Growing pains

The switch to large-format PV cells and modules has pushed the boundaries of what many in the solar industry thought possible. And it caught the rest by surprise. But the logic behind the change makes sense – getting more throughput in terms of watt-peak through cell and module lines, and allowing for longer module rows in PV projects, delivering BOS savings and lower LCOE.

Stocks slip on short supply

Supply shortages and price increases slowed solar stocks in April, writes Jesse Pichel of ROTH Capital Partners. In the United States, however, new policies promise to foster growth in the second half of the year.

Is sustainable market development possible?

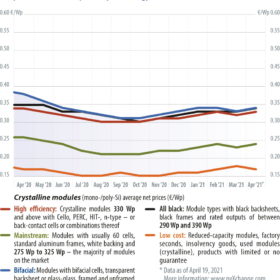

Module manufacturers have once again adjusted their prices upwards. This is already the third or fourth price increase in the last six months, and there is no end in sight, writes Martin Schachinger of pvXchange. But why is it so hard to achieve long-term, sustainable development in the global solar market, at least on the part of manufacturers? Few other industries are so turbulent, with constant swings between excess supply and bottlenecks, between price collapses and price rises – and always to the breaking point of the market. Yet again, planning security is out the window.

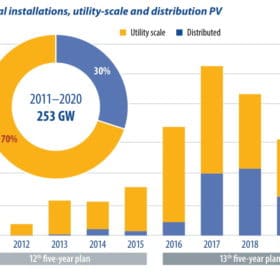

China reaches a tipping point in 2021

This year will be a key period in the development of China’s solar PV market. It is the first year of the 14th five-year plan, the first calendar year after President Xi Jinping announced the 2030-60 carbon emissions commitment, and the first year for utility and commercial unsubsidized projects. IHS Markit expects the solar industry in China to reach another milestone with more than 60 GW of installations this year, advancing the ground for the energy transition and the displacement of traditional energy sources to fulfill the goal of a net carbon future over the next four decades to come.

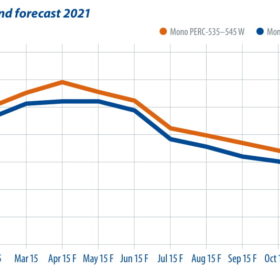

Price trends amid polysilicon shortage

Recent financial statements from the big module manufacturers indicate that higher prices for polysilicon and PV glass since the third quarter of 2020 have dealt a severe blow to profits in the module business. Module manufacturers have gradually scaled down capacity utilization since the Lunar New Year, as demand has been weaker than expected, given the absence of China’s usual June 30 installation rush, as in past years. In April, Tier-1 module makers further cut utilization rates to 55-70%. PV InfoLink’s Corrine Lin examines the price trends that are developing in 2021.

New applications, surging demand

China’s project development segment is dynamic, to say the least. Having undergone significant changes toward a “subsidy-free” footing, developers are now facing requirements to integrate storage, deploy hybrid arrays, and pursue self consumption through BIPV and agrivoltaics applications, writes Frank Haugwitz, the director of the Asia Europe Clean Energy (Solar) Advisory (AECEA).

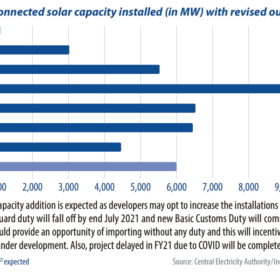

The impact of the second Covid-19 wave

Time and cost overrun risks are increasing for solar project developers, as India goes into partial lockdowns to battle the next Covid-19 wave. Still, analysts say there will not be much of an impact on annual capacity installations, given the upcoming no-duty window.

Five trends to watch in Southeast Asia

Minh K Le, senior renewables analyst at Rystad Energy, examines five key trends to watch in Southeast Asia utility-scale solar, as mega-scale projects ramp up, Indonesia emerges, and Vietnam steps back.

Tracking the load

Over the past two years, larger wafer formats have quickly emerged to displace the previous 156.75 mm standard, which represented more than 90% of the monocrystalline market up until 2018. The largest of these, at 210 mm, offers key advantages in output that have allowed module power ratings to exceed 600 W from a 60-cell PERC solar module.

Drones or measurements?

Project owners need to make choices in terms of plant monitoring equipment. That can be electrical metrology equipment, but could also include new approaches such as using drones and machine-learning algorithms, or both.