The business case for C&I storage

In 2024, European businesses installed roughly 20 GW of commercial and industrial (C&I) solar, but only around 1 GW/2 GWh of C&I battery storage. The gap is striking. Both technologies promise lower energy bills, improved resilience, and decarbonization, but batteries are yet to achieve the same commercial traction that solar enjoys. LCP Delta’s Dina Darshini asks why the gap persists.

Brace for impact

Worldwide, the solar industry has taken a few knocks in 2025. Oversupply has seen PV manufacturers continue to rack up billions in losses, and support for a rapid transition away from fossil fuels has wavered in several key regions.

Poly probe outcome hard to predict

US solar stocks had a strong October but all eyes are on the Section 232 investigation into polysilicon. The size and design of quotas is expected to have a significant impact across the solar value chain, reports Jesse Pichel of Roth Capital Partners.

Beware of solar scammers

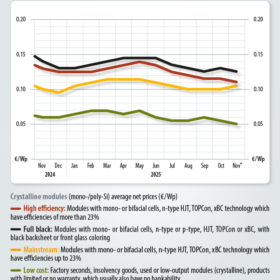

Potential PV system operators recently exchanged notes on an online forum after falling victim to solar scams. Sadly, they had been lured by fraudulent installation companies promising cheap offers and fantastic returns for end customers and investors. Martin Schachinger of pvXchange warns of the growing presence of fraudsters in Europe’s PV industry.

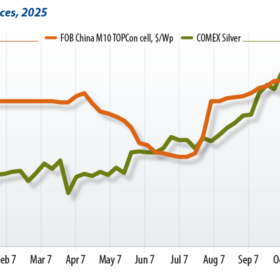

China’s drive for a polysilicon bailout

Following a lengthy period of oversupply and falling prices for solar components, China’s central and local governments are working with PV industry giants to implement an unprecedented plan to purchase and eliminate excess capacities. Vincent Shaw reports on China’s efforts to bring PV oversupply under control.

Consolidation mode

Policy developments, or the lack thereof, continue to shape market sentiment along the solar supply chain. Hanwei Wu of OPIS sees growing likelihood that China will implement a rumored plan to purchase and shut down excess polysilicon capacity, but slow progress keeps prices in a holding pattern.

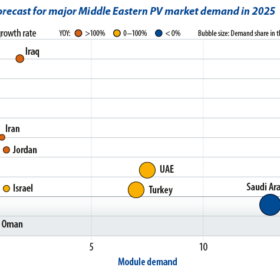

Concentration and localization

Demand for PV in the Middle East has become concentrated in markets with relatively mature regulatory frameworks, bankable power purchase agreement (PPA) terms, and assessable risk profiles. But PV markets in other countries in the region remain limited in scale or still at a stage of policy uncertainty.

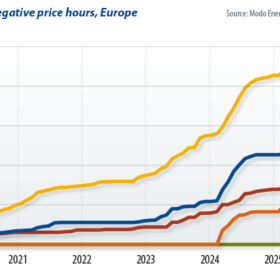

When solar is a zero-sum game

Negative prices are becoming more frequent in key European markets due to solar and wind intermittency, seasonal variations influencing demand and generation profiles, dated grid infrastructure, and market design. Battery storage absorbs excess generation, and tariffs shift consumption during peak demand, but too much market intervention can do more harm than good.

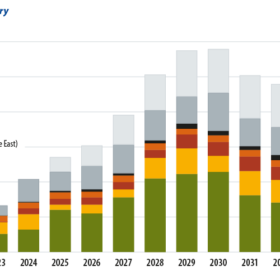

Solar soars in the Middle East

The rapid expansion of solar and battery installations in the Middle East over the past two to three years has taken many by surprise. A region synonymous with rich oil and gas reserves and periodically marked by regional tensions seemed an unlikely source of demand growth, but several factors have helped catalyze a transition that is still unfolding.

From standards to sandstorms

The Middle East now ranks among the world’s most ambitious solar markets. Gigawatt-scale projects across Saudi Arabia, the United Arab Emirates, and Egypt are supported by national programs that pair large tenders with local-content incentives aimed at onshoring production. Yet the same geography that powers the region’s solar boom challenges developers in unique ways, write Intertek CEA experts Jörg Althaus and Huatian Xu.