From pv magazine 02/2020

Ranked by export volumes, the top five largest PV module manufacturers in 2019 were JinkoSolar, JA Solar, Canadian Solar, Trina Solar, and Risen Energy. Together they exported 33–34 GW of modules from China over the course of the year.

Consolidation creeps

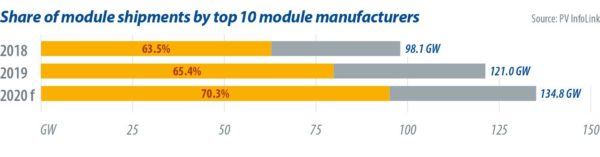

According to the PV InfoLink database, the share of shipments from the top 10 manufacturers grew slightly from 2018. They delivered nearly 80 GW of modules last year, thereby meeting 65.4% of total global demand, which reached 121 GW.

PV InfoLink is treating demand conservatively in China this year, and the market is expected to experience a supply surplus during the post-Chinese New Year period through to the second quarter of the year. Nevertheless, global demand is forecast to grow by 13.4 GW from 2019.

Tier-1 manufacturers are gaining a competitive edge in terms of distribution channels, brand influence, and product competitiveness, and therefore the module market will be increasingly dominated by a few large manufacturers. Against this backdrop, the module production giants are more ambitious this year in terms of shipment volumes. It’s expected that the top 10 will dominate more than 70% of global module demand.

High-efficiency demand

Despite a small difference in total demand between the first and second quarters, supply will grow continuously as wafer, cell, and module capacity increase every three months and eventually go into significant surplus in the second quarter. To keep prices stable, module manufacturers have been increasing the power output of their modules; price quotes on modules topping 400 W have become common among manufacturers. To achieve 400 W, manufacturers need to adopt larger cells and apply half-cut and multi-busbar technologies, and hence a larger number of conventional module lines will be shuttered in 2020.

The widespread adoption of large half-cut cells has led to a jump in the wattage of modules produced between 2019 and 2020, and manufacturers are still stepping up their game. While Longi is promoting modules that use M6 (166 mm) wafers and Zhonghuan Semiconductor is pitching those that use M12 (210 mm) wafers, some other producers have this year begun to seek other wafer sizes that can make their modules more competitive than ever. Therefore, modules that use wafers measuring around 170 mm may hit the market between 2020 and 2021.

As cells and modules continue to grow in size, modules show further potential to evolve on the technical front. While modules assembled with half-cut cells and multi-busbar interconnection are making their way into the mainstream market, Tier-1 makers are seeking to improve module efficiency through continued investment in the research and development of high-density modules. These producers have also given serious attention to superposition welding this year, for paved or shingled modules. Among them, Huansheng Solar, Seraphim, Tongwei, and Canadian Solar have mass-produced shingled module with conductive paste for some years. Jinko, which has received hundreds of MW of orders for its “Tiger” module, leads in the development of superposition-welded modules.

Other Tier-1 manufacturers have also made strides in this regard, and they differ in their approach to the layout and technical design of such modules. Thus, there should be yet another wide range of novel modules on parade at PV Expo Japan, a trade show held in the early part of every year where manufacturers present the fruits of their technological labors. Half-cut and MBB equipment can be upgraded to perform superposition welding, and as long as such a change ensures adequate technical maturity and product yields, numerous manufacturers would soon shift to superposition welding, further pushing up the wattage of mainstream modules.

Looking ahead, module demand will stagnate in the first half of the year – with prices forecast to trend downward, but flourish in the second half. Polysilicon and PV glass may enjoy a solid supply/demand balance, and the module bill of materials cost is not likely to see any marked decline. Therefore, short-term price decreases in the solar supply chain will come mainly from capacity expansion and oversupply in the wafer and cell segments, but also from per-watt cost reductions that follow improvements in module wattage.

As manufacturers are increasing module wattage to win orders, shipments of modules assembled with half-cut and MBB cells have considerably increased. By contrast, producers with low shipments of high-efficiency or special modules will struggle to pick up orders in 2020.

While trade barriers and China’s May 31 Policy triggered a downturn in the PV industry and prompted prices in the supply chain to tumble, very few manufacturers were eliminated as a result.

Yet, things will make a U-turn this year. Production lines for conventional multi-Si cells, in particular, are not going to adopt larger wafers. The entire multicrystalline supply chain may struggle to achieve further cost reductions, making it likely for the market share of conventional multi-Si cells to shrink and production lines for such cells to close down in droves.

Meanwhile, older cell production lines, which incur much higher production costs per watt than ones built between the second half of last year and this year, have no cost advantage – and would not attain any, even if they were modified to adopt larger wafers. They will fare poorly in the price war during this year’s slack season. Consequently, older production lines, whether in the cell or module segment, will cease operation in greater numbers than ever.

Corrine Lin

| Global module shipment ranking 2019 | |

| 1 | JinkoSolar |

| 2 | JA Solar |

| 3 | Trina Solar |

| 4 | Longi Solar Technology |

| 5 | Canadian Solar |

| 6 | Hanwha Q Cells |

| 7 | Risen Energy |

| 8 | Suntech |

| 9 | Astronergy |

| 10 | Talesun |

| Source: PV InfoLink | |

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Thanks for this analysis. Do you think keeping on manufacturing st a far market will grow the market. Am of a view that if your market is in Africa, why do not you bring the factory st the market location, even African will buy more at a minimum price.

Am a Uganda energy promoter for the last 28 yrs and am still going strong with the technology .