This summer season has witnessed a series of unprecedented climatic events, including record-breaking temperatures reached amid consecutive heatwaves, wildfires, extreme drought, and water shortages. Hopefully this shall encourage wider collective ambition to hasten the development of renewables and limit the accelerating impacts of climate change.

PPAs (Power Purchase Agreements) are one way to support the development of renewables and limit the negative impacts of climate change. But what is the current status of the PPA market, set within the context of these extraordinary times? We propose taking a step back and reminding ourselves where we have come from, in order to realize where we stand, and most importantly, ask what comes next?

Energy and power market development

Firstly, let's look back to where it all started with a focus on the development of energy and power markets. Back in September 2021, the markets were still rather tranquil, with energy prices moving up or down within a reasonable range: a comfortable configuration for PPAs, with a significant number of transactions being reported at competitive prices over the long term.

According to Bloomberg, 2021 recorded 31 GW of cumulative capacity of PPAs signed globally. However, by late 2021, a combination of factors led to an exceptional scenario for energy commodities in Europe.

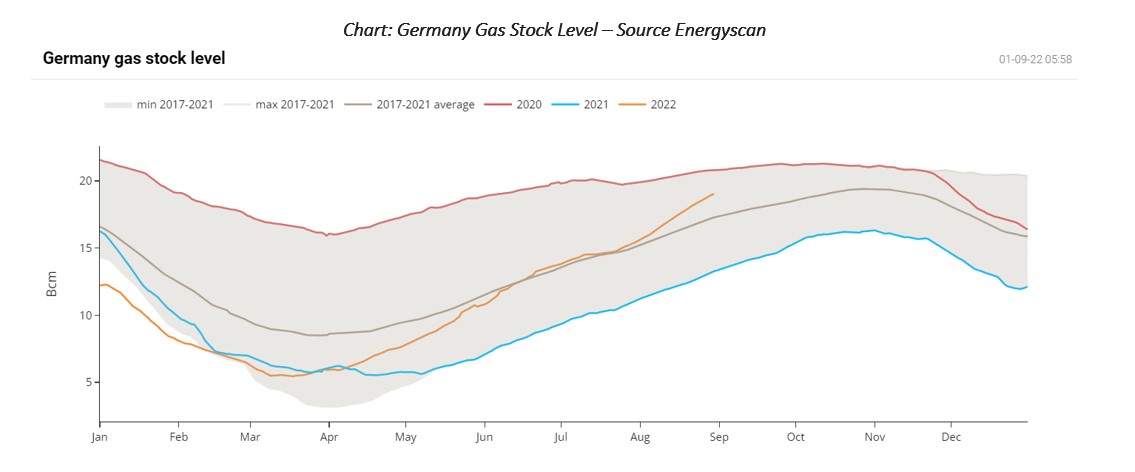

Phase 1: Between the end of Q3 and beginning of Q4 2021, cold temperatures landed in Europe, resulting in stronger demand for gas and power. Nothing surprising, except as the chart below demonstrates, for the fact that gas stocks in Europe were at the lower-end of the range, with the necessity to refill stocks, while entering the winter period. As demand for heating started to increase, this combination resulted in pushing European gas prices up, and quickly.

In the meantime, prices for European Emission Allowances (EUAs) which had been moving smoothly upwards over the course of 2021 on the back of more ambitious climate targets (such as the EU Fit for 55), also experienced a rapid increase from October 2021 onwards, trading just below 100 EUR/T by early-2022. Higher gas and CO2 prices accordingly pushed power prices up marginally, through still within “reasonable” and expected ranges.

Phase 2: In the middle of a winter (21-22) already hit by tight supply/demand conditions, Russia’s invasion of Ukraine propelled the whole energy complex to historically high prices on the back of fears of shortages and supply issues. The series of EU restrictive measures against Russia contributed to further tighten the supply/demand balance, such as the abandonment of the Nord Stream pipeline project (further reducing Europe’s gas sourcing capacity), or the consecutive bans on Russian imports, including alternative fuels such as coal, biomass, and oil.

Phase 3: More recently, extreme summer weather conditions, marked by severe droughts and consecutive heatwaves across Europe, poured more oil on the fire. Demand for air conditioning increased, while record-breaking temperatures also lowered water levels, emptying reservoirs, thus reducing hydropower capacity. Nuclear power production has been impacted as well, facing constraints to use river water to cool plants.

France, the most pro-nuclear power country in Europe (with 56 reactors, representing approx. 70% of the country’s electricity generation) has been the most affected in that respect, while the country was already struggling with maintenance and unplanned work to repair corrosion of reactors.

