From the September edition of pv magazine

Although global module demand reached 45 GW in the first half of 2018, the market is still plagued by PV trade wars and policy changes. Not only is China’s domestic demand depressed after the 31/5 announcement, but India’s 25% safeguard measure has impacted the country’s module demand. India’s 2018 annual demand is now forecast at 8 GW, lower than earlier forecasts of between 9 and 11 GW, reducing the 2018 global module demand forecast to 83 GW.

Module shipments for the top 10 manufacturers accounted for 63% of global module demand in H1 2018, and tier-2 and tier-3 enterprises will be drastically impacted by the depression of China and India this year. It is expected that the top 10 manufacturers will take up 67% of global demand by the end of this year, which is much higher than the 55% in 2017.

Cell makers

The top five for cell shipments in H1 2018 were Tongwei, Aiko, Motech, Uniex and Pingmei. Judging from capacities, Tong- wei and Aiko released new capacities from late 2017 to early 2018 – Tongwei, especially, has plans for large-scale expansion. Hence, it will have the biggest cell shipment volume in both 2018 and 2019, closely followed by Aiko.

Utilization rates of conventional multi- Si cells were generally low for Taiwanese cell makers, as such only Motech made the top five. However, with the merger of NSP, Gintech, and Solartech set to complete in October, the new company, United Renewable Energy, is likely to enter the list.

Consolidation

Polysilicon and wafer capacities were affected by the difference in electricity prices and capacity scale, resulting in a larger difference in manufacturing costs even when just comparing China-based capacities. Polysilicon may remain lower than CNY 85/kg (roughly at $10.70/kg) for a long time; multi-Si wafers will stay below

$0.31/pc for a long period, and mono-Si wafers below $0.40/pc. This price trend has made it difficult for manufacturers with uncompetitive costs to secure their margin. Such companies have begun to cease production. However, because the low season may well last from the 31/5 period all the way to mid-2019, some companies ceasing production in this time are likely to be permanently out of the PV industry.

Non-Chinese polysilicon makers and those located in east coast China are most likely to focus on increasing the portion of mono grade, or otherwise cease production. The mono-Si wafer segment will be taken over by a few top-tier mono-Si wafer makers and vertically integrated companies. For multi-Si wafer, several manufacturers have been ruled out after the industry reshuffle. From the beginning of 2019, multi-Si ingot capacity will have difficulties surviving in non-Chinese regions, except for vertically integrated companies.

Mono on the rise

Due to the increasing concentration of the supply chain, Chinese demand only has the Top Runner Program and poverty alleviation – 85% of the 5 GW General Top Runner demand is from mono-Si products. This has led to the highest market share in China’s domestic demand for mono-Si products, at 54%.

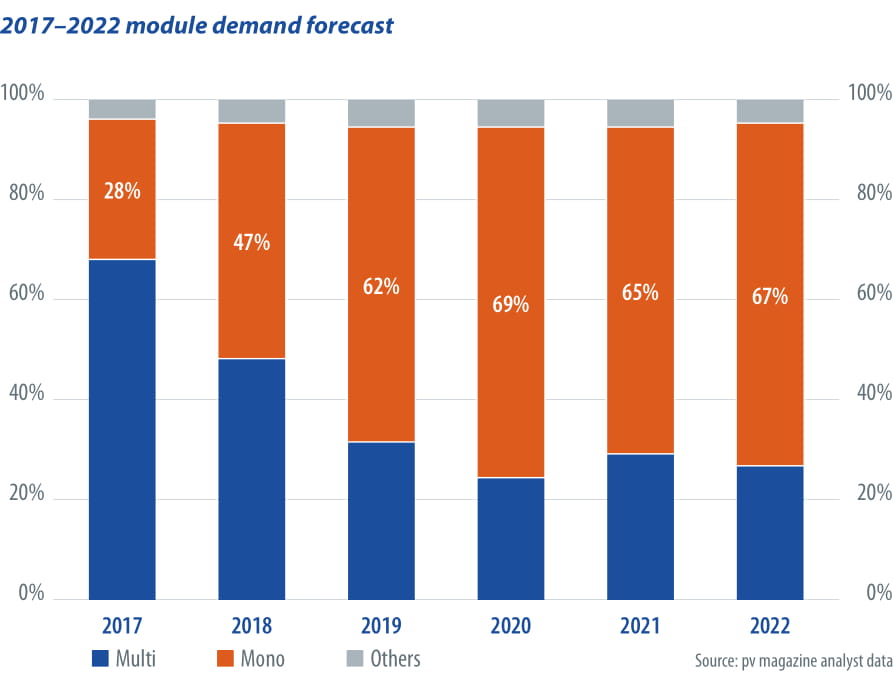

India, where multi-Si products used to take up over 90% of the market, was also significantly affected by the 25% safeguard duty, leading to lower demand for multi. Global demand for mono-Si products will reach 47% this year. Next year, it is likely that the use of thinner wafers by mono-Si products will grow, and the use of thinner multi-Si wafers will be hard to achieve, which will push the market share of mono-Si products to 60%.

Focus turns to non-Chinese markets

With the drop in domestic demand, Chinese module makers have started to look elsewhere. Currently, apart from possible adjustments to India’s duties, Europe’s minimum import price (MIP) was canceled in early September. These two major trade barriers in the PV industry are influential factors for the non-Chinese market trend in H2 2018.

In August, the decrease in India’s demand hit the prices of multi-Si products, as mainstream multi-Si cells with 18.6% efficiency fell to $0.12-0.125/W in late August, a 9% decrease from $0.135/W in late July. With the EU canceled MIP, demand for installations in Europe will increase in the mid-term, but Europe’s spot prices will take a hit as it becomes the target market of all manufacturers. This will heavily impact EU module makers, top-tier module companies, non-Chinese manufacturers, and Taiwanese cell makers, which are currently consistent in shipment.

Looking at the supply chain, the concentration of industry and mono-Si market share will both increase, but global prices will continue to decline. Demand will stay low to Q2 2019, should there be no additional encouragements from the policy side. The overall market trend is far from optimistic.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Shouldn’t Hawha be second after Tongwei in cell capacity?