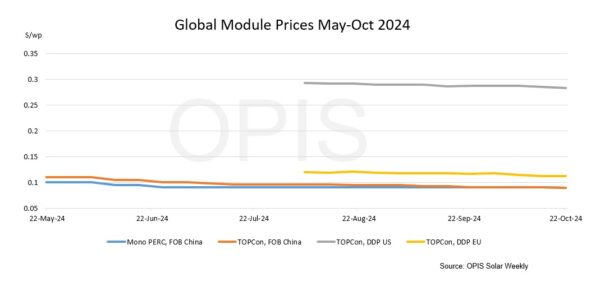

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China, fell to $0.089/W Free-On-Board (FOB) China, amid weaker indications between $0.085 and $0.099/W FOB. Tier 1 manufacturers are currently filling up Q1 2025 orders, with some suppliers offering aggressive pricing for next year, a Southeast Asian buyer said. Another market source noted that spot indications have also weakened as manufacturers seek to clear inventories prior to the end of this year.

TOPCon modules for Q4 2024 delivery into Southeast Asia were heard to be around $0.090/W on a Cost, Insurance and Freight (CIF) basis, market sources said. Meanwhile, TOPCon modules for delivery in the first half of 2025 were at a slight discount, at highs of $0.080/W CIF Southeast Asia.

In China's domestic market, TOPCon module prices softened with market indications driving prices down by 2.19% week-on-week to CNY 0.716 ($0.10)/W. Similarly, mono PERC module prices dropped by 2.25% to CNY 0.694/W. The weaker sentiment is primarily attributed to bearish prices from large-scale procurement tenders, which have pressured spot prices in the domestic market.

The China Photovoltaic Industry Association (CPIA) recently released its October cost estimate for photovoltaic modules, setting the production cost for N-type M10 bifacial modules, including tax, at CNY 0.68/W. This move is aimed at curbing below-cost bidding that has affected the industry.

In Europe, TOPCon modules prices remained stable week-on-week. OPIS assessed the average price at €0.103 ($0.11)/W, with indications ranging between a low of €0.085/W and a high of €0.120/W.

TOPCon panel prices for European imports have fallen this month by an average of €0.01/W as many suppliers are still devaluing their stocks to boost sales, sources said. Market watchers also mentioned an ongoing flat demand in the residential sector, complex authorization processes and uncertainty around longer-term economic conditions. Brokers estimate the current stock levels in Western Europe at around 20 GW.

The U.S market is quiet, according to numerous buy-side sources. As November approaches, most customers are looking towards their 2025 needs and waiting on the results of the U.S. presidential election in early November and the AD/CVD probe in late November.

Earlier this year, it was expected prices would be spiking by now as the AD/CVD probe hits full-stride, but oversupply and landed stock subject to the December utilization deadline continue to have a dragging effect in the near-term. One source said a supplier holding dozens of MWs worth of modules is floating prices between $0.18/W and $0.24/W.

A source that produces modules in both the U.S. and Southeast Asia is offering TOPCon modules DDP U.S. around $0.25/W “plus or minus 10%” for all of 2025, regardless of where they are assembled. The U.S. modules would use cells produced in Asia and therefore have a negligible percentage of domestic content. The source said “the market is not letting us differentiate (between origin)…so at this point, we just want to get deals done.” “It's a tough environment,” they added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.