Lebanon’s Tufail region may host planned 500 MW solar plant

The European Bank for Reconstruction and Development is seeking consultants for a feasibility study for the project. The plant would be constructed on land owned by the Banque du Liban.

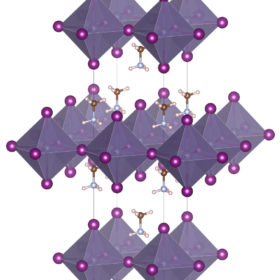

Looking past perovskites

Researchers at the University of California, San Diego – with the help of the university’s Comet supercomputer – modelled thousands of halide compounds to come up with a shortlist of 13 materials that could be candidates for the efficient solar cell materials of the future.

Off-grid solution for Haiti electrification to receive $17 million funding

The government of Haiti and the World Bank have put in place a financial instrument to provide access to capital for companies active in clean off-grid energy solutions. The aim is to power 200,000 households over 10 years.

Overseas developers rallying to invest in Bangladeshi solar

Big names in the running for 45-55 MW project in Chittagong as developers scramble to take advantage of an income tax exemption for clean energy investment that is due to expire this year.

GCL wants to sell 977 MW solar portfolio to pay down debt

The Hong Kong listed polysilicon manufacturer is selling off solar assets to fund its thirst for production capacity expansion. The proposed sale would net the company almost $290 million to reduce its debt pile.

EDF-led consortium wins Moroccan tender for 800 MW CSP-PV project with price of $0.070/kWh

The grouping, which includes UAE-based Masdar and Moroccan independent power producer Green of Africa, is planning to begin construction this year. The project is among those realized by the Moroccan Agency for Sustainable Energy, as part of the Noor Solar Plan to develop a minimum 2 GW of capacity by next year.

US energy storage market set to almost double this year

The solar-plus-storage combination is super-charging the deployment of batteries across the country and IHS Markit says the U.S. will become the largest market for grid-tied energy storage this year.

Russia’s largest PV plant comes online

The 75 MW project was built by Russian developer Solar Systems LLC in Novokuybyshevsk, in the Samara oblast. The facility was mostly financed by Russian state-owned lender PJSC Sberbank.

Scientists cast light on how potassium can fix perovskite cells

Doping perovksite solar cells with potassium is said to eliminate interface trapping defects and mobile ion migration. ‘Hysteresis suppression’ is key for more efficient cells based on the promising material.

Bboxx secures $8 million loan to boost Rwanda operations

The off-grid solar system supplier has received the finance in Rwandan francs to mitigate currency risk and expand operations in its biggest market.