In its 4Q 2017 Global PV Market Outlook, which it has titled, ‘Booming again’, Bloomberg New Energy Finance (BNEF) lays out some of its predictions for the 2018 solar PV market.

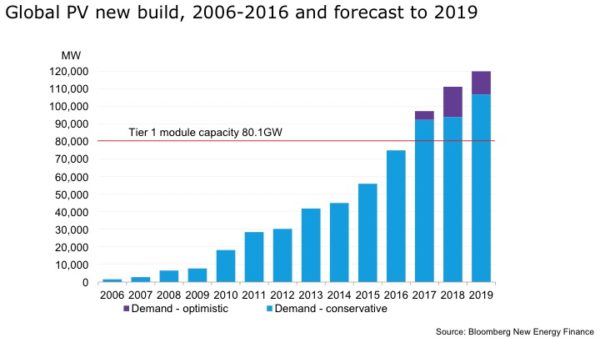

On the back of stronger than expected growth in the Chinese market, BNEF says global installs will reach between 92 GW (conservative) and 97 GW (optimistic) in 2017, which ties in with previous forecasts made this year; and will see solar capacity rivalling that of nuclear, with annual demand breaking the 80 GW barrier for the first time.

With stabilization of the polysilicon market expected, improved cost-efficiencies on the upstream side and increased efforts to meet 2020 energy targets in Europe, demand in 2018 should be between 94 and 111 GW; and 107 and 121 GW in 2019.

“While several European markets have shrunk, others have grown … in a rush to build to meet 2020 renewable energy targets,” write the report’s authors. The Netherlands, France and Spain were highlighted as particularly active markets.

China will again lead overall market growth, with countries bundled under the term “rest of world” or (ROW), coming a distant second. The U.S. and Europe are expected to install similar levels of solar PV, followed by India and finally Japan.

In terms of growth from 2016 to 2017, markets of note include Brazil, at 2,493%; Egypt at 1,100%; Russia at 900%; the UAE at 458%; Malaysia at 318%; Hungary at 296%; and the Ukraine at 268%.

Polysilicon boom

BNEF notes that there is currently a global polysilicon factory boom underway, by both new and existing players, with a total 167kT of new capacity planned by the end of 2018. These include Korea’s OCI, an established player, and China-based East Hope, a new entrant, Jenny Chase, head of Solar Analysis at BNEF told pv magazine. Overall, 2017 is expected to see the production of 445,600 metric tons of polysilicon, a 13% increase on 2016.

“This is enough to support production of 97GW of crystalline silicon modules, assuming weighted average polysilicon consumption of 4.3 grams per watt and 30,000 metric tons sold to the electronics industry. This suggests quite tight supply compared with 2018 installation of 94 -111GW (of which 3-4GW will be thin-film),” write the report's authors.

Polysilicon supply is forecast to increase by 10% in 2018, at around 490,000 tons, enough for 118 GW of crystalline silicon PV modules, said Chase, up 22% on 2017, “assuming the same electronics industry demand.”

Regarding prices, a surge was recorded, notably in China, where polysilicon was priced at $19/kg. This was higher than the $15/kg recorded elsewhere, “because of the import tariffs imposed on U.S. polysilicon and the fact it houses roughly 80% of world ingot capacity.

“A combination of unexpected high demand, temporary scarcity of metallurgical silicon feedstock (as some of the dirtier plants were closed down) and scheduled maintenance of polysilicon factories led to a fairly tight balance of supply and demand in 2017,” continues the report.

Prices are not expected to decrease much by the end of this year, or in the first half of 2018. However, BNEF writes that on the back of an increased usage of monocrystalline products and diamond wire saw (DWS) technology, and increased production capacities, polysilicon shortage will be alleviated in the coming year. Unless, of course, there is another installation boom, like that seen in China this year.

It elaborates, “ …polysilicon consumption per W of wafer side will decrease significantly next year when most of multi wafers are sliced by DWS, which could reduce silicon consumption by 17% per piece. Together with increasing market share of mono product, which generates more power from a single piece, we expect the unit consumption of polysilicon in 2018 to be 9% less than that in 2017.”

Module prices

BNEF states that prices in the module sector are firm, with oversupply not an issue, for once. This trend is expected to continue into 2018. Tier 1 manufacturers claim demand will remain stable until the end of the year, but BNEF sees a weaker Q4 2017 on the back of a market slowdown in both the U.S. and China.

“Shipment to the U.S. for the trade-case triggered stockpiling through October, but it now appears there is little advantage. China may still build 7-10GW in 4Q 2017, but this is much lower than that of 3Q (18GW,” it is explained in the report.

Current global average module prices for utility-scale are around $0.31 to $0.32/W, says Jenny Chase. With limited movement on polysilicon prices in H1 2018, the report adds, market leaders will see H1 prices of around $0.33/W (Based on 10% gross margin), and $0.30/W by mid-year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

In the chart it seems to be mistake it should be GW in accordance with text but MW in the chart. And where is the truth?

Both are correct. 80 GW = 80,000 MW

It will be far far higher lol.

More like 135GW this year and 175GW the year after