In another unprecedented event, France switched from being a reliable net exporter of electricity to a net importer, further augmenting the pressure on its neighboring countries including the UK which traditionally relied on its steady outflows.

The combination of all these factors reinforced the upward pressure on energy prices.

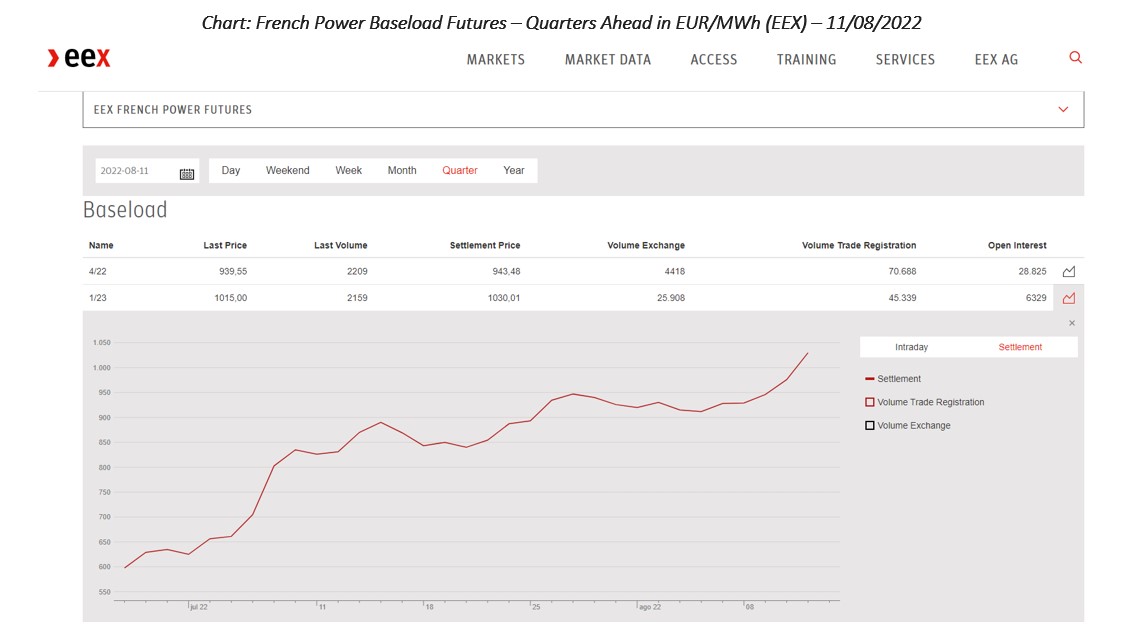

On August 11, the Q1 2023 Baseload contract in France even managed to reach the 4 digits threshold on EEX; trading above €1,000/MWh (followed shortly after by the calendar 2023 Baseload contract, which traded above €1,000/MWh as well on August 26).

Therefore, at the time of writing (end of august) the bullish momentum in the energy and power markets remains intact, recording unprecedented and extreme levels of volatility, whilst high energy prices have become the new norm.

How do these short to medium term events impact the (long-term) PPA markets? It can be argued that the impact of these fundamental events should short-lived and impact spot prices only.

