In pursuit of achieving its climate goals, Canada has announced a new policy under which businesses adopting clean energy solutions will be eligible for a full tax write off for the fiscal year in which a renewable energy system is commissioned. This would allow businesses to reduce their taxable income and thus tax liability, nationwide.

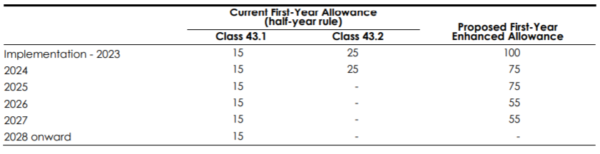

The announcement was made last week as part of the Fall Economic Statement 2018. Therein the government says the policy will be in place for assets that were acquired after November 20, 2018, while it will be gradually be phased out from 2024, and fully phased out in 2027.

Table: Department of Finance Canada

Eligible renewable energy and energy conservation assets that fall under the proposal include solar energy, battery storage and electric vehicle charging infrastructure. The government highlights that through the scheme the business case and access to finance for solar and other renewables are significantly improved as the payback period is accelerated.

John Gorman, President & CEO, Canadian Solar Industries Association (CanSIA) commented, “Canada is moving from planning to action on our national climate action and clean growth strategy. In the future, businesses who reduce their greenhouse gas emissions and manage their energy costs will be the most competitive. This new change to federal tax policy will support businesses to invest in technologies such as solar energy and energy storage.”

In February of this year, the government of Canada announced that it would work towards phasing out coal generation by 2030. To this end, a range of new regulations to reduce greenhouse gas emissions and incentivize the adoption of renewable energy resources are expected to be put in place.

Speaking to pv magazine in February, a spokesperson for Environment and Climate Change Canada Samantha Bayard said, “Through the PCF, the Government of Canada is also launching programs and making significant investments to support the deployment of RE and clean electricity.”

These include Natural Resources Canada’s Emerging Renewable Power Program, which provides up to CA$200 million (US$151 million) to expand the portfolio of commercially viable RE sources available to provinces and territories. Additionally, the program works to reduce greenhouse gas emissions from their electricity sectors.

Moreover, CA$21.9 billion (US$16.5 billion) in green infrastructure, including CA$5 billion for green infrastructure projects through the Canada Infrastructure Bank are being made available, which may include projects that promote renewable energy generation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This is excellent news for businesses struggling to find ways to promote clean energy expenditures to shareholders. As much as the “clean energy” efforts are smiled upon by investors, it is the financial rewards that compel them. This action will help management to put forth sound financial reasoning for investing in better conservation strategies and clean energy production technologies.