Strength in unity

Integrating battery energy storage systems (BESS) with wind and solar has become widespread. The next challenge for asset owners is to ensure they are getting the maximum payback from the ancillary services their hybrid portfolios can provide, says Ricardo Wigman, chief delivery officer at US energy management software provider Power Factors. This requires more than the traditional site-by-site approach to asset management, he argues.

Shaping the future

Distributed generation (DG) has emerged as a central pillar in the transformation of global energy systems. Distributed PV and energy storage systems (ESS) are changing how electricity is generated and consumed and challenging traditional utility models. While the sector has enjoyed rapid growth, recent years have seen a cooling of expansion rates, highlighting both the maturation of the market and the emergence of new challenges.

Lessons from the solar frontier

Utility-scale solar projects are larger, interconnections are slower, and engineering decisions must anticipate regulation and supply chains years in advance. At the CT Solar Platform in Snyder, Texas – a 1.6 GW AC single-site development – the first phase, CT Solar One (110 MW AC), has been a test bed for integrating civil design, BOS optimization and domestic-content strategy. Levona Renewables led the development and engineering of the project and CEO Fernando Queiroz shares some key lessons.

A decade of PV progress

After nine years at the helm of US solar’s main trade body, Abigail Ross Hopper announced she would step down as president and CEO of the Solar Energy Industries Association (SEIA), effective Feb. 1, 2026. pv magazine spoke with Hopper about her tenure and the sector’s rapid growth since 2017.

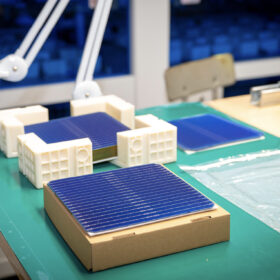

US solar’s push for domestic bliss

Incentives in the US Inflation Reduction Act (IRA) of 2022 drove a surge in announcements of new solar manufacturing facilities across the United States, and the country now hosts more than enough module production capacity to meet forecast domestic demand for several years. A shift in policy priorities has created uncertainty, but the continued availability of manufacturing tax credits and a focus on domestic industry have US module makers looking to add cells and other components to their production plans.

The future is unwritten

Whatever decision the US Department of Commerce makes on polysilicon imports, some market segments are in for a bumpy ride in 2026 as the expiration of tax credits and other policy levers change the trading environment faced by residential installers and others. Jesse Pichel and Lev Seleznov of Roth Capital assess what lies ahead for US solar.

Tax relief deadline sparks selloff

From the beginning, 2026 is shaping up to be a year of radical change for all, and the solar industry is no exception. A calm end to 2025 was shattered in January, and the new year has already brought a PV manufacturing overhaul. Martin Schachinger of pvXchange examines the impacts of a sudden increase in module prices.

Growing pains

The electricity grid is a real bottleneck for energy in the United States, and it’s not only utilities and grid operators who are struggling. Grid congestion also puts pressure on renewable energy project owners and is as much a business problem as it is a technical one, writes Alon Mashkovich, CEO of energy management business software supplier enSights.

Buffalo solar

Indigenized Energy recently led a project deploying an off-grid solar-plus-storage solution for a buffalo ranch owned by the Northern Cheyenne Tribe in the US state of Montana. pv magazine spoke with Serena Romero, the company’s director of marketing and communications, about the potential of off-grid renewables to empower North America’s indigenous peoples.

Policy shifts and rising costs

Policy rebalancing and rising production costs are set to shape China’s solar market in 2026. Just weeks into the new year, two key policy moves have already shifted expectations across the photovoltaic value chain, marking a move away from the prolonged “involution” that has weighed on the industry in recent years. OPIS analyst Brian Ng shares an update.