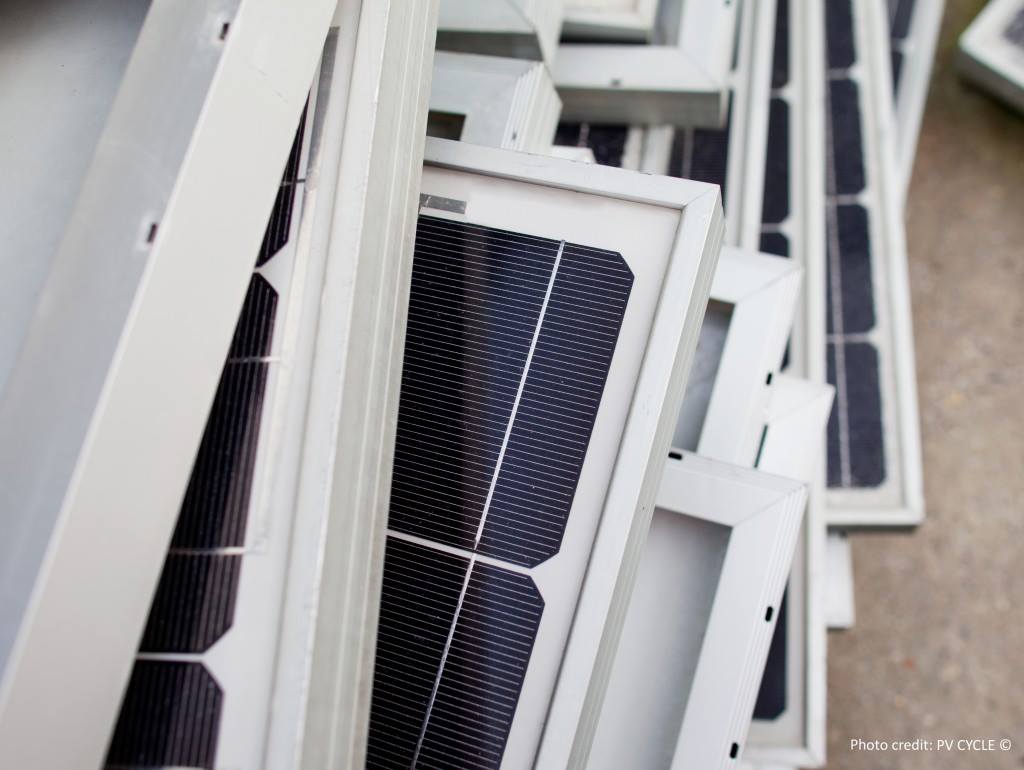

European researchers have delved into the problems facing the transition toward a circular economy for the solar industry, and have found that the majority of PV module waste in Europe is exported outside the European Union.

The study published findings and results from 20 interviews with European PV value chain representatives on current goals, barriers, and enablers for the transition toward a circular economy for solar. Participants, though anonymized, point to reducing the carbon footprint and closing the loop in the European PV industry as major goals while pursuing a more circular economy.

The current PV landscape is noted as being more of a linear economic model, or traditional system in a ‘take-make-dispose’ model.

The study, published recently in the Journal of Cleaner Production, identified four main circular practices in the European PV value chain, which need to be accelerated to become circular: reinserting by-products, digitizing the value chain, preparing PV modules for reuse, and recycling and material recovery.

The European Waste from Electrical and Electronic Equipment (WEEE) directive suggests that as of 2012, PV modules fall under Category 4 of the directive, and the inclusion mandates their proper disposal and recycling. That may be the case, but the reality is quite different, according to the authors of the paper.

“Some interviewees mentioned PV module export rates up to 90% for specific countries, which mirrors a very poor implementation of the WEEE directive,” Tadas Radavičius from Lithuanian solar PV manufacturer Solitek, and an author of the study, told pv magazine.

Radavičius said that collaboration is lacking between the different PV value chain stakeholders, with insufficient information exchange, allowing for significant lapses.

“To improve the traceability for PV modules along their life cycle, we need to digitize the value chain,” noted fellow author Ässia Boukhatmi from Technical University of Berlin, pointing to digital platforms to share data on manufacturers and materials.

Key problems

The huge gains in PV installations in Europe do come with challenges. Theoretical recycling of modules can reclaim as much as 95% of materials back, including plastics and recycling efficiency losses. However, the fate of discarded PV modules in Europe is unknown, even for the PV industry.

Popular content

Barriers to a more circular economy identified by the study include unpredictable volumes for reuse and recycling, uncoordinated legislation across Europe, insufficient value chain collaboration, poor exchange of information, and inadequate purity of recyclates for reinsertion in PV production.

The first barrier is highlighted as the paper links the core issue with PV module exports to non-European countries. This implies, in the best case, the second use of modules, and in the worst case, dumping. Author Roger Nyffenegger, from the Maastricht Sustainability Institute, told pv magazine that “several organizations interviewed mentioned that a large amount of PV modules destined for reuse and recycling disappear after dismantling or pretreatment.”

Solitek’s Radavičius said his company has worked with partners such as Iberdrola, TotalEnergies, and Fraunhofer CSP, with EU funding support to launch the EU Horizon consortium RETRIEVE. This initiative aims to offer a digital platform for recycled materials from PV modules, aiming to get material into the hands of manufacturers.

To build a digitized value chain with strong collaborations between PV value chain stakeholders, such measures help to increase the transparency and traceability of PV modules and waste and thus reduce and impede the export of the same. Only then can the vision of a circular solar industry be realized.

“PV waste export is higher than commonly expected as our research shows,” Radavičius said. “The export rates, however, differ quite significantly depending on the implementation of the WEEE directive into national law and are currently hardly quantifiable as estimations range from 30% to 90%. Currently conducted research implies that countries with a centralized collection scheme including an upfront recycling fee amassing a fund, such as France or Switzerland, tend to have lower export rates.”

The reasons for exports are numerous. National implementation flaws and inadequate oversight of WEEE directive adherence prevail, compounded by limited understanding of end-of-life disposal and associated regulations. Transparency regarding PV waste volumes and trade flows are also lacking, despite promising business prospects due to lower second-hand module prices, compared to new ones in Africa or Middle Eastern countries.

One interviewee from Germany noted how PV waste ends up outside EU countries. PV module recycling costs are usually €100 ($106.12) to €200 per ton of PV waste, or €2 to €3 per module. What happens next is that multiple organizations buy PV waste, so instead of paying for recycling, PV system owners get money for it. The organization that bought PV waste sells it as second-hand panels outside of the European Union, or dispose of the waste in an inappropriate way, such as landfills, while also getting money from EPR schemes.

“We saw a lot of openness on issues and potential solutions proposed by interviewees,” Radavičius concluded. “It was important to keep it anonymous to allow free flow of their thoughts on circularity issues.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.