Australia’s energy storage installed base to grow more than five times by 2030

In its latest report, IHS Markit predicts that energy storage installations in Australia will grow from 500 MW to more than 12.8 GW by 2030. Today, Australia makes up less than 3% of total global installations for battery energy storage and is the seventh largest market globally. By 2030, it is forecast to comprise 7% of global installations and become the third largest market. This growth will be largely driven by three distinct market segments: residential, standalone front-of-the-meter, and collocated with utility-scale renewables.

C&I sector in Sub-Saharan Africa embraces captive solar solutions

The Commercial and Industrial (C&I) solar sector currently accounts for 75% of power demand in Sub-Saharan Africa. However, due to the unreliable nature of energy supply from the grid, consumers under this segment have been forced to invest in alternative sources of energy, which they consider to be more reliable and less expensive, such as the use of captive solar solutions.

New applications, surging demand

China’s project development segment is dynamic, to say the least. Having undergone significant changes toward a “subsidy-free” footing, developers are now facing requirements to integrate storage, deploy hybrid arrays, and pursue self consumption through BIPV and agrivoltaics applications, writes Frank Haugwitz, the director of the Asia Europe Clean Energy (Solar) Advisory (AECEA).

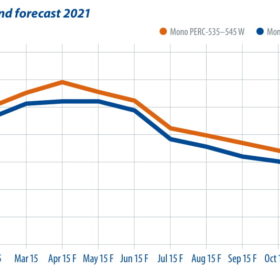

Price trends amid polysilicon shortage

Recent financial statements from the big module manufacturers indicate that higher prices for polysilicon and PV glass since the third quarter of 2020 have dealt a severe blow to profits in the module business. Module manufacturers have gradually scaled down capacity utilization since the Lunar New Year, as demand has been weaker than expected, given the absence of China’s usual June 30 installation rush, as in past years. In April, Tier-1 module makers further cut utilization rates to 55-70%. PV InfoLink’s Corrine Lin examines the price trends that are developing in 2021.

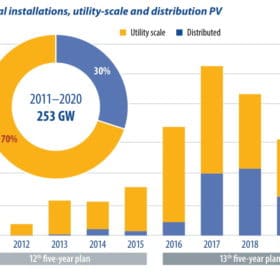

China reaches a tipping point in 2021

This year will be a key period in the development of China’s solar PV market. It is the first year of the 14th five-year plan, the first calendar year after President Xi Jinping announced the 2030-60 carbon emissions commitment, and the first year for utility and commercial unsubsidized projects. IHS Markit expects the solar industry in China to reach another milestone with more than 60 GW of installations this year, advancing the ground for the energy transition and the displacement of traditional energy sources to fulfill the goal of a net carbon future over the next four decades to come.

Botswana tops list of world’s ‘super abundant’ renewables nations

A Carbon Tracker report estimates 60% of the world’s technical solar potential – enough to produce 3.5 exawatt-hours of clean electricity per year – would already be cheaper than fossil fuel if installed. Of the remainder, most would be in sub-Saharan Africa, a region which has the potential to be a global solar and wind powerhouse.

Asia Pacific’s solarized digitization agenda

The virtual 7th Asia-Pacific Climate Change Adaptation Forum was hosted in March by Japan’s Ministry of the Environment, together with the Asia Pacific Adaptation Network (APAN) Secretariat. The theme was “Enabling Resilience for All: The Critical Decade to Scale-up Action” with the goal of formulating National Adaptation Planning for science and technology, and energy and fiscal policies that consider the interlinkages between climate change, health, and biodiversity. These nature- and ecosystem-based policies will serve as the basis for the Asia-Pacific region’s contributions to the “Leaders’ Summit on Climate” in the United States; the United Nations Biodiversity Conference (COP 15) in Kunming, China; and the United Nations Climate Change Conference (COP 26) in Glasgow, United Kingdom.

Battery testing builds certainty

Owners and operators of energy storage systems, as well as investors, need transparent ways to evaluate battery performance. They need certainty that the selected batteries for their ESS projects will perform reliably, have predictable life expectancies, and meet projected revenue and contractual obligations over their lifetimes. The economic viability of entire projects depend on this confidence, writes Michael Kleinberg of DNV.

Analysis of France’s CRE4 PV tenders and their impact

This year will witness the end of the French program for PV tenders known as “CRE4”, which began in 2016. To date, they have enabled over 7.2 GW of solar capacity to benefit from a subsidized tariff (feed-in tariff or feed-in premium). A few months before the last CRE4 tenders and the launch of the PPE2 (or CRE5), Finergreen evaluates their impact on the French solar industry.

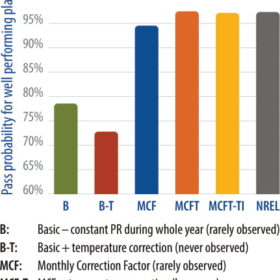

We all trust the PV performance ratio test – but should we?

The performance ratio test is at the core of the handover from EPC to owner. Yet sometimes, even when best practice is applied – and without particularly demanding guaranteed values to be achieved – these tests fail good projects. This can lead to costly delays and wasted effort spent trying to find issues that might not exist. Everoze Partner Dario Brivio reviews the likelihood of this happening and considers ways to increase confidence in the precision of such tests, based on recent independent analysis of real-world projects.