For many PV system components there is still no sign of normalization in supply chains. Manufacturers are still facing huge order backlogs that need to be cleared so the chaos is likely to drag on into the first months of 2023. Also, some of the major inverter and energy storage manufacturers are already announcing price increases again – for the third or fourth time in less than 12 months.

Image: pvXchange

One reason for swelling inventories is German policymakers’ announcement of various adjustments to the German renewable energy sources act (the Erneuerbare-Energien-Gesetz, or EEG) and to federal tax law. One thing that has given pause to investors and developers is major uncertainty about whether the government will skim off “windfall profits” that could be realized due to high prices on the electricity market. As long as there is no definitive answer as to whether this additional taxation is coming – possibly retroactively – or the potential for a cap on returns, market players will be wary. Some trust that, regardless of what happens, returns will be acceptable, while others prefer to wait and push for more planning certainty and a clear rejection of market intervention.

Complicating the matter further is the pending transposition of an EU directive by German lawmakers. The European Commission has approved the reduction of VAT in EU member states to between 0% and 5% for certain products and services related to PV installation. Germany is aiming to implement the directive as early as Jan. 1, as part of its amended annual tax act. Spearheading the push is the German finance minister, Christian Lindner, who wants a tax exemption for all PV installations with a generation capacity of up to 30 kW, on single-family homes; and up to 100 kW on multi-family homes that feed PV power directly into private or public networks. Because this power is not traded on the electricity exchange, there is no need to calculate profits. The new law would also bring the sales tax rate for parts and labor on PV systems installed on residential buildings down to zero.

Uncertainty

Again, though, these plans have created uncertainty among installers and reluctance by consumers. Some companies are already complaining of a slump in orders, at least until after the end of the year. Installations will now be postponed into 2023 at the request of customers and projects that have already started are being delayed. Moreover, wholesalers will still be obligated to pay tax on purchased components, which means they may have to seek finance to cover the cost of the tax until they receive a refund for the prepayment, a month or two later. Financial imponderables loom, particularly in the first two months of the new year. But if we take a closer look at the timing of small-scale plant installation, these problems are quickly put into perspective.

Image: pvXchange

Even today, small PV projects often take several months to complete, if only because of supply chain disruption and limited resources among installation personnel and responsible authorities and network operators. Installers have to have a bit of a financial buffer, have good payment terms with the upstream supplier, or require certain advance payments from their customers. As long as the installer and customer have not agreed on firm performance milestones, with invoicing after each phase, the date of completion of the entire system determines the tax rate. In the case of new PV installations commissioned before the end of the year, completion before January or February is probably unrealistic in the vast majority of cases anyway, so there is no reason for end customers to delay.

Installers’ books are also likely full of old orders where at least inverters and batteries still have to be installed or where the AC side has to be completed. Once suppliers work out the kinks and gradually start shipping ordered goods, there should still be enough material and work available by the end of the year. Then, when the tax exemptions kick in next year, the installation of small-scale systems should be even more attractive for private homeowners and commercial businesses than it already is. For installers, this means preparing for the rush, and planning purchases carefully to avoid the kind of bottlenecks and surprises we saw this year.

The supply situation is still good, especially for solar panels, and prices are stable. Other components should also become more readily available, providing pandemics and war don’t throw another spanner in the works. Installers who have not yet signed contracts with suppliers for 2023should get in touch with their sales staff. Wholesalers have already submitted forecasts to manufacturers ahead of time, based on this year's experience. Interested end customers who have already made a purchase decision but have not yet placed an order would do well to get the ball rolling. Installation capacities at professional installers are tight and will remain so, which means that those who hesitate are merely postponing the date when they can start using cheap, self-generated solar power tax-free in the new year.

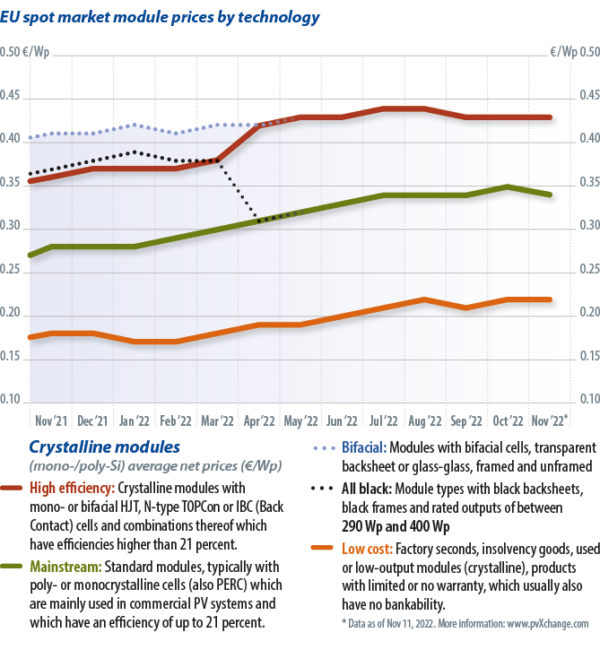

Overview of price points by technology in November, as of Nov. 21, with changes over the previous month.

| Crystalline module type | €/Wp | Trend since October | Trend since January | Description |

| High efficiency | 0.43 | 0% | +7.5% | 340 Wp+ PERC, HJT, n-type, back-contact, or combinations thereof |

| Mainstream | 0.34 | -2.9% | +17.2% | 275-335 Wp, typically 60-cell, standard aluminum frame, white backsheet |

| Low cost | 0.22 | 0% | +29.4% | Factory seconds, insolvency goods, used or low-output modules, and products with limited or no warranty |

About the author: Martin Schachinger has a degree in electrical engineering and has been active in the field of photovoltaics and renewables for more than 20 years. In 2004, he started his own business and founded the internationally known online trading platform pvXchange.com, where wholesalers, installers and service companies can purchase solar panels, standard components and inverters that are no longer manufactured but are urgently needed to repair defective PV plants.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.