The lithium-ion (Li-ion) battery is an energy transition game-changer. Transport electrification is a must for governments – and automakers – with net-zero pledges. Early electric vehicles (EVs) were powered by nickel-metal hydride (NiMH) batteries – good enough for plug-in hybrids (PHEVs) which still relied on combustion engines, but not good enough to go fully electric – NiMH couldn’t cut it.

Li-ion cells can store roughly three times as much energy as NiMH products. Unsurprisingly, the difference between a driving range of 100 miles and 300 miles was crucial in changing public perception of EVs. Sales of PHEVs and battery-only electric vehicles (BEVs) doubled in 2021, compared with 2020. Throw in concerns about the stability of global oil supplies and there’s no better time to go electric than right now.

Overnight sensation

Wood Mackenzie expects passenger BEV and PHEV sales to increase from 11 million this year to more than 36 million in 2030 – an extraordinary rate that is testament to the desire to shift to low emission vehicles. With cheaper technology and wider EV availability boosting efforts, the electrification of transport is an overnight sensation compared to the widespread adoption of car ownership after the 19th century invention of the internal combustion engine.

That sales forecast could be higher. We expect EVs to account for 35% of passenger car sales in 2030. What’s holding back sales is not demand – the EVs of 2030 will be another performance step-change on today’s models – but raw material supply. Li-ion batteries have environmental impact concerns and incorporate critical energy transition materials: lithium, nickel, cobalt, copper, aluminum, and graphite.

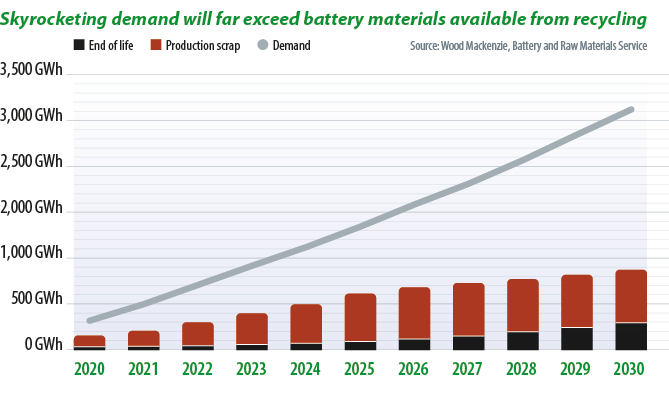

A projected tripling of sales will mean unprecedented growth in demand for critical minerals, particularly lithium, cobalt, and nickel. With those materials needed across the energy transition, the math does not add up.

Building a new mine can take at least five years, sometimes almost 10. Expanding a mine can take two years. And yet miners are not expanding. WoodMac expects miners to be unable to meet lithium or nickel demand in 2030 and that would devastate the EV industry. Using smaller battery packs is an unpalatable option when range anxiety has only just been addressed and concern over charging times is still an issue.

Alternative technology could be an answer, and Chinese battery cell makers have championed the LFP-type, lithium iron phosphate Li-ion battery – which contains neither nickel nor cobalt – in comparison to the nickel-based NMC (lithium nickel manganese cobalt oxide) and NCA (lithium nickel cobalt aluminium oxide) Li-ion products used in Western EVs. Alternatively, sodium-ion (Na-ion) batteries do not require lithium, nickel, or cobalt. There is not enough time, however, to construct LFP or Na-ion cathode and battery plants to meet demand this decade; they are an extra, not an answer.

The spotlight has shifted to the “secondary market”: recycling batteries. Lead-acid battery components are commonly recovered and the critical materials in Li-ion devices ensure recycling will happen, with Mercedes-Benz, Tesla, Nissan, VW and General Motors all having laid down plans for the process.

Doubts remain, though, over how much material there is to recover right now, how best to recycle and whether recycling has a strong enough business case in a world of incessant input-cost reductions.

EV battery demand cannot be met by recycling cells from portable electronics and, with today’s electric vehicle batteries expected to last at least 12 years, it will be the end of the decade before products from EV first adopters come back into play.

Li-ion battery recycling processes are not fully established. Some recyclers use pyrometallurgy, which recovers only nickel, cobalt, and copper – not ideal for a diminishing lithium balance. New players may champion hydrometallurgy, which also recovers lithium and even graphite, but that is not yet commercialized.

Cell makers have spent a decade trimming cobalt content – some will remove it entirely by 2030 – but that removes a central plank of revenue for battery recyclers, even more so in the case of Na-ion cells.

However, help could be at hand. The EV industry was kick-started by subsidies and recyclers could benefit similarly. The EU has tabled a battery regulation which could set minimum requirements for recycled lithium, nickel and cobalt in 2030 and 2035 – forcing automakers to incentivize recycling in supply chains. Meanwhile, without substantial end-of-life battery feedstock recyclers can feed off cell production scrap.

Technological advancements are also on the way. Companies such as Onto Technologies and Ascend Elements are spearheading “direct recycling,” which produces cathode material from feedstock rather than separating metals into individual chemicals. This drastically increases the revenue prospects for recyclers, especially for LFP-type Li-ion batteries. So, while recycling can’t make a huge impact on raw material demand, it will be well placed for the influx of feedstock in the 2030s.

About the author:

Max Reid is research analyst with Wood Mackenzie’s Battery Raw Materials Service. He tracks supply chain developments, technological innovations, and progressions in battery demand sectors. Reid joined Wood Mackenzie in 2021, having previously worked as a research scientist at QinetiQ. In this role, he evaluated battery technology for military applications, worked with universities to scale up next-generation technology, and developed niche battery devices for commercial and military applications.

Max Reid is research analyst with Wood Mackenzie’s Battery Raw Materials Service. He tracks supply chain developments, technological innovations, and progressions in battery demand sectors. Reid joined Wood Mackenzie in 2021, having previously worked as a research scientist at QinetiQ. In this role, he evaluated battery technology for military applications, worked with universities to scale up next-generation technology, and developed niche battery devices for commercial and military applications.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.