From pv magazine Brazil

The Brazilian PV market could see its second consecutive year of contraction, with 2026 additions expected to reach 10.6 GW, a 24% decline from the 15 GW added in 2024. Brazilian photovoltaic association ABSolar warned that regulatory barriers related to curtailment, high capital costs, and restricted access for self-generation systems may discourage new investments and reduce employment in the sector.

Large-scale solar projects face financial losses from curtailment without compensation. Small- and medium-sized PV systems encounter grid-connection barriers, often justified by perceived constraints or concerns over power flow reversal, discouraging consumers from self-generating clean electricity.

ABSolar said Brazil’s high cost of capital, with interest rates near 15% per year, volatile US dollar exchange rates, and elevated import duties on photovoltaic equipment as constraints on new investment.

The association projects BRL 31.8 billion ($5.8 billion) in new solar investments in 2026, down from roughly BRL 40 billion in 2025. Job creation is expected to fall from 396,500 in 2025 to 319,900 next year. Sector revenue is projected to decline from more than BRL 13 billion in 2025 to around BRL 10.5 billion in 2026.

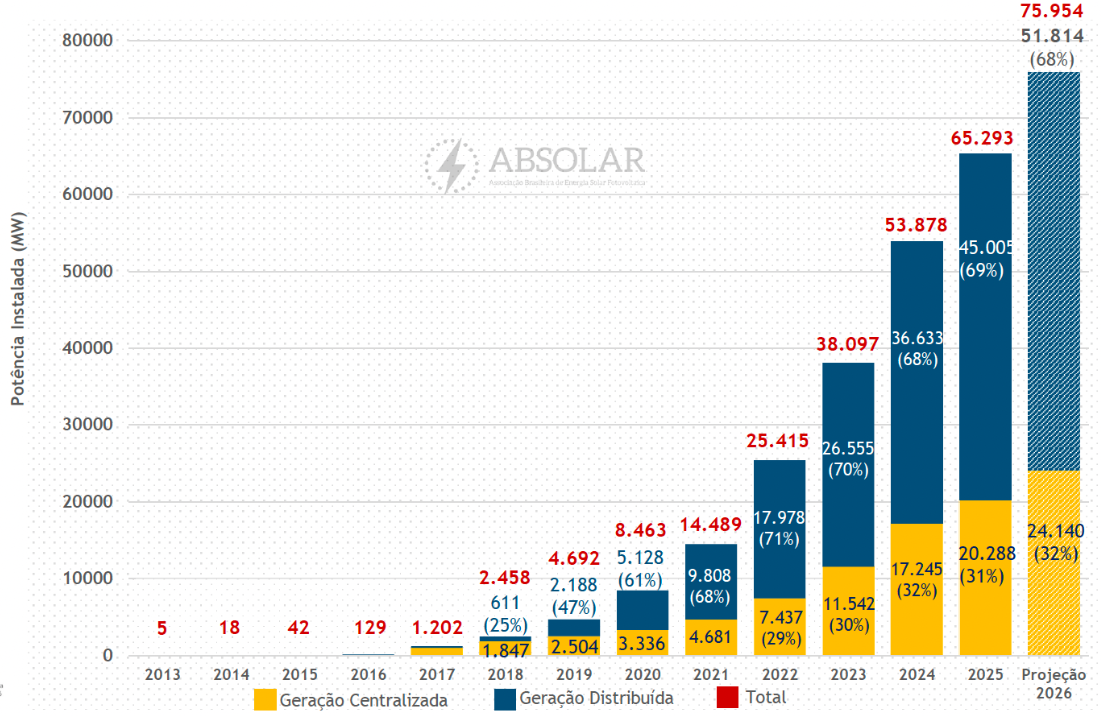

By the end of 2026, Brazil’s cumulative installed PV capacity is expected to exceed 75.9 GW, including 51.8 GW from residential and commercial systems and 24.1 GW from large-scale plants connected to the National Interconnected System (SIN).

ABSolar plans to present proposals to presidential candidates in 2026 calling for compensation for curtailment losses, easier connections for small and medium self-generation systems, and clearer regulations for electricity storage to alleviate market bottlenecks.

The association will also continue working with Brazilian authorities and the electricity sector on expanding transmission and distribution infrastructure, improving system operations, regulating Storage Capacity Reserve Auctions (LRCAP), valuing distributed generation, modernizing tariffs, and implementing electricity-sector reforms under Law No. 15,269/2025.

Despite the market slowdown, solar remains Brazil’s leading source of new generating capacity, accounting for 68% of additions through November 2025, including both distributed and centralized generation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.