to the 2022 pipeline, the safe-harbor extension ultimately changes the shape of IHS Markit’s forecast after 2022, increasing total installations between 2023 and 2025.

About the author

Eric Wright is a senior research analyst with the Clean Energy Technology team at IHS Markit, responsible for the North American solar photovoltaic market, with an emphasis on downstream analysis. He has a background in state-level policy analysis and project implementation, and contributes to country-specific publications, project tracking, and forecasts. Previously, he has worked as an energy analyst assessing integrated resource plans, renewable portfolio and energy efficiency standards, distributed energy projects, and impacts of utility rate cases and new plant investments on clients and utility customer classes.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.