From pv magazine, September 2019

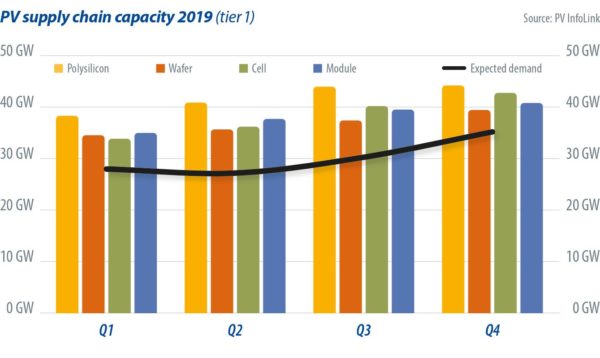

In 2018, the cell segment had the lowest capacity in the supply chain, and that kept profitability of mono PERC cells above 15%. Driven by high profits, many cell manufacturers expanded capacity at a faster pace, while vertically integrated companies also ramped up existing manufacturing capacity for PERC cells. Consequently, new plans to expand PV manufacturing capacity since the end of last year have mainly focused on mono PERC lines or existing line upgrades, leading to record high global PERC capacity additions of more than 50 GW this year. Aggregate capacity is forecast to hit 100 GW by the end of 2019. Following large-scale expansion, the cell segment will accumulate the largest manufacturing capacity in the supply chain by the end of the year. Ongoing expansions and upgrades indicate that the market’s elimination of excess capacity will occur ahead of time.

Price movements

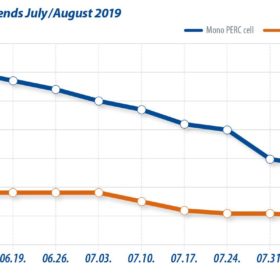

PERC cell prices trended downward in mid-June due to weakening demand, with market prices falling 20% within 45 days, from the previous level of $0.16/W to $0.12/W at the beginning of August. Calculated with mono-Si wafer prices of $0.42 for August, PERC cell prices have broken even for several older manufacturing lines, or met the cost level of small-sized manufacturers.

In the meantime, the Chinese market has been busy with auctions for grid-parity projects. To secure orders for September to December amid low demand and a slump in PERC cell prices, module makers have rapidly reduced bidding prices. Current auction results reveal that mono PERC module prices have come down to $0.252-$0.258/W in China, making the country the market with the world’s cheapest solar yet again.

Demand for PERC products remains weak, despite the rapid price drop. Several manufacturers saw inventory pile up in late July and early August, pushing them to sell products below cost. Cell producers also reduced utilization rates to prevent inventory from piling up.

To remain cost effective, vertically integrated companies with in-house production capacity started evaluating the viability of outsourcing as soon as PERC cell prices broke even. In fact, a few top-tier vertically integrated companies even suspended some of their production lines and purchased cells from other suppliers.

With wafer prices going down from late July and cell prices breaking even for older production lines, profits from multi-Si cells exceeded mono PERC for the first time, driving some cell makers to switch mono PERC lines back to produce multi-Si cells in July. The move aggravated the excess supply situation for multi-Si amid stagnant demand, and prices have since fallen continuously as a result. The trading price of conventional multi-Si cells has declined from $0.18/W in June to $0.11/W at present. After multi-Si cell prices hit bottom, manufacturers started pushing the upstream sector to lower multi-Si wafer prices.

Based on its latest auction results, Chinese demand – which stood slightly above 10 GW in the first half – is forecast to double to 20 GW from September to December, prompting rush orders to start from the end of August and the beginning of September. Moreover, market demand in the United States and Europe is expected to rise in the high season throughout the third and fourth quarters. PV InfoLink thus projects that cell prices will rebound after hitting a low in August.

While prices were reduced further to increase sales, many manufacturers continued capacity expansions. The third quarter will see more than 20 GW of new PERC capacity from Aiko and Longi, as well as some new gigawatt-scale players coming online. Uniex and Tongwei will join the game later in the fourth quarter. Tongwei, in particular, will have new capacity coming online at the end of 2019 and the beginning of 2020. There’s no end in sight for PERC cell capacity expansion.

Source: PV InfoLink

The record-breaking volumes of commissioned PERC capacity foreshadows the elimination of older PERC production lines with higher cost structures. With an estimated 92 GW of full-year global mono PERC demand expected in 2020 – but a forecast of 113 GW and 150 GW of aggregate global mono PERC capacity in 2019 and 2020, respectively – excess PERC capacity from the end of the year to the beginning of next year will mean that PERC lines with no cost advantage may struggle to survive. Nevertheless, manufacturers have not immediately ceased activities on older lines, despite losses. The market will therefore see fierce competition on PERC cell prices over the next year.

Looking ahead, prices likely won’t stabilize until demand bounces back in September. However, price increases for PERC cells will remain limited in September through the end of the year, due to large volumes of new PERC production lines and line upgrades coming online in the third and fourth quarters.

On the conventional multi-Si product side, the revival of the Chinese market in the fourth quarter is expected to drive up demand for multi-Si modules. Constrained by auction projects, module prices sit at around $0.22/W, despite multi-Si cell demand turnaround, and it will remain difficult for multi-Si cell makers to raise prices.

Overall, low demand only hit the market after the Chinese Lunar New Year holiday and the July-August period this year. However, the midstream sector will experience notable price fluctuations in the low season in the future, because of massive capacity expansion across the supply chain this year. With cell manufacturing capacity becoming excessive, the era of high profitability for PERC cells has come to an end.

Corrine Lin, PV InfoLink

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.