The acknowledgement by the European Commission (EC) that its minimum import price (MIP) mechanism for solar cells and modules imported into Europe has been ineffectual could be undone by the proposal of new mechanism for pricing that SolarPower Europe says “divorces prices from reality”.

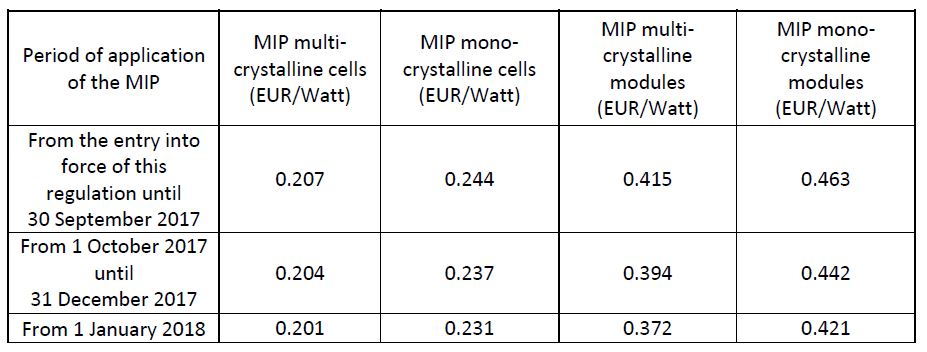

The proposal by the EC’s DG Trade department, seen by pv magazine (PDF), includes a schedule designed to control the prices of panels and cells on the European market over the next 14 months, by laying out a timeframe of when – and by how much – the pricing of its control mechanism will drop.

However, these assessments are not only potentially inaccurate, but could actively stymie solar’s growth as developers could be tempted to delay the realization of projects as they wait for the new, lower prices to come into effect.

“The EC clearly states that market prices recorded in Q1 2017 will only be reached in the EU in September 2018,” said SolarPower Europe president Christian Westermeier. “This implies a full-time lag of 1.5 years for European companies to benefit from the true market price of solar.”

Westermeier added that the MIP level proposed for July 2018 is already “well above” today’s global solar prices in terms of dollar-per-watt.

“This is not the way to bring the energy transition in a cost-effective manner to the citizens of Europe,” he said.

SolarPower Europe CEO James Watson called the proposal another missed opportunity to bring European solar prices closer to global market prices. “It is positive they [the EC] recognize a difference in price between multi- and monocrystalline panels and cells in the new proposal, but this progress is entirely undone by keeping the prices of these products artificially high by not basing the new system on an active market index.”

When contacted by pv magazine, the EC declined to comment.

Popular content

In its new proposal, DG Trade states that “interested parties considered that a variable duty MIP will be more transparent, predictable and enforceable”, adding: “The evidence provided by all interested parties confirmed that the cost of production in the solar industry has been continuously falling, which is reflected in the learning rates of the solar industry”.

However, the EC felt that the use of solar industry learning rates would introduced considerable uncertainties into its pricing, and so has proposed to set its new pricing mechanism against the price quotes offered by Taiwanese market intelligence agency PV Insights.

SolarPower Europe fears that should this DG Trade proposal be enacted, then companies could be tempted to simply scan the pricing schedule and wait until the end of the measures before making an investment in a solar project.

The EC has invited interested parties to submit their comments on the proposed new system until August 2.

The MIP was left looking like a hollowed-out shell towards the end of 2016 as a swathe of Chinese companies dropped out of the agreement, prompting the EC to examine other means for protecting the European solar manufacturing sector from alleged dumping by Chinese companies.

The rate of the MIP was subject to a quarterly adjustment mechanism, with tariffs informed by reference to international spot prices as reported by the Bloomberg database.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.