One of the world’s leading solar cell manufacturers has shut down its production line in Suzhou, China, due to “environmental” issues, and in response to “industry market needs”.

In a filing to the Taiwan Stock Exchange this week, Motech Inc. responded to earlier Chinese media reports that it had shut capacity down on August 13, due to falling sales and an unexplained environmental issue.

“The Company aims to adjust its production capacity efficiently for the industry market needs, as well as upon the environment issue of Motech (Suzhou),” read the filing.

It added that it plans to focus its efforts on Motech (Maanshan) and Motech (Xuzhou), with these becoming its main production lines in China in the long-term.

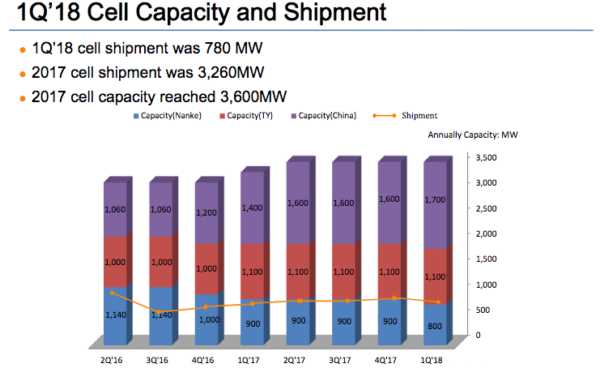

According to its Q1 2018 financial report, released in May, Motech has a current cell production capacity of 3.6 GW, 1.7 GW of which is located in China (compared to the 1.6 GW in Q4, 2017).

In the April edition of pv magazine, however, IHS Markit wrote that the company had a production capacity of 4.182 GW in 2017, with this increasing to 4.482 GW this year.

Commenting on the discrepancy, Karl Melkonyan, senior analyst, solar demand at IHS Markit said, “The difference in numbers was mainly related to the new fab with 800 MW in Kunshan, China, which was planned initially. However, it is now postponed and might be even canceled with the replacement of the equipment to other fabs in China. There is also some capacity decrease in Taiwan, which might refer to elimination of some old equipment.”

He added that in its Q1 financial report, Motech makes no mention of around 200 MW of capacity, which it acquired from Aide Solar in Xuzhou, China. “It’s current annual capacity is, therefore around 3.8 GW,” concluded Melkonyan.

According to Motech's latest financials, Q1 shipments were just 780 MW, above the 727 MW shipped in Q1 2017, and down slightly from the 866 MW shipped in Q4. Overall, in 2017, the manufacturer shipped 3.26 GW of cells.

In terms of markets, Motech said in the filing this week that China, India, and other emerging regions are of interest. It has been a “slow season” it said, but visibility is increasing, thus serving to boost long term sales contracts.

Meanwhile, it says it has experienced “moderate” impacts from the U.S. anti-dumping and countervailing duties, and Section 201 tariffs.

According to Taiwan media outlet Digitimes, Motech also halted production of its solar ingots and wafers in Taiwan in June; while on August 6, Motech announced that Dr. Peng-Heng Chang had resigned from the position of Chairman and Director of the Board. He was replaced by Mr. Steve Tseng, founder of Motech.

Motech had not responded to requests for more information at the time of publishing.

Financials

While Q1 2018 shipments remained relatively stable, its Q1 2018 revenues took a tumble, falling 21% from Q4 2017, to NT$4.9 billion (around US$160 million), and compared to NT$5 billion in Q1 2017.

Popular content

A net loss of NT$1.09 billion was recorded in the first quarter, similar to the NT$1.08 billion in Q1 2017, and not far off the NT$991 million lost in Q4 2017. Its operating margin also fell to -19.7%, down from -7% in Q4 2017, and -18.7% in Q1 of the previous year.

While no official financial statement has been released, in another stock exchange filing, Motech reported on August 6 that it had suffered further, large, losses in Q2. These included revenues of NT$4.4 billion, and a net loss of NT$2.096 billion.

“Due to the uncertainty in solar industry, therefore, compared to the same quarter in the previous year, the net revenue decreased by 21.05%; the gross loss increased by 160.17%; the operating loss increased by 63.88%; the net loss (attributable to Motech stockholders) increased by 199.52%; the comprehensive loss (attributable to Motech stockholders) increased by 217.99%,” read the filing.

Global ranking

In 2016, following the merger with Topcell Solar International Co., Ltd a year prior, Motech had 3.2 GW of cell production capacity, thus catapulting it to the leading manufacturer globally.

Last week, PV Infolink ranked the company among the top five global solar cell manufacturers – the only Taiwanese firm to achieve this status, with Taiwanese players showing “disadvantage in cell costs.”

“The utilization rates of conventional multi-Si cells were generally low, hence only Motech made it to the top five,” it reported, adding, “However, with the merger of NSP, Gintech, and Solartech, the new joint venture is likely to enter the top five list of cell makers.”

The merger, first announced last October, will unite cell manufacturers Neo Solar Power, Gintech Energy Corp and Solartech Energy Corp as the United Renewable Energy Company (UREC). It will have a production capacity of around 3 GW, IHS Markit's Melkonyan tells pv magazine.

Taiwan’s troubles

With increasing cost pressures, particularly from China, and most recently, China's 31/5 policy turnabout, Taiwanese manufacturers along the solar supply chain are struggling to keep up.

On the back of the changes, “Taiwanese multi-Si wafers with higher costs almost closed factories entirely,” said industry analyst, Corrine Lin. Similarly, the cell and module segments have seen falling utilization rates, beginning with the multi-cSi segment. “Multi-cSi cells are the first to reduce utilization rates, especially Taiwanese makers and tier-2 Chinese makers,” she continued.

Looking at wafer manufacturers, Digitimes reported earlier this week that domestic wafer manufacturers are “ill-equipped” to deal with such changes in the market.

Indeed, while Chinese companies have four options open to them to respond to the new market dynamics – upgrades to enable poly black silicon cells; produce quasi-mono-Si ingots; turn to mono-Si wafers; or exit the business – none are attractive for Taiwan makers, due to either tighter environmental protection standards, or for financial reasons.

“Withdrawal from market seems the last choice for Taiwan's makers, but none of them have decided to to [sic] so. They hope the government can extend help,” it wrote.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.