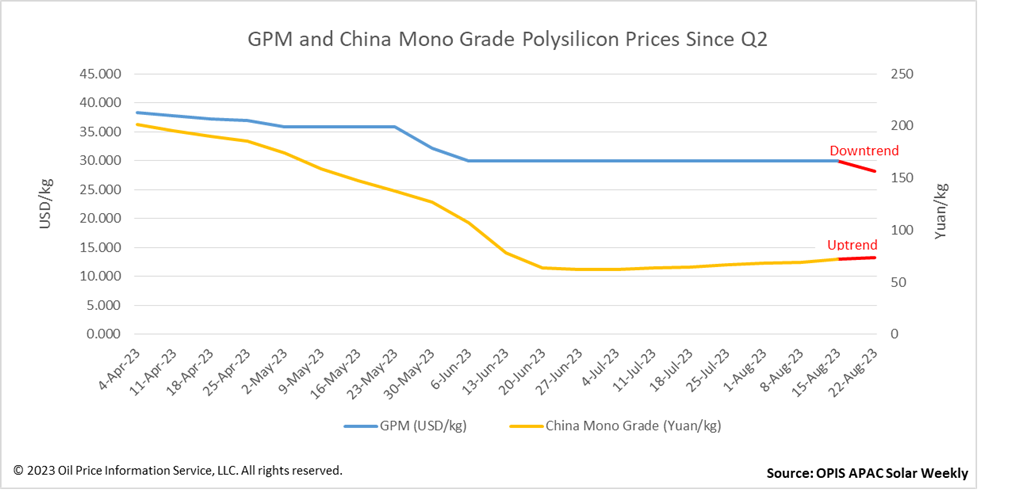

The Global Polysilicon Marker (GPM), the OPIS benchmark assessment for polysilicon outside China, fell to $28.2 per kg with a week-to-week decline of 6%. Multiple sources confirmed they saw lower pricing for non-China polysilicon being signed.

One global producer sold polysilicon this month at around $27/kg, and will do so at even lower prices next month, to a major solar manufacturer, according to a source at the latter.

Some sources expressed surprise at the falling prices and could not offer explanations as to why. One source’s comments proved representative of many: “There is a lot of demand for non-China poly,” so “we are not really clear on why” global producers have reduced their prices. Even some sources expressed doubt, stating that it is improbable that the aforementioned global producer will have lowered prices below $30/kg.

“My guess is that customers cannot absorb the big price difference between China and non-China polysilicon anymore” and have pushed for lower figures, a solar market veteran said. Although there are a lot of plans for ingot and wafer capacity in the U.S., moving forward, “the only demand today” is from big Chinese buyers, he added.

Reflecting how the global and China polysilicon markets are essentially bifurcated, this week saw them move in opposite directions. China Mono Grade, OPIS’ assessment for polysilicon in the country, extended gains for a seventh week running to CNY73.75 ($10.12)/kg.

Popular content

The 2.57% increase comes as the available supply of China polysilicon is lower than expected. Prices for the material are increasing slowly because of how inventories have been consumed in recent days, and “the slow rate at which new production capacity is being added,” a source explained.

Looking ahead, China polysilicon prices could edge upwards a little more, before ultimately decreasing on the overall picture of oversupply that remains on the horizon. Traders are taking off-grade material again, “which means that prices will be stable or even rise slightly in the next 1-2 months,” according to a market veteran. More broadly, once all new polysilicon production capacity slated to come online this year does, price increases will see a reversal.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.