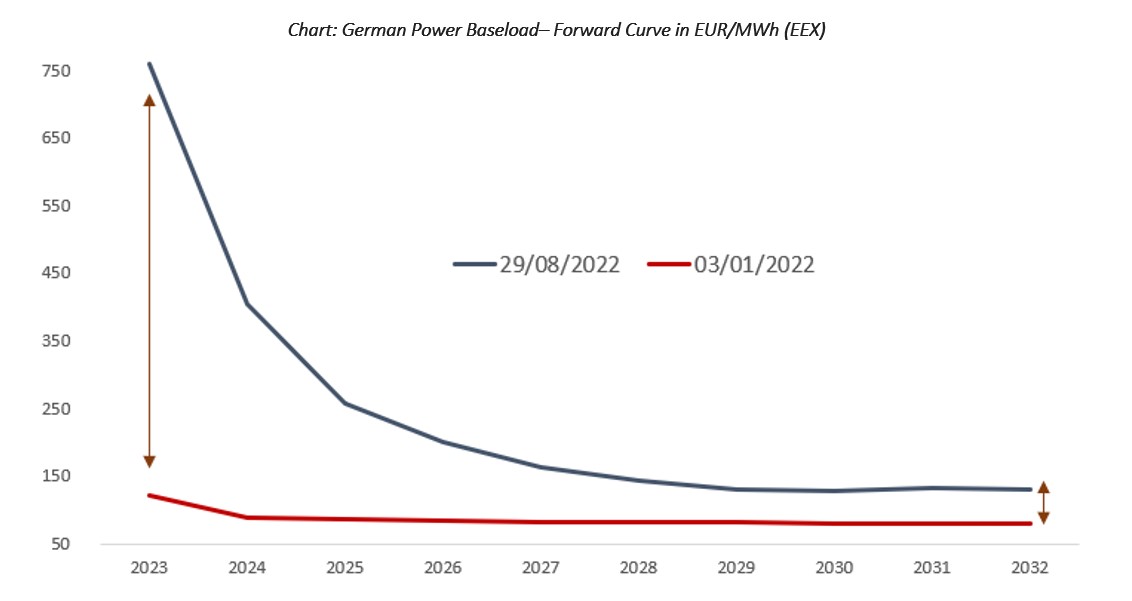

This is partly true as the chart below demonstrates, where we can observe a very strong backwardation:

Focusing on PPAs and long-term power contracts, it is important to note that not only have prices skyrocketed, but also:

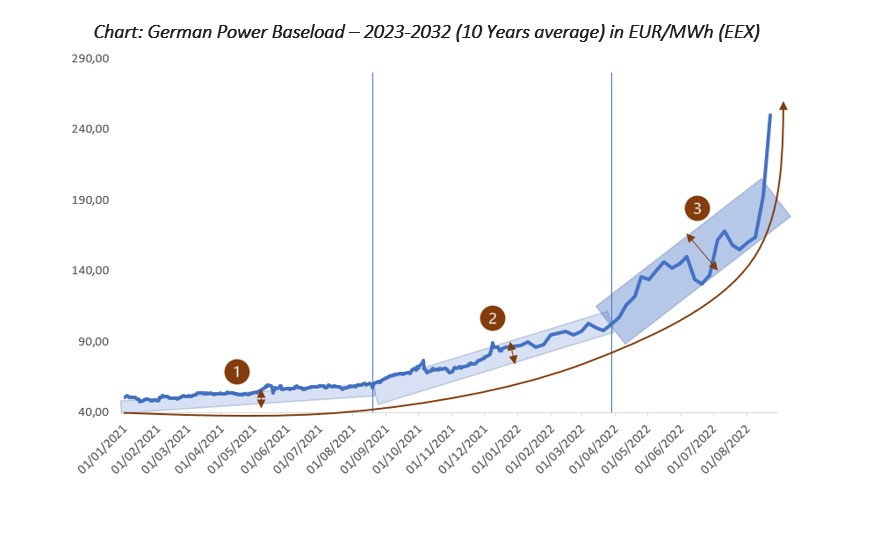

- Prices are rising more quickly (see the exponential curve illustrated below)

- Volatility is increasing (see below the widening channels in blue)

- Liquidity is getting lower as higher prices also mean treasury issues for market participants (accelerated credit lines´ consumption, requiring bigger and more expensive – guarantees to cover counterparty risks, and bigger margin calls)

- Risk premiums from Utilities & Traders are also feeding the upward trend, as market conditions are reaching extreme scenarios, which need to be priced in, especially for long-term agreements.

In Germany the year-ahead contract (2023 power baseload) rose by 623%, moving from €122/MWh on 03/01/2022 (Close EEX) up to €760/MWh on 29/08/2022. To a lesser extent the 10 Years baseload average rose by 282% (from €87/MWh to €245/MWh) during the same period (see above chart).

In Germany the year-ahead contract (2023 power baseload) rose by 623%, moving from €122/MWh on 03/01/2022 (Close EEX) up to €760/MWh on 29/08/2022. To a lesser extent the 10 Years baseload average rose by 282% (from €87/MWh to €245/MWh) during the same period (see above chart).

This bullish trend is being replicated all over Europe. As an example, in Spain the 10-year pay-as-produced PPAs were trading below the €30/MWh mark at the end of 2021. Price references are now above the €40/MWh mark. Regulated tariffs and governmental auctions are following suit.

