Fossil fuel financing on upward trajectory with trillions invested since 2015

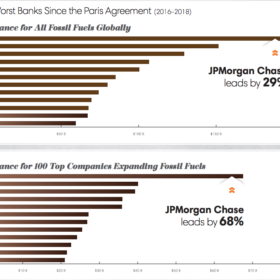

While some lenders and financiers have signaled plans to stop funding polluting power stations, a new report shows that 33 global banks have poured $1.9 trillion into financing the fossil fuel industry as a whole since the adoption of the Paris Agreement. Big U.S. banks led by JPMorgan have invested most heavily.

New Zealand identifies 11 GW solar potential

The nation already meets well above 80% of its electricity demand from renewable energy. With e-mobility and electric industrial processes on the rise, higher demand has created new development opportunities.

Industry urges policymakers to catch up with technology at COP24

The Global Solar Council has released a 15 point plan, which is largely policy focussed, alleging that the industry has down its homework to slash the costs of solar. Now its policies turn to even the playing field. In a similar effort, the World Future Council has announced that it will launch a new platform for policymakers and the industry to enable an ongoing dialogue.

Over 400 investors call on world’s leaders to address climate change

A total of 414 investors managing US$32 trillion in assets have called on the world’s policy makers to take action against climate change. It has been called the “single largest policy intervention” of its kind.

A vision of carbon neutral power around the globe by 2050

A scenario in which no additional oil, coal or nuclear capacity is built and renewables grow at a pace of 3-4%, would see solar comprise 69% of the global electricity system by 2050. According to an EU thinktank, such an effort would boost European manufacturing, creating jobs and prosperity.

EU Commission presents plan to go carbon neutral by 2050

As part of its Paris Agreement obligations, the EU Commission has presented a carbon-neutral vision for 2050, which encompasses GDP growth through smart investments and public health savings.

French turn on nuclear opens €45 billion renewables investment opportunity

The French government is expected to show a draft plan on how to achieve nuclear generation reduction plans. After minister Hulot left the government in August, amidst disagreements with Macron’s handling of the nuclear lobby, the parliament has voted for a bill to reduce nuclear generation capacity. If the plans are realized in compliance with the climate targets, solar and wind deployment could grow significantly.

IPCC: 1.5°C limit needs rapid and far-reaching action, but enables SDG progress

The Intergovernmental Panel on Climate Change (IPCC) has released a new report on different ways global warming can be kept within the 1.5°C limit. The panel seeks to inform policymakers before the upcoming COP24 in Poland this December. Resulting from their analysis, the 91 authors state that drastic action and significant investments are needed. Such climate action across all sectors would have significant positive effects on sustainable development progress, they say.

Solar PV to grow 65-fold by 2050, 2°C target will be missed by a long shot – report

DNV GL has issued its annual Energy Transition Outlook. It reports that global electricity demand is set to grow by a factor of 2.5. Over half of this demand is expected to be met with renewable energy by 2050, while storage will play a key role. It adds that grid infrastructure expenditures are less related to variable renewable energy assets than to increasing energy demand. In the current scenario, meanwhile, global warming is likely to reach 2.6°C.

Banks turn their back on coal amid emissions concerns

While global coal mining companies are enjoying the highest prices in years on the back of boosted Asian demand, banks and financiers are increasingly ending their support for coal power. London-based Standard Chartered the latest to stop financing new coal-fired stations.