SolarPower Europe: SolarWorld bankruptcy marks “sad day for Europe”

The European solar industry’s peak body SolarPower Europe says that yesterday’s insolvency announcement, from German-based producer SolarWorld, is regrettable and that it is of “vital importance” that all parts of the solar value chain are present in Europe.

LPKF sees 65% YoY revenue increase in Q1

German laser specialist LPKF has made a good start to 2017, with especially strong performance from its solar equipment segment, which saw a revenue increase by 71% compared with the same period for the previous year.

Manz posts positive operating result in Q1 2017

The German equipment provider reports an operating profit of €20 million for the first quarter of this year.

Interview: Asia Clean Capital CEO Thomas Lapham

China is shifting its major PV installations from previous large utility-sized ground PV plants in the west and north to small-sized distributed PV projects in the eastern coastal areas. During this process, many companies have found new opportunities.

Daqo New Energy posts $23 million net profit in Q1

The Chinese polysilicon producer’s net income attributable to shareholders reached $22.9 million in the first quarter of 2017, from just $8.3 million a year earlier.

Italy plans to introduce auction scheme for large-scale solar starting 2020

In the country’s new energy strategy, the Italian government is planning to phase-out coal power plants starting 2025, and to support utility-scale PV projects through long-term PPAs.

Big challenges: Raj Prabhu on the SolarWorld insolvency and U.S. solar manufacturing

Today, SolarWorld AG filed for insolvency in Germany, and it is unclear whether or not its U.S. subsidiary will also file. In the following interview, Mercom Capital CEO Raj Prabhu talks about what this means for the U.S. solar industry.

EU ProSun: SolarWorld insolvency “heavy blow” for European solar

EU ProSun has described the bankruptcy of SolarWorld as a “serious blow to the German and European solar industry.” The lobby group, which has long advocated for tariffs against Chinese solar modules, “deplored” the news of the German-headquartered manufacturer’s insolvency – in a statement released minutes after SolarWorld’s official announcement.

Breaking: SolarWorld insolvent

Pioneering solar PV manufacturer SolarWorld AG is insolvent. The company announced today it is “over-indebted” and would immediately file an application for insolvency.

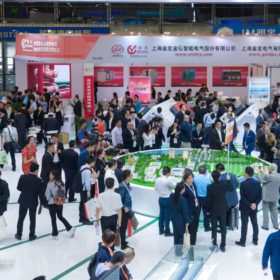

Video: China market not to disappoint in 2017

Far and away the largest PV market in the world, China’s development has broad consequences for the entire PV industry. Nowhere was this more evident than at the SNEC trade show in Shanghai last month, where the question of China’s projected installations for 2017 was hot on everyone’s lips.