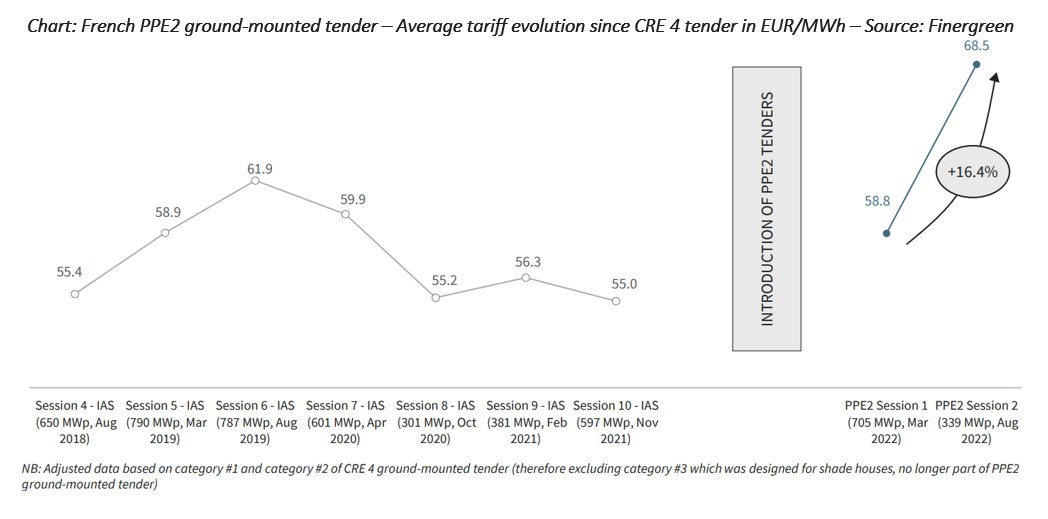

Winning bids at the next Spanish auction, which will be launched in November this year for 3.3 GW of renewable energy projects, are expected to be higher for the second consecutive time since the late-2021 auction, which already resulted in higher tariffs than the previous auctions. In France under the new PPE2 ground-mounted tender, the average awarded tariff in August experienced an unprecedented increase (+16.4%).

This upwards price adjustment is logical. Developers need it. They are directly impacted by increased Capex (modules & transport) and financing costs. Central banks are now moving towards tighter monetary policy, and increasing interest rates, to limit inflation, which in turn resulted from the largest quantitative easing programme in history after the Covid-19 pandemic.

This upwards price adjustment is logical. Developers need it. They are directly impacted by increased Capex (modules & transport) and financing costs. Central banks are now moving towards tighter monetary policy, and increasing interest rates, to limit inflation, which in turn resulted from the largest quantitative easing programme in history after the Covid-19 pandemic.

On the demand side, the appetite of corporates for PPAs has grown drastically. PPAs are no longer seen as a support to their decarbonization strategies. PPAs stand today as the main tool to hedge long-term against skyrocketing wholesale power prices, thereby protecting them against the uncertainty of a significant input cost to their business.

PPA market checkup

This extraordinary market configuration, with a number of factors combining at the same time, has severely impacted the PPA market, mainly in Europe but also globally. As a result, 2022 will record less transactions, higher prices, and some slowness in closing deals. Looking ahead over the short-to-medium term, it is evident that the PPA Prices observed before this “crisis” are gone for good.

So, what’s next? Well winter is coming…again!

European energy prices may set new records in a worst-case scenario which can happen in the case of:

- Prolonged droughts reducing hydropower capacity;

- Extended maintenance on French nuclear assets;

- The ongoing conflict with Russia and application of sanctions preventing Europe from accessing Russian gas;

- Early-start and harsh winter conditions leading to peak demand for heating;

- Other bullish factors such as unfavorable geopolitical context, high commodities prices, and freight rates, tightening financing conditions, and increased interest rates, etc.

At the other end of the scale, a best-case scenario is probable too, and there must be a stop somewhere, sometime anyway. The EU has just warned that it will intervene to fight against high energy prices which started to trigger losses. Additionally, the higher energy prices go, the lower the demand for gas in the European industrial sector.

As time goes on, energy buyers are being exposed to a larger portion of spot prices (result of S-curve power purchase strategies). Some may face an incapacity to pay, leading eventually to insolvency and payment defaults, or a total shutdown of activity.

Recent market conditions have offered projects the opportunity to hedge short-term, eventually Baseload or even to finance on a full merchant basis. A market price correction is looming. The question is when and by how much? At least lower volatility would support a return to more realistic, and stable, market conditions. This is a must for the confidence of all PPA stakeholders.

In the meantime, and until the storm is over, the key for successfully closing PPAs is: (1) projects shall be (really) Ready-To-Build (“RTB” – ie. incl. clearance of permit access and licenses, modules procurement & EPC closed, financing engaged, etc.); (2) bankability of players; and (3) willingness from buyers and sellers to reach an agreement. With these ingredients in place there is always room for executing a PPA.

By Yohann Guichard, Head of PPA Advisory, Finergreen

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.