Livoltek commissions inverter factory in Brazil

The company opened an inverter factory in the Manaus Free Trade Zone with a capacity of 1.8 GW, or 300,000 units per year. In the second phase, it plans to bring in the production of hybrid inverters and lithium batteries as well as chargers for electric vehicles and motors for electric boats. The company will have distribution centers in Curitiba and Fortaleza to ensure rapid delivery of equipment to the domestic market, with a minimum warranty of 10 years.

Grid backlog drives innovative approaches in Brazil

The rapid growth of renewable energy in Brazil has not been matched by transmission and distribution infrastructure. Connection restrictions for both “distributed-” and centralized-generation sites are leading companies to adopt new strategies to maintain expansion, reports pv magazine Brasil’s Livia Neves.

Solar module prices rising in Brazil

Despite global overcapacity, several factors may contribute to a slight increase in solar panel prices in Brazil, with shipping costs and quotas for fiscal exemptions on imported PV modules playing a key role.

267 MW PV plant inaugurated in Brazil

The BRL 950 million ($175 million) São João do Paracatu solar park in Minas Gerais employs 500,000 solar modules distributed over an area of 509 hectares and counts clients in the areas of mining, magnesium industrialization and plastic production and recycling.

Floating solar power in Brazil provides opportunity for hydroelectric power plants

The Itaipu hydroelectric power plant could almost double its generation capacity if it were to install a large floating solar plant that would occupy only 10% of its 1,350-square-kilometer reservoir area, according to an estimate released by the energy consulting and analysis firm PSR. The installation of floating PV could be an alternative to the repowering of power plants, although it faces regulatory and operational constraints.

FRV to invest some $5 billion in 2 GW of green hydrogen capacity in Brazil

FRV is one of a number of companies that has already signed contracts with the Ceará government for the production of green hydrogen and its derivatives in the state. Its H2 Cumbuco project is set to expand to 2 GW of electrolyzer capacity in two phases. The project will use residual urban water treated by the local sanitation company.

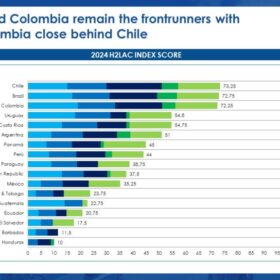

Chile, Brazil, Colombia lead hydrogen market in Latin America, Caribbean

Colombia, Brazil, and Chile lead the hydrogen market in Latin America and the Caribbean, according to new data presented by Hinicio and New Energy at the recent 4th Hydrogen Congress for Latin America and the Caribbean (H2LAC 2024).

Solatio plans 4 GW of solar for hydrogen production in Brazil

Spanish solar developer Solatio says that it plans 4 GW of solar to support hydrogen production in Brazil, under a $1.94 billion agreement with the state government of Piauí.

The Hydrogen Stream: China may hit 2025 green-hydrogen targets a year early

Rystad Energy says China appears set to smash its national hydrogen targets, solidifying its lead in the global electrolyzer market, while European Union and Japan have agreed to cooperate on hydrogen research.

Livoltek set to commission Brazilian inverter factory

Livoltek says it has invested $13.2 million in a new inverter factory in Brazil. The facility will also produce soon lithium-ion batteries and electric-vehicle rechargers.