Total corporate funding – including venture capital funding, public market and debt financing – for the solar industry experienced a 55% year-on-year increase in Q3 2023 and is currently valued at $28.9 billion, up from last year’s $18.7 billion in Q3 2022, new analysis by Mercom Capital Group reveals.

The total corporate financing deals, however, decreased by 5% year-over-year, with only 124 in the first nine months of 2023 compared to 131 over the same period in 2022.

According to Mercom Capital Group CEO Raj Prabhu, the solid results from the first three quarters of 2023 were due to a “strong push” towards global decarbonization and incentives from the North American Inflation Reduction Act. “M&A activity, on the other hand, has faced adverse effects, especially in the realm of project acquisitions, due to increased due diligence, higher costs, delays, and a tight labor market,” he said.

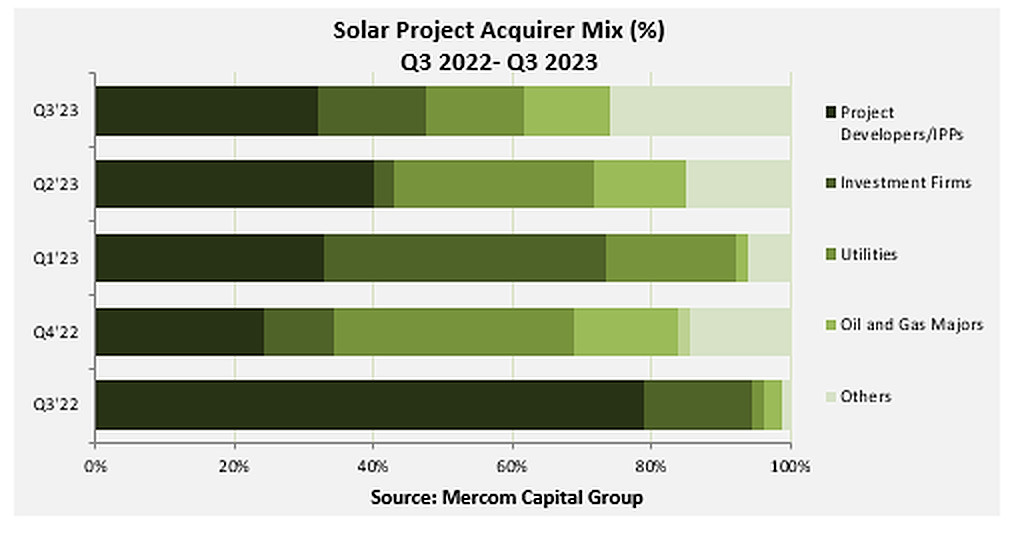

“Project developers and independent power producers were the most active acquirers of solar projects in Q3 2023 – picking up 2 GW – followed by insurance companies, pension funds, energy trading companies, industrial conglomerates, and IT firms with a total of 1.6 GW,” Mercom states.

“Investment firms acquired 959 MW; electric utilities acquired 877 MW; and oil and gas companies acquired 759 MW of projects.”

Popular content

During the first three quarters of this year, there were fewer venture capital funding activity deals – 51 in the first nine months of 2023 compared to 72 over the same 2022 period – but this value increased 4% year-on-year, representing $5.7 billion in Q3 2023 compared to $5.5 billion in Q3 2022.

There were 10 solar top venture capital securitization deals totaling $3.2 billion in Q3 2023 compared to eight deals totaling $2.3 billion in Q3 2022, representing a 39% year-on-year increase. A total of 166 solar top disclosed mergers and acquisitions, comprising 31.6 GW, occurred in 9M 2023. This is compared to 207 projects acquired, comprising 52.2 GW, in 9M 2022.

Mercom Capital Group, a US-based communications and renewable energy research firm, publishes its Solar Funding and M&A Reports on a quarterly basis.

Mercom Capital Group.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.