Although a number of global banks have started reviewing their coal investment policies amid rising concerns about climate change, a new report shows that financing for fossil fuels has increased every year since the Paris Agreement.

With $612 billion invested in 2016, $646 billion in 2017 and $654 billion in 2018, bank financing for fossil fuels has been on the rise, shows a report by NGOs Banktrack, Rainforest Action Network, Indigenous Environmental Network, Oil Change International, Sierra Club and Honor the Earth.

In another report released in October, the Intergovernmental Panel on Climate Change (IPCC) calculated the costs and benefits of staying within a 1.5°C warming scenario, compared to a 2°C scenario. It noted that limiting global warming to 1.5°C would require unprecedented changes in all aspects of society, with a total of $2.4 trillion for the transition of the industrial, energy, agricultural, residential and transport sectors — an amount that is very close to what banks are presently investing in fossil fuels.

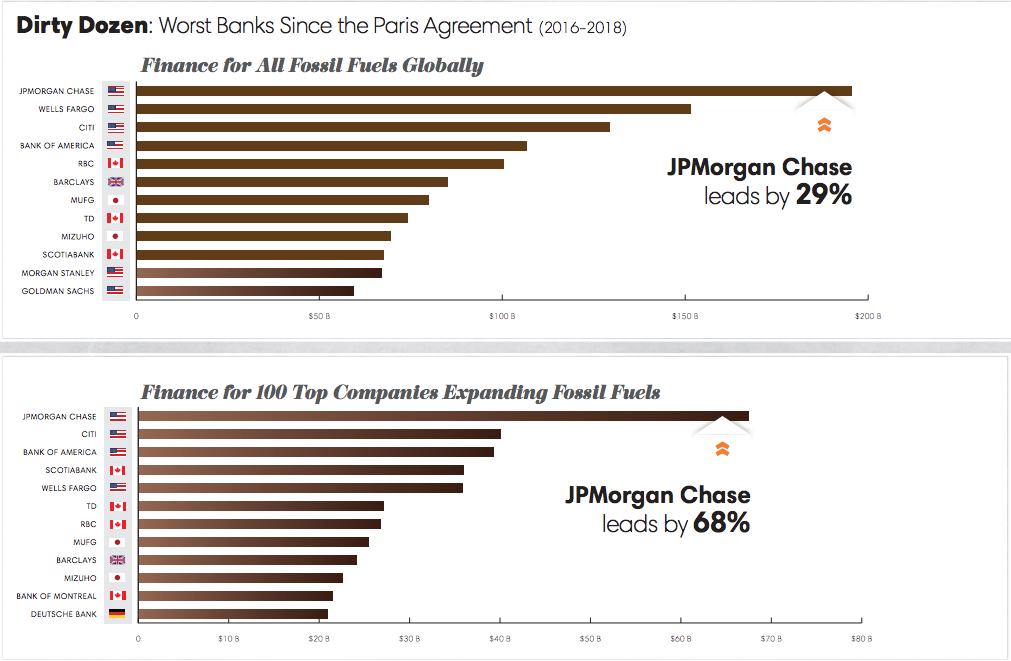

The most prominent player in the group of investors by a wide margin is JPMorgan Chase, with $196 billion invested in dirty energy projects. It is followed by its U.S. rivals Wells Fargo, Citi and Bank of America, signaling the massive economic weight of the U.S. oil and gas industry.

“With Morgan Stanley in 11th place and Goldman Sachs in 12th, all six of the U.S. banking giants are in the top dirty dozen fossil banks; together, they account for an astonishing 37% of global fossil fuel financing since the Paris Agreement was adopted,“ the report states.

The U.S. top four is followed by three Canadian banks, two Japanese lenders and one European bank in the following order: Royal Bank of Canada in Canada, Barclays in Europe, MUFG in Japan, TD in Canada, Scotiabank in Canada and Mizuho in Japan, the “Banking on Climate Change – Fossil Fuel Finance Report Card 2019” report shows.

Popular content

While the report does not assess bank financing of clean energy, it recognizes the huge importance of ramping up finance for clean technologies and setting targets for funding these sectors. Only earlier this week, as reported by Bloomberg, a JPMorgan executive said that the world is not cutting emissions anywhere near quickly enough, and called for politically unpopular changes in the U.S., such as carbon taxes. But, while it committed to cut financing for the global coal industry a few years ago, the banking heavyweight remains one of the top 10 financiers of coal mines and coal-fired power stations.

Last year, a number of banks signaled plans to shift away from fossil fuels. For instance, Japan’s Marubeni Corp. revealed plans to halve its 3 GW global coal-fired power portfolio by 2030, and double its holdings of renewable energy within the next five years, thus joining its compatriots Mitsubishi UFJ, Sumitomo Mitsui Banking Corp., Mizuho Financial Group and Nippon Life Insurance in tightening lending criteria for coal power.

Europe’s largest bank, HSBC, said in April it would largely stop funding new coal-fired power plants, oil sands and Arctic drilling projects, as part of its efforts to support a transition to a low-carbon economy. London-based Standard Chartered committed to financing and facilitating $4 billion worth of clean technology by 2020, and even U.K.-based Barclays, which appears in the report’s top 10, declared it had “no appetite” for financing greenfield thermal coal mining.

But while it could take time before the cut in coal-fired power financing has a real effect on the industry, the latest report lays bare that things are still far from improving.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Banks that don’t finance fossil investments could advertise that fact and maybe pick up some new customers.