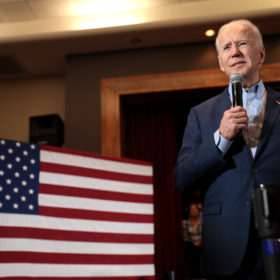

Five pro-renewable energy actions to expect from President-Elect Joe Biden

As the U.S. economy continues to recover from its Covid-19-induced recession, it’s likely that Congress and the president will put together a multi-trillion dollar relief package, similar to the one that lifted the economy out of its doldrums following the 2008 economic crisis.

CPIA: China will add 40 GW of solar in 2020

The China Photovoltaic Industry Association secretary-general has revealed the world’s biggest solar market is unlikely to add more than 30 GW of solar generation capacity this year after just 17.5 GW was installed to the end of October.

US: Tariffs bite Q3 solar market

Wood Mackenzie and SEIA’s latest Solar Market Insight report shows a big fall in utility-scale project completions from July through the end of September, but the promise of a massive fourth quarter.

India to introduce cap on solar tariff

In a major development, the Ministry of New & Renewable Energy (MNRE) has directed the Solar Energy Corporation of India (SECI) to fix the upper permissible solar tariff at Rs. 2.50 (US$0.036)/kWh and Rs. 2.68 ($0.038)/kWh for developers using domestic solar cells and modules (without safeguard duties), and imported products (with safeguard duties), respectively.

Even with duties, Chinese PV modules will be competitive in India

Despite safeguard tariffs against certain imports of solar PV products into India, Chinese manufactured modules will remain competitive, says TrendForce. It further anticipates PV demand falling 30% in fiscal year 2018 in India, while cost pressures will mount for EPCs and project developers.

India: 25% safeguard duty will threaten ongoing solar PV projects

The two-year period of the recommended safeguard duty is very short, discouraging any investment in setting up new solar manufacturing capacity, say analysts and companies pv magazine spoke to. At the same time, for solar project developers, the duty will impact tariffs to the tune of 12-15%, posing an immediate threat to viability of projects under execution, they add.

US could slap additional 25% tariffs on Chinese cells, modules

The new round of IT-related tariffs could make it more expensive for any manufacturers planning to import cells from China for module production in the United States.

US trade authorities provide details on exemptions to solar import duties

Solar PV makers seeking exemptions to Section 201 duties must make them by March 16, but there is no guarantee that any will be granted.

US imports of Chinese solar climbed sharply in Q4

1,200%. According to Bloomberg New Energy Finance, that’s how high imports of Chinese modules rose in the fourth quarter last year, in a desperate attempt to stockpile sufficient numbers before tariffs choked off international supplies.

Kann, Shiao: No US “manufacturing renaissance” due to solar tariffs

The latest analysis by current and former GTM Research executives argues that there is insufficient economic reason to manufacture solar in the United States.