The May 31 announcement by the National Development and Reform Commission, Ministry of Finance, and National Energy Administration of China, states that there will be temporarily suspended arrangements for utility-scale solar PV plants in its 2018 target, and a cap on distributed generation (DG) at 10 GW for the entire year. The notice also reduces the PV feed-in tariff (FIT) by CNY 0.05 (US$0.007) starting May 31. The sudden notification has severely impacted China’s PV demand.

It appears that utility-scale and DG projects are among the most impacted categories. Further, the residential market, which has been rapidly growing since last year, leads an accumulated 10 GW of DG project installations from the first five months of this year, while demand for the second half of the year has fallen to almost zero, as a result of the notification. Subsequently, the 40-45 GW installations originally estimated for China in 2018, has plummeted to between 28 and 35 GW. Global annual installations have, thus, fallen to 80-85 GW – a 20% recession compared to just over 100 GW in 2017.

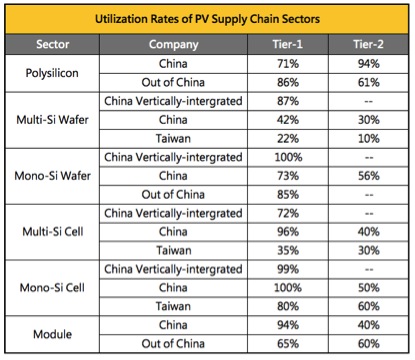

Decreasing utilization rates

Panic spread across the entire Chinese PV supply chain following the notification. Polysilicon manufacturers brought forward their equipment maintenance plans, in order to control the polysilicon supply-demand. Originally, they were scheduled for July.

Multi-Si wafer makers immediately lowered their utilization rates to 30-40%, and vertically-integrated manufacturers have continued to lower the utilization rates of their multi-Si wafer production lines. Some have even suspended all production. Taiwanese multi-Si wafer manufacturers with higher costs almost closed factories entirely, for instance.

The top mono-Si wafer makers did not make a significant change to their utilization rates in early June, due to the June 30 FIT deadline for utility-scale project installations in China. However, utilization rates were lowered to 60-80%, starting from late June.

Since the cell sector has the lowest capacity across the entire supply chain, the decline of utilization rates for cell manufacturing has not been as substantial as other sectors. Similar to the wafer segment in early June, multi-Si cell manufacturers were the first to reduce utilization rates, especially the Taiwanese and Tier-2 Chinese manufacturers. From late June, when China’s utility-scale projects began to reach completion, the same happened to the utilization rates of conventional mono-Si cells.

For modules, Tier-2 and -3 manufacturers, which mainly relied on the Chinese market and OEM orders placed by top-tier manufacturers, have lowered their utilization rates to 40-70%. Top-tier manufacturers are expected to make substantial adjustments for the second half of 2018, on the back of low demand.

Serious oversupply

Multi wafers, in particular, are facing serious oversupply, after manufacturers changed from slurry saws to diamond wire slicing, resulting in prices falling lower than cash costs.

Even polysilicon prices, which were at a long time high, have plummeted; and the same is happening in cells and modules. The mono-Si supply chain also started to decrease in late June, as a result of weakening demand.

With demand shrinking within China, the immense module capacity is being redirected to overseas markets, leading to price decreases in the highly sensitive Indian market. Held in late June, the Smarter E was an event for Chinese module makers to secure and explore their overseas markets. During the exhibition, prices in Europe apparently went down, despite there still being no conclusion as to whether the minimum import price (MIP) will be canceled or not.

Even the European market, formerly one of the markets with the highest prices in the module sector, witnessed significantly low prices, showing that overseas module prices have also fallen.

Popular content

Strategies and future plans

Despite a significant recession in this year’s market, and the fact that China can only struggle to remain stable in terms of domestic demand next year, global demand in 2019 is still likely to surpass 100 GW. This will come thanks to a rebound of developed markets and support from numerous emerging markets.

Demand will bounce back at the beginning of 2019, when the low season ends in the second half of this year. In the second half, the entire supply chain will keep low utilization rates, causing cell and module expansion projects to be postponed or stopped.

Current production lines should speed up in terms of technical upgrades, in order to increase orders by making high-efficiency products during the low season. According to data collected following the notification, a capacity upgrade of 22 GW in the passivated emitter rear contact (PERC) sector will still happen this year, 20 GW of which will be installed in China.

Also, in each of the next two years, we will witness at least 20 GW of new PERC installations, as manufacturers plan to upgrade conventional lines to PERC during this time.

Further, selective emitter (SE) technology revived this year. Due to the newly established SE production, the average cell production efficiency quickly increased by 0.2-0.25%. As a result, Chinese PERC lines are in desperate need of SE upgrades, in order to catch up with the high efficiency of 310 W for the Top Runner mono PERC 60 cell modules. There will be a capacity of more than 20 GW equipped with SE.

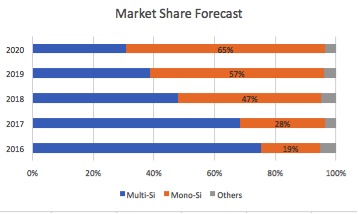

Mono-Si products continue to increase in market share, thanks to capacity expansions in the PERC sector, and the room for price decreases in mono-Si wafers in the future. According to the new estimation following the reduction of annual global installations, mono-Si products will achieve a market share of almost 50% this year, which is higher than previous expectations.

Looking at future trends, the global PV market appears promising in 2019, following a harsh situation this year. Chinese manufacturers plan to slow down the pace of new expansion projects in the near future. Instead, they are focusing on upgrades of current production lines.

For cells, upgrades to PERC and SE will both happen; for modules, half-cut modules will increase in shipments in the second half; and bifacial modules will be promoted more actively by manufacturers.

The new policy has cooled down the vigorous trend for capacity expansions, but the market will continue to head towards a promising future when the storm has settled.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

On the new Chinese policy: “… there will be temporarily suspended arrangements for utility-scale solar PV plants in its 2018 target ..”

Apart from being unclear, this suggests a halt to utility PV for which I can find no evidence in the Chinese text (link). If we can trust Google Translate, this clearly states that the scale of ordinary utility PV is not regulated. The announcement does include two disruptive shocks: decentralisation to provinces, and subsidy-free auctions instead of FITs. The sudden double transition is asking for trouble in the form of confusion. But if there is a policy decision to slow down, it’s not here. Jinko for one thinks its Chinese sales will not fall.

As for the policy, there is no quota for utility -scale PV in 2018, those got quota in 2017 and under construction is not within this scale. New quota will be granted in 2019, most likely. This is a great cut-off of the total demands of China market. In addtion with the cap of distributed PV which includes the residentail roof-top segment of 10GW total, Jinko will very probably get a clear reduction of its China’s sales. Jinko’s module shipment in China market was about 3GW in 2017, can’t believe this will continue in 2018.