Concerns about LNG supply shortages did not end up affecting electricity and gas futures prices as much as anticipated. However, most European renewable PPA prices rose in August, and the EURO Composite – Swiss consultancy Pexapark's global index, which averages PPA prices across different technologies and geographies – rose by an average of 1. 4% to end the month at €56.10 ($59.80)/MWh.

Italian PPA prices rose the most, at 12.8%, while French prices experienced the biggest decline, with a month-on-month drop of 5.7%, as French electricity futures fell due to an increase in nuclear production in August and confidence in the security of winter electricity supplies.

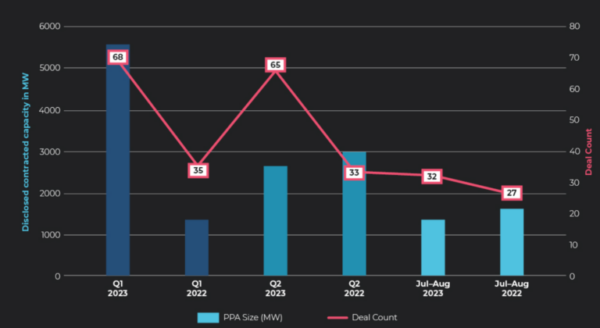

Only nine new PPAs for 193 MW were announced in August, down 83% from July, and significantly below any other month in 2023 thus far. The numerical average of deals has been more than 22 per month since the beginning of 2023.

Between July and August 2023, 1.34 GW of new PPAs were registered, or about 10% less than the nearly 1.49 GW of the same period in 2022.

Denmark accounted for 55% of the activity for the month, as five of the nine deals in August came from newly built photovoltaic assets in the country. Although only around 6% of Danish electricity production comes from photovoltaics – compared to more than 50% from wind – the vast majority of PPAs announced in the country are for solar assets.

The largest deal in August was closed in Sweden, with AstraZeneca's purchase of 200 GWh per year of onshore wind capacity from Statkraft. Another significant deal was Orange's purchase of 30 GWh per year of solar from Engie in Romania, which also represents the fourth PPA registered by Pexapark in the country.

In addition, Pexapark said that the first quarter of this year marked the start of a golden era for PPAs in Europe. During this period, 5.5 GW of new capacity was registered across 68 agreements, up more than 109% from the previous year. There was also a 95% quarter-on-quarter rise in the number of agreements.

Popular content

In the second quarter, contracted volumes halved to approximately 2.6 GW, but the number of agreements remained similar, with a total of 65 PPA announcements. In July and August, there was another slowdown, which was to be expected for the period, but there were still more notable than in the same period a year earlier.

Pexapark said that one of the main challenges in 2023 has been the increase in the levelized cost of energy (LCOE) and the fact that PPA prices have not kept pace with inflation-induced project costs. Concerns about changing legislation in some countries, such as the United Kingdom, could also have a negative impact.

However, Pexapark said that it remains optimistic, pointing to the record 9.5 GW (166 agreements) that have already been registered so far this year.

“Given that third quarter activity has not yet concluded and that the fourth quarter is still ahead – a typically intense quarter, as many deals rush to close before the end of the year – expectations around 2023 appear to be materializing,” the company said in his monthly “PPA Times” report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.