GCL concern over senior notes due January 30

Investors sitting on three-year notes worth $500 million have been asked to postpone settlement for another three years and to sign away their rights to oppose the debt restructure plan which would be needed if the company defaults on the commitment, triggering a cross default.

Chinese polysilicon makers driving industry’s second great consolidation

The 275,000 metric tons of annual polysilicon production facilities pushed out of the industry by the expansion of big Chinese producers is more than double the capacity lost in the last great poly market shake-out, between 2010 and 2013.

GCL shareholders set for a busy festive period as votes loom on $903m worth of solar project sales

Chinese state entities are now behind five phases of two separate sales deals which, if approved, will transfer more than 1.8 GW of solar generation capacity into public ownership.

China set to acquire 820 MW of solar project capacity

The latest, seven-project, 217 MW, $150 million project sell-off announced by the development business of polysilicon producer GCL-Poly means a lot will be at stake in the vote by its shareholders at an extraordinary general meeting in the new year.

GCL to generate $304m with 430 MW Chinese project sale

The debt-saddled GCL New Energy solar project business of the polysilicon manufacturer is aiming to sell off solar farms to transform into an ‘asset light’ operation.

Terms worsen for GCL in latest proposed project sale to China Huaneng

Chinese solar project developer GCL has added 109 MW of generation capacity to the portfolio it plans to sell to the state-owned buyer but on worse terms than the initial phase of project sales.

Chinese PV Industry Brief: GCL begins work on new polysilicon factory, GoodWe listed on Shanghai exchange

Polysilicon maker GCL-Poly has started construction of a factory with an annual production capacity of 54,000 MT as Chinese inverter manufacturer Goodwe launched an IPO on the Shanghai stock market.

Chinese PV Industry Brief: New supply deal for Daqo plus more cell and PV glass production capacity

Chinese polysilicon manufacturer Daqo has secured a long-term supply agreement with PV equipment provider and monocrystalline wafer manufacturer Wuxi Shangji Automation, Shanxi Coal International Energy Group has unveiled a plan to set up a 10 GW heterojunction solar cell production fab and Longi has held its wafer prices.

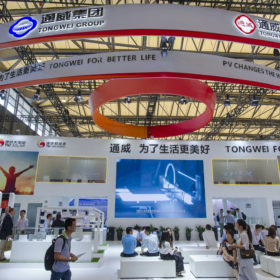

Chinese PV Industry Brief: Tongwei freezes cell prices, state body opens procurement round

Longi has also joined the 500 W-plus module club with its new Hi-Mo5 product, while Sunport has announced to expand production of its MWT module.

GCL generates another $85 million with new shares and 100 MW project sale

The polysilicon manufacturer, which is bent on slimming down its capital-intensive project development business, has generated another windfall to go towards servicing its onerous debt pile.