The challenge of 2020

The coronavirus outbreak is gripping the global community and the economic impacts are being felt, with the solar industry profoundly affected. With something like 90% of the solar module supply chain located in China – the source of the Covid-19 outbreak – the ripples from the profound disruption to production in the early stages of this year will likely be felt for many months to come.

‘Sector rotation has begun’

Solar stocks significantly outperformed the broader market in February.

The coronavirus wake-up call

The coronavirus (Covid-19) outbreak is now dominating daily headlines from China to Europe. There is also increasing talk that the long-underestimated and downplayed epidemic, which likely originated in the Chinese city of Wuhan, is having a negative impact on the global economy. Although we may all be suffering from information overload about this terrible news by now, the impact of the virus on the solar industry is, unfortunately, a sad reality, and the full extent of its devastation is just beginning to reveal itself.

Perovskite technology – beyond efficiency records

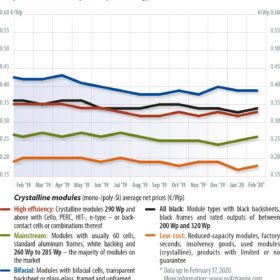

Technological innovation in PV is taking place in the context of extreme price competition among solar manufacturers, writes Karl Melkonyan, senior analyst for solar demand at IHS Markit. This, he argues, explains the focus on lowering manufacturing costs, increasing efficiencies, and reducing losses at all stages of the manufacturing process.

Short-term symptoms

The 2019 coronavirus outbreak has disrupted the global PV supply chain. China, the largest manufacturing hub for solar products, has postponed factory openings in many regions, as it has been hit by logistical hiccups, staff shortages, and delivery delays. Manufacturers in some Chinese provinces are running under capacity, while those overseas are facing the same situation.

US boom in the shadow of a black swan

Supply-chain constraints related to China’s coronavirus outbreak could weigh on the performance of the U.S. solar market in 2020, writes SPV Market Research’s Paula Mints.

Turkish policy turns to the rooftop

Turkey’s stuttering economy, shifting PV policy landscape, and the fruitless YEKA tenders have undermined the country’s solar progress, even though it was considered Europe’s most promising market as recently as two years ago. But its rooftops could still bloom if new regulations that will be issued in May manage to make solar attractive to both businesses and households alike.

Bust looms over Ukraine

Ukraine’s solar market catapulted itself into the gigawatt club in 2019. But a familiar tale of boom and bust is hanging over Kyiv. The story is complicated by the country’s political and energy market reforms, as well as geopolitics and a new orientation toward the West in the wake of the country’s 2013-14 revolution.

MENA: More than just mega-projects

While massive utility-scale PV projects throughout the Middle East and North Africa often have an outsized influence on regional installation rates, newly added solar capacity in MENA declined year on year in 2019. But steady, ongoing demand for rooftop arrays could be on the horizon, says Gulnara Abdullina, JinkoSolar’s general manager for the MENA region.

The research behind dust mitigation

Solar PV is surging in the Middle East, due to its sustainability and decentralized nature. But with the ample sunlight of the region comes fine dust, which can sharply reduce power output. Zulfa Rasheed from the Rochester Institute of Technology in Dubai looked at the latest research in the field and found that module-glass coating and robotic solutions appear to be the most promising options when it comes to dealing with dust.